Delivery apps charge double for some supermarket groceries – Which?

Ordering supermarket groceries via a delivery app such as Deliveroo, Just Eat or Uber Eats could cost twice the price of buying directly from the same store, according to Which? Meanwhile, Amazon is charging up to 45% more for Morrisons products than if they were bought from the supermarket’s own website, the consumer group found. Which? acknowledged that ordering groceries from Deliveroo, Just Eat or Uber Eats is “undeniably convenient” and could be received in as little as 30 minutes, but warned it found “shocking” price differences across a range of products in its snapshot investigation. It compared the price of a basket of 15 popular grocery items at five major supermarkets against the cost of ordering the same basket from the same supermarket to the same postcode via a delivery app, not including delivery fees. Almost all of the items were either more expensive on the delivery apps or the same price. Ordering groceries from Deliveroo, Just Eat or Uber Eats is undeniably appealing but the cost of this convenience could be double what you'd pay if you cut out the middleman Ele Clark, Which? Which? also found that customers would pay on average 8% more for Morrisons groceries via Amazon than by ordering directly from the supermarket. In one case, a 250g pack of Country Life unsalted butter cost 45% more on Amazon. The rapid delivery apps also charged a premium of as much as 106% in one instance. The Which? basket, which included branded goods such as Doritos crisps alongside own-label milk and ready meals, would have cost £36.63 from Iceland, but getting the same items delivered from the same Iceland store by Just Eat would have cost £50.50, not including delivery fees – a 38% premium. In some individual price differences, own-brand Fairtrade bananas cost 85p at Sainsbury’s and £1.75 on the three apps, Warburtons Toastie Thick Sliced White Bread cost £1 on Iceland’s website but £2 on Just Eat and Uber Eats, while Hovis Best of Both Medium Bread cost £1.19 on the Morrisons website but £2.05 from Uber Eats. Other examples included Asda own-brand Pinot Grigio costing £7 on the supermarket’s website and £9.10 on all three apps. Which? retail spokeswoman Ele Clark said: “Ordering groceries from Deliveroo, Just Eat or Uber Eats is undeniably appealing but the cost of this convenience could be double what you’d pay if you cut out the middleman. “As well as the extra cost on your groceries, you’ll probably have a delivery fee too, so it’s worth weighing this up before ordering anything to your door.” Customers who choose to order groceries via apps like ours do so because of the convenience, speed and choice on offer from rapid delivery Uber Eats A Deliveroo spokeswoman said: “The prices for grocery items available on the Deliveroo platform are set by our grocery partners. “Deliveroo always seeks to deliver great choice, availability and value for money to our customers, and we have agreed price-matching with our grocery partners including Morrisons, Co-op, Asda and more across hundreds of items.” An Uber Eats spokeswoman said: “Everyone who partners with Uber Eats sets their own prices and we always encourage them to match the prices offered in-store. “Customers who choose to order groceries via apps like ours do so because of the convenience, speed and choice on offer from rapid delivery.” A Just Eat spokeswoman said: “At Just Eat, we want all of our customers to have a positive experience when ordering from our platform. We work with more than 75,000 partners across the UK, giving our millions of customers access to choice and convenience through a variety of local takeaway options, restaurant brands and grocery stores. “As independent businesses, any restaurant or grocer using Just Eat are in control of their menus and set the prices they charge. We continue to work closely with our partners to bring value to our customers.” Amazon said that all prices of products sold through the ‘Morrisons on Amazon’ service were set by Morrisons, and added that being able to shop for Morrisons groceries on Amazon offered customers fast delivery options and value. Read More Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live Therapist develops secret app to help abuse victims Artificial intelligence warning over human extinction labelled ‘publicity stunt’ ‘I feel lost’ – AI pioneer speaks out as experts warn it could wipe out humanity

2023-06-03 07:26

Chinese hacking group spying on U.S. critical infrastructure, Western intelligence agencies say

By Zeba Siddiqui and Christopher Bing (Reuters) -A state-sponsored Chinese hacking group has been spying on a wide range of

2023-05-25 06:20

All Warzone 2 Season 3 Reloaded Trophy Hunt Camo Challenges

Ten new Trophy Hunt Camo Challenges are now live in Warzone 2 and MW2 Season 3 Reloaded for players to complete to earn free camos for every weapon in the game.

