China's SMIC sees lower Q4 gross margin, lifts annual capex forecast

(Reuters) -Semiconductor Manufacturing International Corp on Thursday lifted its annual capital expenditure forecast to around $7.5 billion and said it

2023-11-09 20:17

Scientists discover new truth about the Sun's structure

Our understanding of the Sun may have completely changed after astronomers calculated that it might not be quite as big as we thought it was. The Sun is so powerful that it can disrupt the Earth’s magnetic field giving us the Northern Lights. It also continually baffles scientists, as one recent discovery found that part of the Sun is broken. Now, experts have discovered that the Sun may be a bit smaller than everyone thought, which could alter how we think of the star at the centre of our universe. Two astronomers made the calculation that the radius of the Sun is smaller, by a few hundredths of a per cent, than originally believed. The results, which are being peer-reviewed, are based on evidence gathered from sound waves that are made and trapped inside the burning hot sun. These sound waves are known as p-modes and they make noise like a growling stomach, suggesting a pressure change in the Sun’s interior. Analysing p-mode oscillations offers a “dynamically more robust” understanding of the Sun’s insides, according to astrophysicists Masao Takata from the University of Tokyo and Douglas Gough from Cambridge University. According to their research using evidence from p-modes, the solar photospheric radius is fractionally smaller than calculations made using the traditional reference model for the Sun’s seismic radius that analyses waves called f-modes. The reason for this difference is not very well understood. Astrophysicist Emily Brunsden told New Scientist: “To understand the reason for their difference is tricky because there’s just a lot of things going on.” How to join the indy100's free WhatsApp channel Sign up to our free indy100 weekly newsletter Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.

2023-11-09 19:53

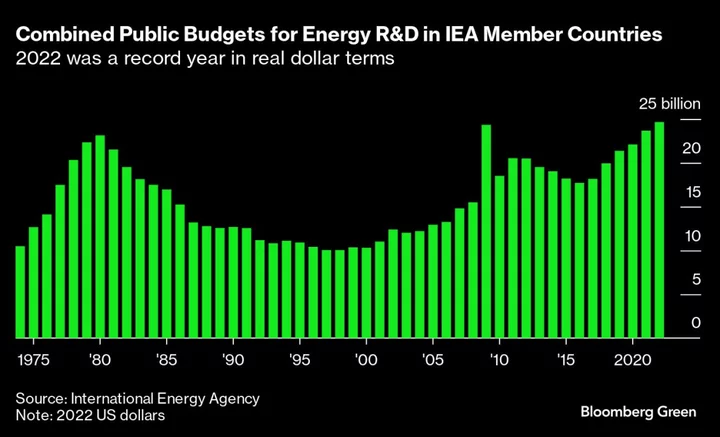

Nuclear Is Out, Hydrogen Is In: Where Countries Put Energy R&D Money

Since the International Energy Agency was founded five decades ago, it has compiled data on the government research

2023-11-09 19:48

‘No One Is Safe From Climate Change’ After Hottest 12 Months Ever Recorded

The past 12 months have been the hottest on record, as 99% of the world’s population experienced above-average

2023-11-09 19:27

South Africa’s Climate Adviser Rebuts Report Target to Be Missed

South Africa’s Presidential Climate Commission dismissed a report that said modeling shows that the country will miss its

2023-11-09 19:25

Israel's Wix.com posts Q3 beat, says business as usual

By Steven Scheer JERUSALEM (Reuters) -Wix.com, which helps small businesses build and operate websites, reported a higher-than-expected rise in quarterly

2023-11-09 19:25

New AI Pin clips ChatGPT to your clothes

A US startup is set to unveil an AI-powered device that it claims could replace smartphones. Humane’s AI Pin, which launches today, will clip directly to a person’s clothes and is expected to feature a projector to turn any surface into a screen. An embedded camera and microphone means it could function as a wearable smartphone without a screen, with its creators say has been “built from the ground up for AI”. Leaks suggest the AI Pin will cost $699 and require a $24-per-month subscription fee to access AI models developed by Microsoft and OpenAI, which may include a version of the viral ChatGPT chatbot. Documents obtained by The Verge suggest it will come with two “battery boosters”, a “personic speaker”, and will be powered by a Qualcomm Snapdragon processor. It will also be able to summarise your email inbox, translate languages and come with an “AI DJ”. Humane did not respond to a request for comment but has announced that it will unveil the AI Pin on 9 November. A version of the device was revealed earlier this year at Paris Fashion Week, with models wearing a small square box on the lapels of their clothes. Humane co-founder Imran Chaudhri, who spent 22 years at Apple as a designer before forming his own startup, also gave details about how the clip will function in a TED talk in May. A demonstration showed the tech founder receiving a phone call through the device, using its laser-projected display to turn his palm into an interactive screen. “We believed that artificial intelligence would be the driving force behind the next leap in device design,” he said. “[The AI Pin] is completely standalone. You don’t need a smartphone or any other device to pair with it... It interacts with the world in the way that you interact with the world – hearing what you hear, seeing what you see – while being privacy first and safe, and completely fading into the background of your life.” Humane describes the experience as “screenless”, “seamless” and “sensing”. In a press release earlier this year, Humane co-founder Bethany Bongiorno said: “Our relationship with technology is changing profoundly, becoming even more personal as our devices morph into extensions of our bodies, minds and hearts.” Read More Elon Musk’s new AI bot will help you make cocaine which proves it’s ‘rebellious’ ChatGPT update allows anyone to make their own personalised AI assistant How Elon Musk’s ‘spicy’ Grok compares to ‘woke’ ChatGPT The mystery AI device that could replace your phone

