Arm Ltd. Chief Executive Officer Rene Haas, gearing up for the biggest initial public offering of the year, is pitching investors on a pivot.

His message to potential shareholders is that Arm is poised to become a bigger and more profitable business — not just because of the industrywide boom in cloud computing and artificial intelligence, but also due to a major change in how it operates.

“We made a significant shift in our strategy,” Haas said in a video presentation for prospective inventors seen by Bloomberg.

For most of its history, Arm’s main focus has been designing chips for smartphones and other electronics and then selling that technology for pennies per chip to companies like Qualcomm Inc. But now, Arm is doing complex design work focused on specific products, tailored for what it sees as key areas of growth. It’s a “purpose-built approach” addressing the urgent needs of companies making mobile devices, cloud computing, car electronics and internet-connected technology, Haas said in the presentation.

Getting that message across is key to the lofty valuation — as much as $54.5 billion — that Arm is seeking in its IPO this week. That would be a big markup from 2016, when SoftBank Corp.’s Masayoshi Son bought Arm for $32 billion. To bolster the point that Arm really is a different company, the video presentation features endorsements from Nvidia Corp. Chief Executive Officer Jensen Huang and James Hamilton, architect of much of Amazon.com Inc.’s AWS hardware, among others.

Huang, in a reference to his failed attempt to purchase Arm for $40 billion in 2022, said the world knows how much he loves Arm and praised Haas’ shift into new markets, particularly the artificial intelligence ecosystem. Nvidia, now the most valuable chip company, is backing Arm’s IPO and plans to be a strategic investor.

It was Nvidia’s unsuccessful pursuit of Arm that led to Haas’ overhaul. His pitch for the CEO job — when his predecessor, Simon Segars, stepped down in early 2022 — was that Arm was doing much of the work in defining technology in the mobile phone and computing industries but wasn’t being paid or valued accordingly.

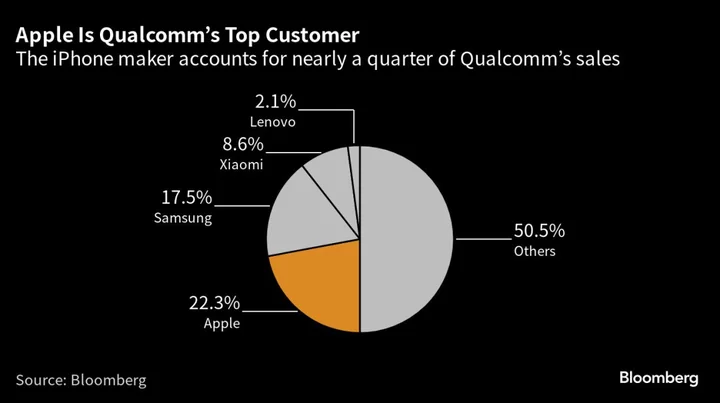

Chipmakers like Qualcomm and Broadcom Inc. have licensed Arm’s partial designs and computer code and put them in their own chips. The products adhere to industry standards, making it easy for software makers to ensure that various forms of technology are compatible. That’s why Arm’s designs are in nearly every cell phone made today.

When Son acquired Arm, his big push was to bring that same compatibility to the so-called Internet of Things. As more and more devices became connected, he reasoned, they’d need the kind of coherency around standards that made the mobile phone industry grow so quickly.

His argument to investors eight years ago was that — while Arm was already pervasive in the billion-unit smartphone market — the proliferation of computing into everything from household electronics to factory equipment and traffic signals would take it into billions of new devices.

Haas has flipped Arm’s emphasis, saying more isn’t necessarily better. He has pushed Arm to move beyond licensing the basic building blocks of chips and instead provide customers with blueprints they can take straight to the factory and put into production. Now Arm is charging much higher royalty rates per device because it offers customers more complete designs that are more technologically capable.

Arm’s pivot is an attempt to take advantage of a shift that’s been brewing for several years. Some of the biggest technology companies have increasingly started to see the ability to make the fundamental components of their products and systems as a key competitive advantage.

Apple Inc.’s A and M series processors are the most obvious example, powering devices from MacBooks to iPads. Likewise, Amazon.com Inc., Alphabet Inc.’s Google, Microsoft Corp. and their Chinese counterparts are also trying to equip data centers with chips that fit their specific needs, instead of relying on Intel Corp. for generic solutions.

That’s given Arm the chance to do complete designs for chips that may cost hundreds, if not thousands of dollars.

While Arm might get paid low-single-digit dollars on a $30 main chip in a smartphone, the potential inside the kind of processor that’s at the heart of a cloud data center is much greater. In that kind of environment, chips can have more than a hundred computing cores, or mini processors, and Arm can charge more than a dollar per core.

The revenue opportunity in cloud computing will grow to $28 billion by 2025, expanding at a rate of 17% per year from now, Arm Chief Financial Officer Jason Childs said in the video presentation.

The company has a gross margin, or percentage of revenue remaining after deducting costs of production, of 95%. Going forward, Arm will decide on the level of profitability it wants to deliver depending on industry circumstances.

When the chip business goes through changes, Arm is likely to invest more into research and development to gear itself up for opportunities. When it’s more stable, profitability will increase, he said.

“For chips where our products have provided more value, we will typically receive a higher royalty rate per chip,” Arm said in a recent securities filing. “Accordingly, we believe that our investments in higher performance, higher efficiency, and more specialized designs will drive greater demand for our products and higher value for our customers, which is expected to result in higher royalty fees.”

That makes Arm increasingly a competitor for its chipmaker customers who want to be seen as the ones who add the most value for the computer and phone makers they supply.

A legal dispute between Arm and Qualcomm, which centers around the fees the San Diego chipmaker has to pay too use another Arm licensee it acquired, is a sign of this increasing tension.

Switching to another instruction set — the basic code that a chip uses to communicate with software — away from Arm’s would cause chipmakers like Qualcomm massive headaches. So even as they persist in trying to out-design the UK-based company, they’ll likely have to stick with using its basic technology.