Electric-vehicle sales are poised to more than double by 2026 but eliminating emissions from road transportation by the middle of this century will require even greater efforts, according to BloombergNEF.

The research firm sees shipments of plug-in passenger vehicles surging to around 27 million from 10.5 million last year as sales jump in China and the US. That’s offsetting slower growth in Europe, where tight supply chains and a cost-of-living crisis are weighing on demand.

While shipments of combustion-engine passenger cars have peaked six years ago, it’ll take time to replace the roughly 1.3 billion roaming roads today. Some 30% of the global fleet will still burn gasoline and diesel by 2050. Heavier commercial vehicles are expected to be trailing cars with just 32% of the fleet decarbonizing on that timeline.

Read more: The Race to Clean Up Trucking Emissions Is Just Getting Started

Investments in zero-emission trucks “should be a priority focus for policymakers,” BNEF analysts led by Colin McKerracher wrote in the researcher’s annual Electric Vehicle Outlook released Thursday. “Eliminating emissions from road transport will require all hands on deck.”

After a plodding start, EVs are now spreading rapidly as automakers from General Motors Co. to Volkswagen AG are forced to keep pace with tightening emissions regulation, retooling factories to churn out a wide variety of battery models with attractive driving ranges. Countries are now competing to attract investments to build new manufacturing clusters — mainly battery cell plants but also mining, processing and recycling operations.

Read more: How US Green Deal Has Opened Floodgates for Subsidies: QuickTake

In the US, so far a slow mover in the electric transition, President Joe Biden’s package of generous clean-technology subsidies is turbo-charging spending. The share of EVs in the country will more than triple by 2026 to 28% of passenger-vehicle sales, according to BNEF. EVs will be even more prevalent in China and Europe, where their share will climb to 52% and 42%, respectively.

The shift to battery power, already displacing 1.5 million barrels of oil a day, will cause road fuel demand to peak in four years. That’s ratcheting up pressure elsewhere, with lithium-ion battery prices rising for the first time last year. BNEF expects innovation to deliver new battery chemistries that are more resource-efficient and powerful.

Read more: Ford Strikes Lithium Supply Deals With World’s Top Producers

Even so, lithium could become a supply-chain risk if no new discoveries are made over the next two decades and more investments are needed. Hydrogen’s role in decarbonizing big rigs, offering fast refueling times and transportability, remains uncertain due to its cost, BNEF said.

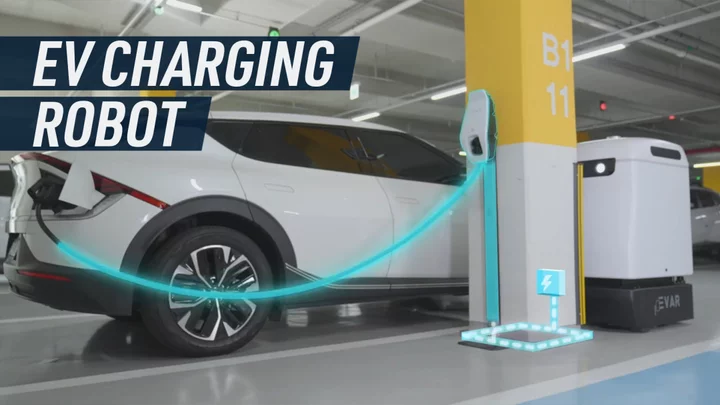

To get to BNEF’s net zero scenario, investments in charging infrastructure are set to reach as much as $3 trillion by 2050. Reaching the last 10% to 20% of the market is particularly challenging, according to the report.

“Support for charging infrastructure needs to be expanded dramatically, including for remote and otherwise under-served locations,” BNEF writes. “Dense public charging networks can help reduce the EV range consumers feel they need, which will in turn reduce pressure on battery raw material supplies.”

Read more: EU Slips in Bid to Keep US, China Pace in Clean-Tech Race