2023-11-09 19:19

LME appoints new technology manager to strengthen expertise for flagship project

LONDON The London Metal Exchange (LME), which faces lengthy delays to its trading technology revamp, said on Thursday

2023-11-09 18:22

Setback for Ireland as EU legal adviser recommends revisit of Apple tax case

A legal expert at Europe’s top court has said a lower court committed “errors in law” when it threw out a decision by the European Commission which would force Apple to pay more than 13 billion euro in back taxes to Ireland. The non-binding opinion is seen as a significant setback to Ireland’s defence of its past tax treatment of the US technology giant. In 2016, following an EU investigation which launched in 2014, the commission concluded that Ireland gave undue tax benefits to Apple, which would be illegal under EU state aid rules. Ireland and Apple fought the commission on the matter and in July 2020, the General Court of the European Union annulled the decision. However, the European Commission subsequently appealed against the decision to the European Court of Justice (CJEU) saying the lower court’s ruling was legally incorrect. On Thursday, Giovanni Pitruzzella, an advocate general at the CJEU, agreed that the earlier ruling had contained “a series of errors in law”. He said the judgment should be set aside and referred the case back to the General Court for a new decision. While the opinion of the advocate general is non-binding, it is usually followed by the court and therefore could have significant implications for corporation tax bills. There was no sweetheart deal Finance Minister Michael McGrath The commission’s original position was that that tax rulings issued by Ireland to Apple in 1991 and 2007 substantially and artificially lowered the tax paid by the iPhone manufacturer in the country since the early 90s, in a way which did not correspond to economic reality. As a result, competition commissioner Margrethe Vestager said Ireland had granted illegal tax benefits which enabled it to pay substantially less tax than other business over many years. The investigation found that Apple had paid an effective corporate tax rate of 1% on its European profits in 2003, down to 0.005% in 2014, 50 euro for every one million euro of profit. The process involved recording almost all sales profits of two Irish incorporated companies, which the commission said only existed on paper. The companies, fully owned by Apple, held the rights to use the firm’s intellectual property to manufacture and sell its products outside North and South America. The commission said this situation allowed Apple to avoid taxation on almost all profits generated by sales of its products in the entire EU single market. It said this was due to Apple’s decision to record all sales in Ireland rather than in the countries where the products were sold. The findings were disputed by the Irish State, which said all tax owed had been collected, and Apple, which had come under scrutiny in the US for its tax practices years earlier. At the time, Apple’s chief executive, Tim Cook, branded the EU findings as “political crap”, maddening and untrue. The Irish Government, which was also used to defending a comparatively low 12.5% corporation tax rate, said Europe had overstepped the mark in attempting to dictate tax laws and enforce retrospective taxes decades later. Ireland and Apple fought the commission on the matter and in July 2020, the General Court of the European Union annulled the decision. The General Court found that the commission had not shown that there was an advantage deriving from the adoption of the tax rulings. However, the commission subsequently appealed the decision to the European Court of Justice with Ms Vestager saying the lower court’s ruling contained errors of law. On Thursday, the advocate general agreed the General Court had erred when it ruled that the Commission had not shown to the requisite legal standard that the intellectual property licences held by the two incorporated companies and related profits, generated by the sales of Apple products outside the US, had to be attributed for tax purposes to the Irish branches. The advocate general was of the view that the General Court also failed to assess correctly the substance and consequences of certain methodological errors that, according to the Commission decision, “vitiated the tax rulings”. It is the non-binding opinion of Mr Pitruzzella that it is necessary for the General Court to carry out a new assessment. The decision of the CJEU on the matter is expected next year and will have significant implications for how member states grant tax breaks to major firms. Apple has argued it has been paying tax on the profits in question in the US, while Ireland has seen it necessary to defend its reputation on taxation issues to protect foreign direct investment. Last weekend, Finance Minister Michael McGrath had said the advocate general’s opinion would be “significant” but added it is not the final step in the process. Mr McGrath said: “We are confident in our position in respect of the Apple case. “We take encouragement from the findings they have made so far, but it is a significant day.” He added: “There was no sweetheart deal. “This was the application of Ireland’s statutory corporation tax code.” In the interim, the 13.1 billion euro has been held in an escrow fund pending the outcome of the case. The money, with interest, is due to be entered into the Irish exchequer if the commission wins the case. However, other member states may make claims that they are owed some of the money. If the commission loses the appeal, the large sum will be returned to Apple. Read More Smartphones ‘may be able to detect how drunk a person is with 98% accuracy’ Ireland and Apple await major development in long-running EU tax dispute Guidance urges parents not to buy smartphones for primary school children William ‘blown away’ by futuristic technology from Singapore start-ups Return of original Fortnite map causes record traffic on Virgin Media O2 network NatWest creates new AI-powered chatbot capable of ‘human-like’ conversations

2023-11-09 18:22

Apple suffers setback in fight against EU's $14 billion tax order

By Foo Yun Chee and Bart H. Meijer LUXEMBOURG (Reuters) -An EU tribunal made legal errors when it ruled in

2023-11-09 18:21

Exclusive-Geely's Zeekr edges closer to US IPO, to make filing public this week - sources

SHANGHAI (Reuters) -Zeekr, Chinese automaker Geely's premium electric car brand, will this week publicly release some details of its plans

2023-11-09 18:16

US-China Climate Talks Wrap Up With Warm Words But Few Details

The top climate envoys from the US and China ended five days of face-to-face talks late Wednesday, hailing

2023-11-09 16:58