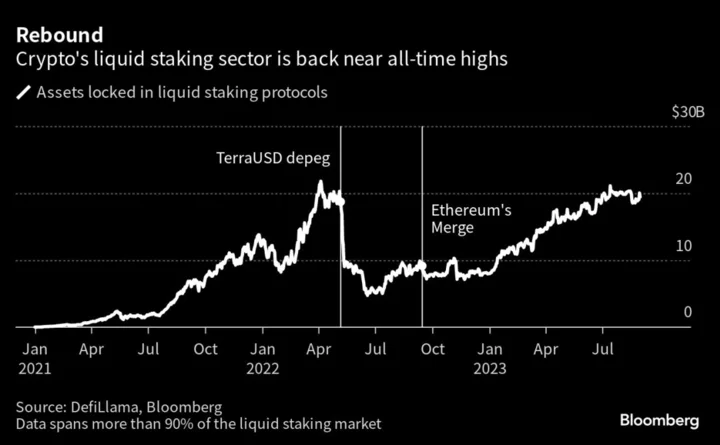

One corner of crypto has shaken off a prolonged digital-asset slump to come within touching distance of an all-time high.

The sector is liquid staking, which offers easier access to the rewards earned when tokens are pledged to help operate blockchains. DefiLlama data shows that the value of assets locked in liquid staking services has jumped 292% to $20 billion from a June 2022 low, when crypto was reeling from a crisis.

That’s helped to make liquid staking the biggest segment of decentralized finance, or DeFi, which lets people trade, lend and borrow without intermediaries via automated, blockchain-based software. Previously, lending was the top application of DeFi technology.

Liquid staking protocols such as Lido and Rocket Pool peaked in April last year with just over $21 billion of assets before sliding as the collapse of the TerraUSD stablecoin exacerbated a $2 trillion crypto-market rout. The prices of major tokens and interest in the bulk of DeFi services remain far below records set in 2021 and 2022, a sharp contrast with the recovery in liquid staking.

Staking has grown in popularity after being embraced by Ethereum, the most important blockchain commercially, as part of upgrades to the network over the past year. People who lock up Ether tokens to help operate Ethereum currently earn the equivalent of about 4% annually in the form of more coins. Rival blockchains such as Solana and Cardano also offer staking rewards.

The number of validators — participants who pledge coins and help to approve Ethereum transactions — rose almost 40% after a major related enhancement of the network in April, according to Steve Berryman, chief business officer at staking service provider Attestant.

Directly participating in staking involves complex software and hardware. In the case of Ethereum, it also requires locking up at least 32 Ether — equivalent to about $52,000 at present prices — for a certain period of time. Liquid staking protocols shoulder the technical burden, accept smaller investments and give users a version of pledged coins that they can deploy elsewhere.

Risks, Regulations

Kunal Goel, Messari research analyst, described the services as “the onchain equivalent of government bonds.” He said that “while they aren’t entirely risk-free, they represent lower risk and haven’t yet had any hacks or exploits.”

The rebound in liquid staking protocols comes amid a regulatory crackdown on crypto in the US, including on staking products from centralized exchanges that led the likes of Kraken and Bitstamp to discontinue the products there.

Other regimes have also taken a tough stance on staking. Hong Kong’s rulebook for digital-asset platforms is viewed as outlawing such products, while Singapore has banned them for retail investors.

“The regulatory crackdown around staking products offered by centralized exchanges has definitely helped liquid staking,” said Richard Galvin, co-founder at DACM.

Lido now ranks as the largest DeFi service based on the $14 billion of assets locked on the platform, according to DefiLlama. Lido’s native token has advanced 60% this year, exceeding the 27% increase in a gauge of the largest 100 cryptoassets.