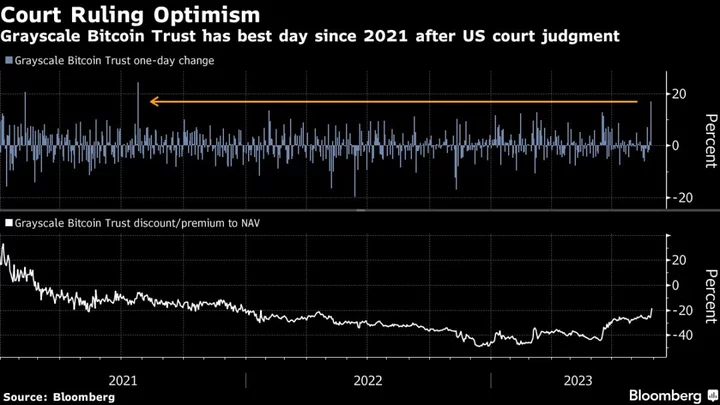

The $17.4 billion Grayscale Bitcoin Trust rallied the most since July 2021 after a US court ruling potentially paved the way for the vehicle to convert into an exchange-traded fund.

Shares in the world’s largest Bitcoin portfolio jumped 17% on Tuesday, narrowing their discount to the value of the fund’s underlying token holdings to about 18% compared with a December shortfall of nearly 50%.

Grayscale Bitcoin Trust (ticker: GBTC) currently has a closed-end structure, leaving it prone to big deviations from its net asset value, or NAV. Becoming an ETF would allow shares to be created and redeemed to keep pace with NAV, a prospect that triggered a flurry of bets on a shrinking discount.

The renewed interest was underlined by a surge in trading volume to the highest level in over a year as more than 19 million shares changed hands, according to data compiled by Bloomberg.

If a spot Bitcoin ETF is approved, “it will mark a key moment in the development of the asset class, catalyzing additional mainstream adoption of Bitcoin and cryptoassets and bringing fresh capital and institutions into the space,” Citizens JMP Securities analysts including Devin Ryan wrote in a note.

The trust’s biggest shareholders include Digital Currency Group, parent of crypto asset manager Grayscale Investments LLC, portfolios at investment manager Horizon Kinetics LLC, a smattering of Morgan Stanley funds and the ARK Next Generation Internet ETF (ticker: ARKW).

Grayscale Investments prevailed over the US Securities and Exchange Commission when an appeals court on Tuesday overturned the agency’s decision to block a proposal to turn the trust into a spot Bitcoin ETF.

The SEC may still appeal the judgment, having taken a tough stance on crypto since a 2022 market rout and the collapse of firms such as the FTX exchange.

“Although the swing higher on strong volume has been impressive, and today’s news does provide some hope for crypto on the regulatory front, one day does not make a trend,” Bespoke Investment Group wrote in a note.

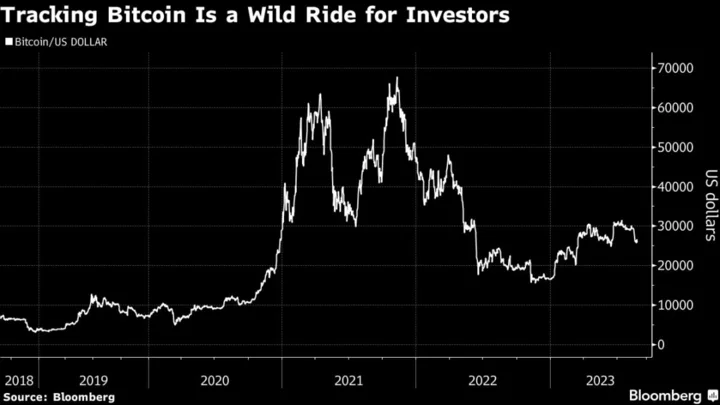

Grayscale, BlackRock Inc. and Fidelity Investments are among a number of fund managers vying for permission to start the first US spot Bitcoin ETFs. The prospect of fresh demand for the largest digital asset is among the drivers of a 67% rebound in Bitcoin this year.

The token climbed just over 6% in the US on Tuesday and held the gains early Wednesday in Asia, trading at around $27,550 — still far lower than its 2021 pandemic-era record of close to $69,000.

Smaller digital assets such as Ether and meme-crowd favorite Dogecoin also retained overnight advances, reflecting the broad bout of optimism that swept across the cryptocurrency market in the wake of the court ruling.