Britain’s public finances are more vulnerable to shocks than other major economies, the Treasury’s fiscal watchdog said, as it warned that geopolitical tensions, climate change and an aging society will cost tens of billions of pounds more each year.

The Office for Budget Responsibility said in its fiscal risks report on Thursday that the public finances are on a “very risky” footing after a series of shocks including the Covid pandemic, the war in Ukraine and soaring interest rates.

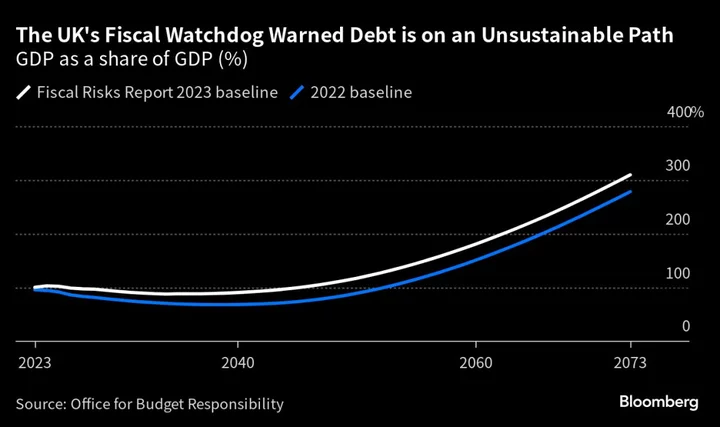

It warned that UK public debt will be on an “unsustainable path” and soar to more than 300% of gross domestic product by 2072-73. Stopping debt from rising above 100% of gross domestic product, its current level, would require tax rises and spending cuts of 4.4% of GDP in 2028-29.

The findings underscore the tensions Prime Minister Rishi Sunak’s government is under, with voters demanding improvements in strained services, such as in healthcare, at a time when the public finances are already stretched. He is also under pressure from members of the ruling Conservative Party and business groups that are seeking tax cuts.

In a bleak assessment of the country’s long-run finances, the OBR estimated that:

- Retiring baby boomers and higher inflation will cause the country’s pensions bill to rise £23 billion ($30 billion), or by 0.8% of gross domestic product, by the 2027-28 fiscal year when compared with the start of the decade.

- The spread of electric vehicles will drain £13 billion a year in fuel duties from the Treasury by 2030 while public investment to support the shift to net zero emissions may cost £17 billion a year by then.

- The outbreak of war in Ukraine and growing security threats in Asia indicates that defense spending may rise by £13 billion a year in today’s terms — to 2.5% of GDP from 2%.

“The 2020s are turning out to be a very risky era for the public finances,” the OBR said in the fiscal risks report. “Looking out over the next 50 years, a new set of long-term fiscal projections illustrates the challenges in trying to keep debt from rising inexorably.”

The OBR said the Treasury’s finances are especially vulnerable to shocks by it having more inflation-linked debt than peers, shorter maturities and the sharpest rise in borrowing costs of the Group of Seven nations in the last 12 months. It also has more of its debt in the hands of foreign investors than most G-7 countries, leaving it hostage to swings in global sentiment.

Shocks “have pushed government borrowing to its highest level since the mid-1940s, the stock of government debt to its highest level since the early 1960s, and the cost of servicing that debt to its highest since the late 1980s,” the OBR said.

It said the Chancellor of the Exchequer Jeremy Hunt’s plans for stabilizing and reducing debt are “relatively modest by historical and international standards.”

The Bank of England’s quantitative easing program will cost the state a total of £118 billion over its lifetime, the OBR said in an updated analysis of the money-printing program. In March, it had estimated the net loss on the £895 billion money printing program at £63 billion but changes in interest rates and inflation since then have worsened the outlook.

The OBR stressed that the calculation was “not an assessment of the overall fiscal, let alone economic, impact of QE” since it was launched in 2009, because it had other beneficial effects such as boosting employment and growth in the immediate aftermath of the financial crisis and subsequent years.

“The wider economic and fiscal benefits of these interventions would need to be taken into account in any comprehensive assessment of the impact of QE,” the OBR said.

(Updates with details from the report.)