SoftBank Group Corp. semiconductor unit Arm filed for what is set to be the year’s largest US initial public offering, disclosing key details of its finances and giving struggling equities markets their biggest lift in almost two years.

Arm Holdings Ltd. didn’t disclose proposed terms for the share sale in its filing Monday with the US Securities and Exchange Commission. The company plans to start its roadshow the first week of September and price the IPO the following week, seeking to be valued in the listing at $60 billion to $70 billion, Bloomberg News has reported.

While Arm had been aiming to raise $8 billion to $10 billion in the IPO, that target could be lower since SoftBank has decided to hold onto more of the company after buying Vision Fund’s stake in it.

The offering is being led by Barclays Plc, Goldman Sachs Group Inc., JPMorgan Chase & Co. and Mizuho Financial Group Inc. The filing lists 24 other underwriters below that top tier.

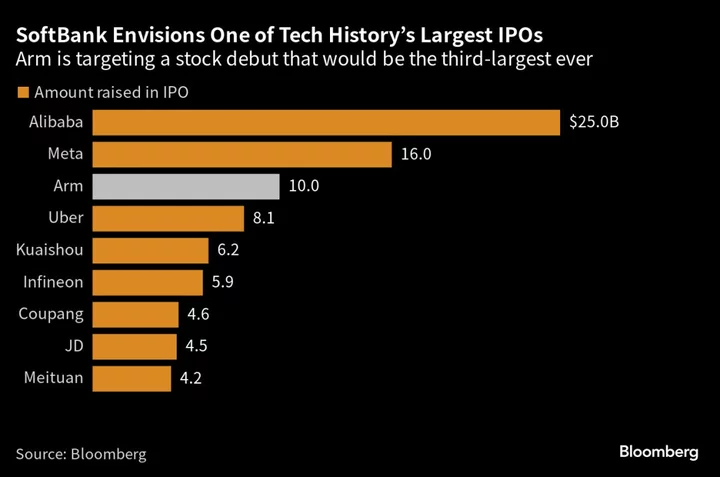

The listing is set to be the largest in the US since electric-vehicle maker Rivian Automotive Inc.’s $13.7 billion offering in October 2021. It could rank near or even just below the tech industry’s largest-ever IPOs: Alibaba Group Holding Ltd.’s $25 billion 2014 offering and 2012’s $16 billion debut by Meta Platforms Inc., then known as Facebook Inc.

A successful debut by Arm would provide a welcome relief for SoftBank founder Masayoshi Son, whose Vision Fund lost a record $30 billion last year. It could also spur dozens of startups such as online grocery delivery company Instacart Inc. and marketing and data automation provider Klaviyo to follow through on — or further delay — their own IPO plans.

Read More: Instacart Said to Plan for September IPO

Arm’s target valuation underscores a shift in market mood in favor of technologies linked to artificial-intelligence chips and generative AI.

While the Cambridge, UK-based company’s technology is used in almost every smartphone, its place in the industry has long been obscure. Arm sells the blueprints needed to design microprocessors, and licenses technology known as instruction sets that dictate how software programs communicate with those chips. The power efficiency of Arm’s technology helped make it ubiquitous on phones, where battery life is critical.

Rene Haas, who took over as Arm’s chief executive officer last year, is now working to expand beyond the smartphone market, which has stagnated in recent years. He’s targeting more advanced computing, particularly the chips for data centers for cloud computing and artificial intelligence applications.

Processors for that market are among the most expensive — and profitable — in the industry. Amazon.com Inc. has adopted Arm-based chips for its Amazon Web Services because it says they are more efficient both in terms of energy and economics. They are used by 40,000 AWS customers.

SoftBank will remain the controlling shareholder of Arm after it begins trading, according to the filing. SoftBank has acquired substantially all of the Vision Fund’s 25% stake in Arm for $16.1 billion, according to the filing.

The filing confirms that Arm saw its revenue decline about 1% in its last fiscal year. Its sales fell to $2.68 billion for the year ended March 31, according to the filing, which is still subject to change.

Arm plans for its shares to trade on the Nasdaq Global Select Market under the symbol ARM.

--With assistance from Min Jeong Lee, Giles Turner and Amy Or.

(Updates with comparable IPOs in fifth paragraph)