Nvidia Corp.’s stratospheric ascent has lured at least 100 more ESG funds in recent weeks, transforming the company into one of the most popular stocks among asset managers who integrate environmental, social and governance metrics into their investment strategies.

There are now over 1,400 ESG funds directly holding Nvidia, according to data compiled by Bloomberg based on the latest filings. A further 500 are indirectly exposed, the data show. Nvidia shares hit a record high this week, bringing gains so far in 2023 to about 200%.

The company is now more popular among ESG investors than traditional green powerhouses such as Vestas Wind Systems A/S and Tesla Inc., according to the Bloomberg data. The funds analyzed are registered as either “promoting” ESG, making it their “objective” or simply marketing themselves as ESG.

Nvidia has become an “ESG darling,” said Felix Boudreault, managing partner at Montreal-based Sustainable Market Strategies. And that’s “not ludicrous,” because the company is “exemplary” when it comes to traditional ESG risk management, he said.

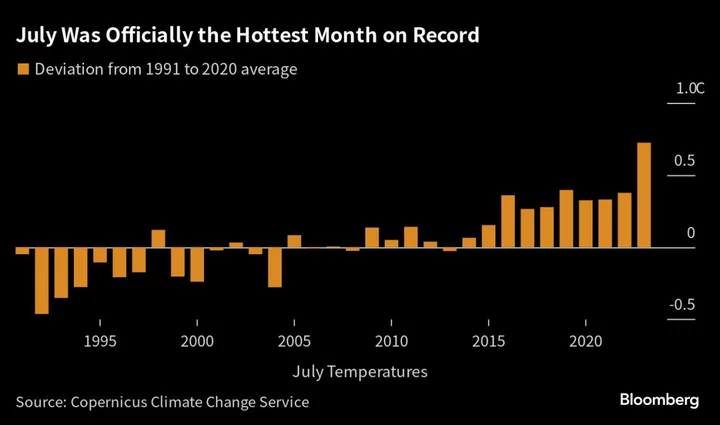

Daniel Klier, chief executive officer of sustainability data and technology firm ESG Book, calls Nvidia “one of the best-performing companies in the large-cap universe,” thanks to a high level of ESG disclosures and a business that’s aligned with the critical global warming threshold of 1.5C.

Peter Krull, partner and director of sustainable investing at Earth Equity Advisors, a Prime Capital Investment Advisors company, says Nvidia is “absolutely” a good sustainable investment. “They’re making the steps that big companies need to make to both be lighter on the planet” with their products, and contributing to innovation, he said.

ESG’s growing exposure to tech — and in particular artificial intelligence — has the potential to change the narrative around an investment strategy that last year suffered a number of headwinds. Amid an energy crisis and rising interest rates, ESG found itself the target of political attacks in the US, with Republicans calling it an anti-American form of business and investing that put a “woke” agenda ahead of financial returns.

This year, however, ESG funds’ reliance on tech is driving outperformance. The top ESG funds so far in 2023 are all tech-heavy and invested in AI, and all have returned more than 40%. In Europe, ESG equity funds have delivered about 12% this year on average, compared with gains of roughly 7% in the Stoxx Europe 600 Index.

Read More: Barclays Strategists Say Buy AI Stocks on Any Pullback in Rally

Among ESG-registered funds with the biggest returns so far in 2023 is one managed by T. Rowe Price Group Inc. (Ticker: TRGBTEA LX), which is up about 45%. Nvidia is its fourth-largest holding, according to Bloomberg data. The fund, whose top three stocks are Apple Inc., Taiwan Semiconductor Manufacturing Co. and Microsoft Corp., has beaten 97% of peers since the end of December.

An ESG fund run by the asset management unit of JPMorgan Chase & Co. (Ticker: JPMUSTC LX) is also up 45%, according to Bloomberg data. Its biggest holdings are Facebook parent Meta Platforms Inc. and Nvidia.

As investors pile into AI, Europe and the US are figuring out how best to rein it in with regulations amid warnings from some of the scientists behind the technology that it may pose a serious threat to society without adequate guardrails.

Analysts at Bloomberg Intelligence don’t expect the US to adopt an aggressive approach toward regulating AI. But if it were to do so, it could hurt growth at a number of companies including Nvidia, according to BI.

Boudreault says that if done right — and with the right regulatory boundaries in place — the “AI revolution” could actually have “massive positive impacts to address the world’s most pressing challenges, be they social or environmental.”

Meanwhile, the mania surrounding AI-related stocks is starting to look overdone to some. Cathie Wood, founder and CEO of Ark Investment Management LLC, said earlier this year she had decided to drop Nvidia as the company faces growing competition. Wood is instead looking “to another set of plays,” she said.

Read More: Cathie Wood Defends Bailing on Nvidia, Citing Risk of Chip Cycle

James Penny, the chief investment officer of TAM Asset Management and a veteran investor who correctly predicted the headwinds facing ESG last year, said earlier this month that the current mood around AI is reminiscent of the early days of the tech bubble that burst in 2000 and wiped more than 70% off the Nasdaq.

Chasing a market frenzy “is never a good strategy,” said Boudreault. But if the question is whether it makes sense to hold Nvidia from an ESG point of view, then the answer is “increasingly, yes,” he said.

--With assistance from Amine Haddaoui and Carlo Maccioni.

(Adds BI opinion on AI regulations in 13th paragraph.)