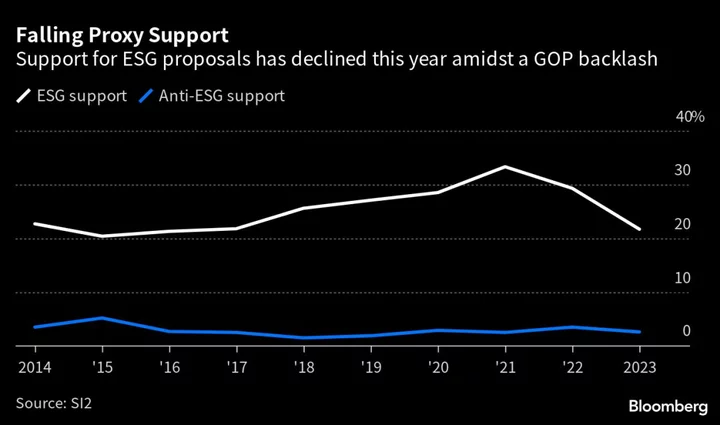

Investor support for environmental and social shareholder proposals slumped to the lowest in six years amid the Republican backlash against sustainable investing.

Average backing for resolutions focused on climate change, workers’ rights, diversity and corporate governance declined this year to about 22% at annual shareholder meetings, down from a peak of 33% in 2021, according to a tally of votes compiled by the Sustainable Investments Institute through Thursday. Support hasn’t been this low since 2017.

“That’s just striking,” said Heidi Welsh, who runs Sustainable Investments and has been monitoring shareholder votes for more than three decades. Republican opposition to ESG initiatives has become a “wrecking ball,” she said. “It’s across the board that support has dropped.”

Corporate annual meetings have become the latest front in the GOP-led movement against environmental, social and governance investing, with more and more asset managers avoiding topics like climate change, gender and racial diversity. Shareholders also have become more cautious about how they vote amid concerns they’ll be blacklisted by Republican officials from doing business in their states. Pressure has been growing since March when asset managers were warned by a group of state attorneys general that Americans’ savings shouldn’t be used to “push political goals.”The biggest opposition has focused on environmental initiatives, followed by human capital management and human rights, the Sustainable Investments analysis shows. Issues related to questions about political activity and health care, such as Covid drug pricing and access, had smaller declines. The number of ESG proposals that went to a vote fell to 240 from a peak of 283 last year.

After GOP state attorneys general raised their concerns about shareholder actions, a group of state financial officers followed up last month, asking large asset managers, including BlackRock Inc., to detail how they vote. “We are concerned that taxpayers’ best long-term economic interests might have become subordinated to environmental, social and political interests often divorced from shareholder value—and often pushed through shareholder proposals,” they wrote in a May 15 letter.Still, the Republican-led attacks didn’t lessen support for numerous worker-related shareholder proposals, while opposition to anti-ESG proposals increased slightly.

It isn’t only GOP-led efforts that are influencing shareholders. Overall support has been sliding since the US Securities and Exchange Commission allowed more proposals, opening the door to votes on issues that took more extreme positions, said Bloomberg Intelligence senior ESG analyst Rob Du Boff.

“Looking at just the numbers, the support levels appear to be dwindling,” he said. “But if you look at the substance of what major shareholders actually voted for this year versus three or four years ago, I don’t think very much has actually changed.” BlackRock, the world’s largest asset manager, backed about 21% of environmental proposals in the 2021-2022 voting season, down from about 26% in the 2020-2021 season, according to data tracked by Insightia. Vanguard Group Inc.’s support for social resolutions dropped to about 10% globally from 22% in the same period.

In 2023, support for climate-related proposals has essentially halved to about 23% from two years ago, according to data from the Center for Active Stewardship. Activist investors filed environmental resolutions this year that have been more “aggressive” and that’s led to a higher level of disapproval, said Nolan Lindquist, executive director of the group. For example, one rejected proposal asked Exxon Mobil Corp. and Chevron Corp. to take responsibility for curbing emissions from customers that burn their fuels, or so-called Scope 3 emissions.

“Before, investors were merely asking for reports disclosing emissions goals and energy-transition plans,” Lindquist said. “Recent proposals are much more specific about executing on those plans.”

Even as overall support has waned, investors continue to back ESG proposals that are clearly linked to a company’s financial risk and reputation, said Nadira Narine, senior director of strategic initiatives at the Interfaith Center on Corporate Responsibility, which tracks activist shareholder recommendations.

- A majority of Starbucks Corp.’s voters backed a proposal to study the company’s labor actions after the National Labor Relations Board cited the company for interfering in unionization activities at its coffee shops.

- Shareholders also agreed that Dollar General Corp. should move ahead with a health-and-safety audit for its workers. The company is on the US Labor Department’s Occupational Safety and Health Administration’s “severe violator” list of companies with working conditions that endanger employees.

- And almost half of McDonald’s Corp. investors agreed the company should better explain its lobbying efforts, which may be contrary to the interest of its workers.

Even with the backlash, the small number of explicitly anti-ESG recommendations have been roundly rejected.

At Amazon.com Inc., a conservative group asked the company to report on the costs and benefits of its diversity, equity and inclusion program, including efforts to conduct racial-equity audits. The proposal garnered just 0.8% of votes. Another asked drugmaker Eli Lilly & Co. to disclose its risks and costs from the company’s opposition to enacted or proposed state policies on abortion. That resolution got just 1.9% of support.

The point of such proposals isn’t necessarily to win, but to force companies to take a position on issues such as whether White people are being hurt by diversity efforts, said Scott Shepard, executive director of the Free Enterprise Project at the National Center for Public Policy Research, a conservative group that pushes for free-market solutions to policy issues.

“All we’re seeking in every effort we’re taking is to get companies back to neutral,’’ he said. “So they are admitting ESG is left wing and partisan by calling us anti-ESG, but we’ll take it because the admission itself is pretty huge. I think we can score that as a big win for our team.”

According to Sustainable Investments' Welsh, even if conservatives didn't win, they have been successful at shifting the conversation.

“We really are in a sort of ‘which side are you on’ moment,” she said.