Cryptocurrency exchange Kraken was ordered by a judge to provide a wide swath of information about its users to the Internal Revenue Service for the agency’s investigation of underreported tax liability.

The IRS has said it wants information on Kraken accounts that did at least $20,000 of cryptocurrency trading in any single year, from 2016 to 2020. Kraken had called the agency’s summons an “unjustified treasure hunt,” arguing it went well beyond the boundaries set in a similar fight with Coinbase about six years ago.

Friday’s ruling siding with the government comes amid a deepening US crackdown on cryptocurrency. The Securities and Exchange Commission this month filed separate lawsuits accusing Coinbase of running an illegal exchange and alleging that Binance.US mishandled customer funds, misled investors and regulators, and broke securities rules.

Read More: SEC’s Coinbase Lawsuit Heralds Deepening US Crypto Crackdown

The IRS didn’t win everything it was seeking from Payward Inc., the San Francisco-based company established in 2011 to operate Kraken, but US Magistrate Judge Joseph Spero directed the company to turn over users’ names, birth dates, taxpayer identification numbers, addresses, phone numbers, email addresses, some documents and transactional ledgers.

The IRS “has a legitimate purpose for seeking the materials,” the judge wrote, namely to “determine the identity and correct federal income tax liability” for users in the designated time period.

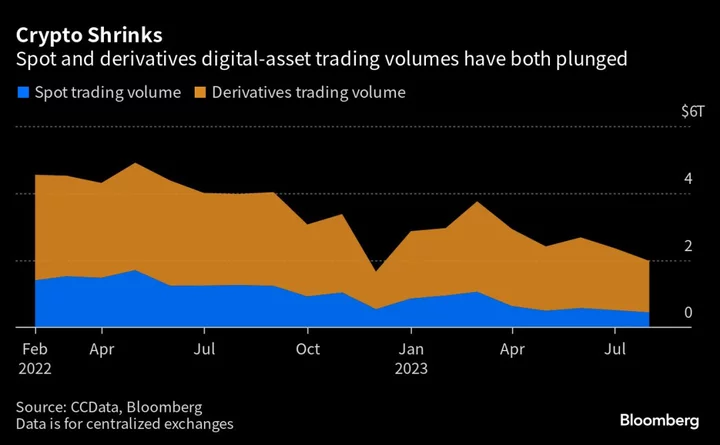

The agency’s demands are backed up by the fact that taxpayers filing returns with Bitcoin-related investments are “dwarfed by the amount of trading activity that occurs on Kraken,” Spero said. The exchange had 4 million clients conducting more than $140 billion in trades from 2011 to 2017, and was registering as many as 50,000 new users daily, according to the order.

Kraken is a top crypto exchange with daily trading volume of roughly $650 million globally, according to CoinMarketCap. The company didn’t immediately respond to an emailed request for comment on the ruling.

The judge agreed with the IRS’s evidence that under-reporting of income is “substantially higher where there is no third-party information reporting, as is the case with Kraken.”

In the earlier dispute between Coinbase and the agency, the IRS scaled back its initial request, but the company continued to resist. A judge ultimately ruled that a summons targeting more than 14,000 of the exchange’s users wasn’t overly intrusive because the IRS had a legitimate interest in investigating taxpayers who may not be reporting their Bitcoin gains.

Read More: Crypto Exchange Kraken Blasts IRS Summons as ‘Treasure Hunt’

Spero said that while both the US and Kraken made arguments that bordered on mischaracterizing the Coinbase ruling, it is “clearly not the case,” as Kraken argued, that the earlier decision established a limit on the number of cryptocurrency accounts that can be targeted by the IRS.

The judge rejected IRS demands for information in due diligence Kraken questionnaires, including users’ employment, net worth and source of wealth. He also declined to order Kraken to turn over information from anti-money laundering investigations.

The case is United States of America v. Payward Ventures Inc., 23-mc-80029, US District Court, Northern District of California (San Francisco).

(Updates with judge’s reasoning.)