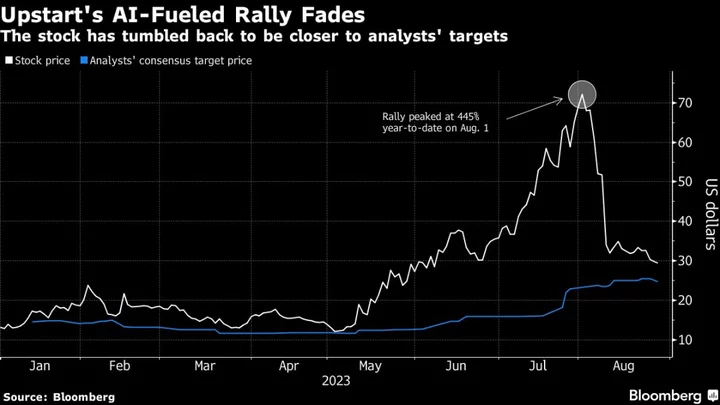

A rapid reversal in the shares of online-lending firm Upstart Holdings Inc. underscores the dangers for stocks swept up by AI fervor.

By the start of August, Upstart was one of the best performers in the Nasdaq Composite Index, its rally for the year peaking at 445% amid the euphoria about artificial intelligence. Its market value has since fallen by half, showing how difficult it can be for companies to live up to the hype.

“AI is certainly a very popular innovation right now. It’s obviously to some degree going to change the world,” said Jefferies analyst John Hecht. “But that doesn’t mean that everything-AI doesn’t come with certain risks tied to it.”

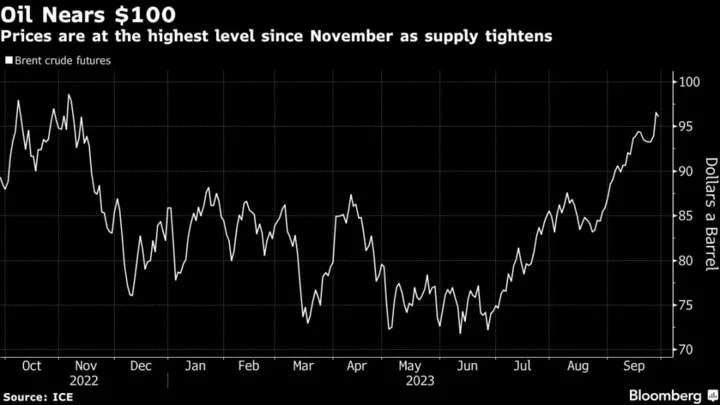

Animal spirits in the stock market, fueled in part by speculation the Federal Reserve would soon cut interest rates, have cooled amid signs of economic resiliency and stickier-than-expected inflation. That’s caused traders to pull back from riskier, higher valuation stocks they piled into for much of the year.

Upstart isn’t alone in struggling to live up to lofty expectations, of course. Software maker C3.ai Inc., which at its June peak had more than quadrupled this year, has since lost about a third of its value. The volatility highlights the stakes for stocks inflated by AI excitement, that have drawn the attention of retail traders and short sellers.

Though to be sure, there’s a distinction to be made between companies swept up in the hype because of their relationship to the technology, and those that are directly profiting from the uptick in demand for components.

AI Lender Upstart’s 445% Rally Fades as Outlook Cools Frenzy

Upstart uses artificial intelligence to evaluate individuals applying for personal loans, in an effort to offer a broader method of assessment. Its shares dropped 53% in August, with most of the losses coming the week after the lender offered a disappointing outlook, under pressure from higher interest rates.

“This is a company that markets themselves as an AI lender, so it became a frenzy of ETFs and different types of funds and retail investors that were buying anything AI, without doing much diligence frankly,” Hecht said.

It’s still up 145% this year, however. Short interest remains high at more than 30% of the float, according to data from S3 Partners.

“Building a sustainable AI leadership position in such an entrenched and regulated part of our economy doesn’t happen overnight, and significant stock price fluctuation can be expected to be part of the journey,” an Upstart spokesperson said.

Bubble in Profitless Firms Has Potential to Burst: Tech Watch

A group of unprofitable tech firms tracked by Goldman Sachs Group Inc. has pared its 2023 gains to 37% after reaching as much as 56% in July. A basket of AI beneficiaries the firm tracks has ebbed from levels earlier this month.

Even as chipmaker Nvidia Corp.’s recent earnings reflected the power of AI demand, the stock’s lackadaisical reaction to the blowout report showed how hard it is to excite investors when stocks are up by triple-digits on the year. C3.ai Inc. is down 23% since its report in late May underwhelmed.

For tech stocks, the jump in valuations has pushed multiples to a point where investors should be more selective, according to UBS.

“The surge in AI applications and investments has created a powerful new narrative for the broader tech sector,” wrote Solita Marcelli, chief investment officer Americas at UBS Global Wealth Management. “But rich valuations may limit near-term upside. We suggest investors maintain exposure but balance near-term optimism against other portfolio considerations.”

Tech Chart of the Day

Amazon.com Inc. rose 2.2% on Thursday, contributing to a monthly gain of 3.2%. August represented the sixth straight monthly gain for the e-commerce and cloud-computing company, its longest such streak since July 2011. The stock gained more than 46% over the six-month advance.

Top Tech Stories

- Tesla Inc. unveiled the first refresh of its popular Model 3 sedan with a sleeker look and longer range, and slashed the price of its premium cars in the US and China in an all-out push by Chief Executive Officer Elon Musk to boost sales.

- Broadcom Inc., a supplier of chips to Apple Inc. and a broad swath of the tech industry, gave a disappointing forecast for the current period, signaling that demand remains sluggish for electronic components.

- Dell Technologies Inc. reported better-than-expected sales of personal computers and data center hardware, fueling hopes of a recovery in the market for corporate technology. The company also said demand for products that help businesses use artificial intelligence are a “long-term tailwind.”

- Alphabet Inc.’s Google told a federal court Thursday that it should be allowed to interview the Justice Department’s top antitrust official under oath, alleging his “deep-seated bias” against the company led the federal government to sue it for antitrust violations.

- Samsung Electronics Co. jumped more than 6% on reports the company has won the right to supply advanced memory chips to AI leader Nvidia Corp.

- Arm Holdings Ltd., one of the most anticipated stock listings of the year, is preparing to set a price range for its initial public offering before embarking on an investor roadshow next week, according to people familiar with the matter.

Earnings Due Friday

- No major earnings expected

--With assistance from Ryan Vlastelica, Jeran Wittenstein, Subrat Patnaik and Rheaa Rao.

(Updates throughout for market open.)