(Bloomberg) --

Bank of America Corp. returned to the green bond market last week, ending a seven-month issuance drought for bonds tied to ESG financing from Wall Street’s biggest lenders.

The Charlotte, North Carolina-based bank tapped the European investment-grade market to sell €1 billion ($1.1 billion) of bonds maturing in five years to help fund renewable energy projects, said a person with knowledge of the matter. It marks the first ESG-linked deal from the largest US banks since November, according to data compiled by Bloomberg.

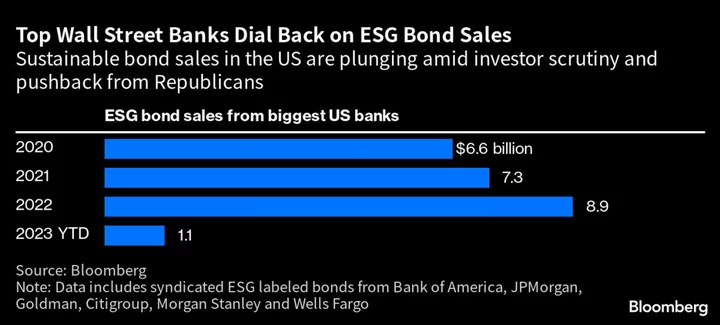

By contrast, banks had sold $8.9 billion of environmental, social and governance-linked debt during all of last year. The drop in issuance has dovetailed with a sharp overall decline in US sales of bonds designed to help companies “do good” as right-wing political pressure backed by Big Oil and other polluting industries increases and investors grow more skeptical about the impact of the bonds on the environment and society.

Banks may be more active in sustainable bond markets denominated in other currencies given the recent scrutiny on ESG in the US, according to Nicholas Elfner, co-head of research at Breckinridge Capital Advisors. The European green bond market is “arguably deeper, has a more developed sustainable regulatory framework, a dedicated investor base and a less mobilized anti-ESG contingent,” he added.

“Issuers will need to be more thoughtful about how they structure these deals” because of “the additional scrutiny of certain structures,” Elfner said.

Read More: US ESG Bond Market Chokes on Republican Attacks

Banks also have dialed back their overall bond issuance, given volatility earlier this year as higher interest rates roiled markets. Financial institutions account for about 38% of new issuance so far in 2023, down from 55% last year, Bloomberg data show. And none of the sales have been ESG-related, except for Bank of America’s recent offering.

“Funding levels and spreads haven’t been particularly attractive so—to a degree—banks have been waiting it out,” Elfner said.

The average spread on a financial institution bond was at 156 basis points as of Monday, 19 basis points wider than the spreads for the broader high-grade bond index, according to Bloomberg index data.

The slowdown in ESG sales from the big banks correlates with lower overall issuance, said Arnold Kakuda, senior analyst for the financial sector at Bloomberg Intelligence.

Kakuda predicted in January that sales of ESG and conventional bonds by Wall Street’s biggest banks would drop 33% this year to $132 billion. On June 12, he said the decline may be even larger given the slow pace of issuance so far in 2023.

Read More: Wall Street Scrutiny Resets $6 Trillion ESG Debt Market

Bank of America, the second-largest US bank, has issued about $15 billion under different ESG debt labels since it started tapping the market in 2013, making it the biggest issuer of the bonds among US corporate and financial issuers, according to Bloomberg data.

The financial-services industry is being pressed by Republican-controlled states, including Texas and Florida, to stop considering ESG criteria in their decision-making processes. A recent survey found that almost half of North America’s biggest asset managers are concerned that politics around ESG exposes them to legal risks.

Last week, Bank of America became the latest target of an anti-ESG group, which criticized the company for being too vocal about ESG topics like the climate crisis. The company responded by sticking to its guns. The bank said “responsible growth is how we deliver industry-leading service to our 68 million American consumers, being a great place to work for our employees and supporting communities across the United States while delivering strong returns for our shareholders.”

The internal corporate debate between “doing good” and steering clear of political backlash isn’t going away anytime soon, which leaves banks and other companies in a bind.

--With assistance from Jiayu Liu.