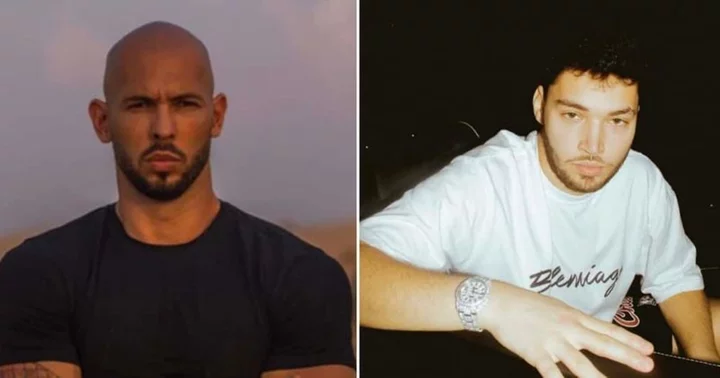

What happened between Andrew Tate and Adin Ross? Top G takes a dig at Kick streamer: 'I have lost respect for certain people'

'Anyone with a brain knows Adin is just using Tate for viewers,' a user said about Adin Ross using Andrew Tate to grow his fame

2023-07-05 19:54

Alexander Sorloth FIFA 23: How to Complete the Shapeshifters SBC

Alexander Sorloth FIFA 23 Shapeshifters SBC is now live and it's one of the best pieces of content released. Here's how to complete the SBC.

2023-06-21 01:57

Google, Microsoft, OpenAI and Anthropic announce industry group to promote safe AI development

Some of the world's top artificial intelligence companies are launching a new industry body to work together — and with policymakers and researchers — on ways to regulate the development of bleeding-edge AI.

2023-07-26 23:24

X sues hate speech tracker over Twitter reports

X is suing a nonprofit group in US federal court over reports that hate speech has flourished at the platform...

2023-08-02 01:59

Valorant Knight's Market Buddy: How to Get for Free

To get the Valorant Knight's Market Buddy for free, players must link their Riot Games account to their Amazon Prime account and then claim the reward.

2023-08-31 04:49

Nvidia's dominance in AI chips deters funding for startups

By Max A. Cherney Nvidia's supremacy in building computer chips for artificial intelligence has chilled venture funding for

2023-09-11 18:23

Why you should never drain your pasta in the sink

Pasta lovers are often guilty of draining their pasta water down the sink before adding sauce. But there is an important reason to save your pasta water and it is pretty scientific. Because pasta is made of flour, it releases starch into the cooking water as it boils, creating a white, cloudy liquid that emulsifies sauces it is added to. Emulsification is the process of blending two liquids that would otherwise repel each other ― in the case of pasta, it’s oil and water ― into a smooth, inseparable mixture. Sign up to our free Indy100 weekly newsletter Starchy pasta water is also a thickener, so saving some and mixing it into sauce creates something creamy and thick that won’t ever separate. This makes for a better sauce, so if you ladle some pasta water out before draining the rest you are going to be giving serious chef vibes. With that said, it is time to impress everyone you ever cook for again - just from the simple act of saving a small bit of water. Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.

2023-06-26 20:18

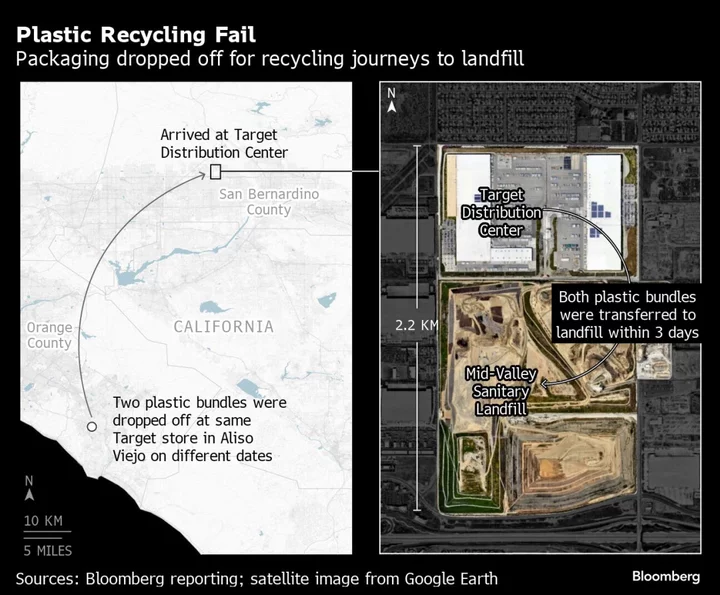

Don’t Trust Plastic Snack Wrappers With Recycling Instructions

The former teen idol Zac Efron is riding a skateboard, and then he’s dressed for some reason in

2023-09-29 21:49

Biden to Visit Hawaii in Stepped-Up Response to Disastrous Fires

President Joe Biden aims to show the federal government is there for Maui residents when he visits the

2023-08-21 17:18

Lattice Stock Tumbles. Like ON Semi, the Chip Maker Sees Weaker Auto Sales.

The company's earnings beat expectations but its guidance disappointed as it forecast a drop in demand.

2023-10-31 22:21

Fact check: Ron DeSantis on Amanda Gorman poem being pulled from a Florida elementary school library

Florida Gov. Ron DeSantis said Friday that he "had nothing to do with" a poem recently being moved from an elementary school library to a middle school library.

2023-05-31 08:30

CryptoZoo victims take jibes at Logan Paul for spending $1.8M on fiancee: 'Paul brothers shouldn’t be given attention or clicks'

Logan Paul was heavily criticized by CryptoZoo victims after he gifted a diamond ring to his fiancee

2023-08-28 14:25

You Might Like...

Did the Nemesis AR Get Buffed in Apex Legends?

Nexa3D Adds Metal 3D Printing Capabilities with ColdMetalFusion, Partners with Headmade Materials

Intelsat Adds European Capacity with Telespazio’s Fucino Space Centre in Italy

Will Ludwig join Kick? Pro streamer's verified account on platform sparks speculations among fans: 'It's never too late'

xQc suggests plan to rescue FaZe Clan: 'Fire all employees that do content'

Get a great deal on a wireless gaming mouse, on sale for $49.99

Does Roblox have Cross-Progression, Cross-Platform Play?

White House tasks hackers with breaking ChatGPT