2023-05-12 00:29

Israel Illegally Storing Millions of People’s Photos, Audit Says

Israel’s immigration authorities are illegally storing millions of photos of citizens and foreign nationals, according to a government

2023-05-16 21:29

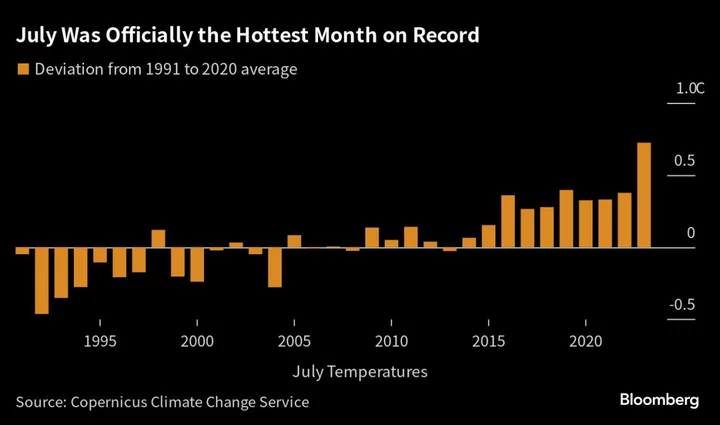

July Was the Hottest Month on Record

July was officially the earth’s hottest month on record, causing the Antarctic to shrink at a record pace

2023-08-09 01:57

BYD Launched BAO 5 under Its New Brand FANGCHENGBAO and the DMO Technology

SHENZHEN, China--(BUSINESS WIRE)--Sep 4, 2023--

2023-09-04 18:29

AI Researcher Who Helped Write Landmark Paper Is Leaving Google

An artificial intelligence researcher who co-authored one of Google’s most influential papers in the field is leaving the

2023-07-11 11:45

Gamers are boycotting Starfield because players can add pronouns

A handful of gamers have erupted across social media due to the option to select pronouns for characters in the game Starfield. The role-playing game (RPG) allows players to customise their characters, including deciding which pronouns they have. The feature was discovered after the game went live on Friday 1 September for those who had pre-ordered. Bethesda, who have previously made games such as The Elder Scrolls V: Skyrim and Fallout 4, allowed Starfield players to select they/them pronouns for non-binary characters if they so pleased. But a small number of notable gaming streamers seemed extremely upset over the decision. They accused video game publishes of going “woke”. Streamer Herschel ‘Guy’ Beahm IV, known by his online alias Dr Disrespect, was outraged both at the pronoun option and the head of publishing at Bethesda, Pete Hines, having his pronouns in his Twitter/X bio, saying “it all makes sense now. Beahm also shared with his viewers that he had tried to work with Bethesda prior to the release of Starfield, but was told no due to “past controversies.” Another streamer known online as 'Heel vs Babyface', revealed his sheer lack of imagination when he screamed at his camera for two-and-a-half minutes claiming the choice of pronouns meant he was being “dragged out” of the immersive experience of the game. “Do you want to get immersed in our world? Yeah well guess what, f**king pronouns,” he screamed. “F**king gender ambiguity. F**king current-day California s**t, because that’s all we f**king know.” As expected, many mocked those who were upset over a two-second feature in a video game. One user called Heel vs Babyface “pathetic”: Others told him to “grow up”: Outside of streamers who are unable to comprehend an experience outside of their own, Starfield has received less than favourable reviews from critics for valid reasons such as poor performance and calling the title “disjointed”. Sign up to our free Indy100 weekly newsletter Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.

2023-09-04 23:17

China Halts 50 Million Tons of Coal Output After Deadly Accident

China halted operations at 32 coal production locations in Inner Mongolia after a deadly accident in February triggered

2023-05-09 13:53

Elon Musk says he's found a woman to lead Twitter as new CEO

Elon Musk says he has found a new CEO for Twitter, or X Corp. as it's now called

2023-05-12 04:55

Battery Giant CATL’s New Fast Power Pack to Tackle Range Anxiety

Battery giant Contemporary Amperex Technology Co. Ltd. unveiled a new superfast-charging battery Wednesday that could be a game-changer

2023-08-16 16:53

Thames Water Rocks ESG Funds With Sewage-Tainted Green Bonds

ESG funds that piled into green bonds sold by Thames Water Plc are now trying to figure out

2023-07-04 21:15

You Might Like...

Get a pack of two Apple Watch keychain chargers for $39

Sony Q1 profit slides 30%, in line with estimates

Microsoft Concedes Activision Cloud Streaming Rights to Ubisoft

Air Liquide announces long term agreements supporting electronics industry expansion in North Texas

Women's World Cup: Hosts New Zealand and Australia kick off 2023's summer of football

Is Adin Ross transphobic? PayMoneyWubby slams Kick's decision to feature streamer as their top star: 'Absolute biggest blunder'

John Warnock, Adobe Co-Founder Who Helped Invent the PDF, Dies at 82

Wood’s Ark Adds Possible ‘Silver Bullet’ to Bitcoin ETF Filing