Nomura Holdings Inc.’s crypto unit may take longer than expected to break even after a rout in digital assets slashed trading volumes and upended business plans.

Laser Digital, which started last year and had aimed to turn a profit by 2024, has also been hit by the sector’s turmoil, its Chief Executive Officer Jez Mohideen said.

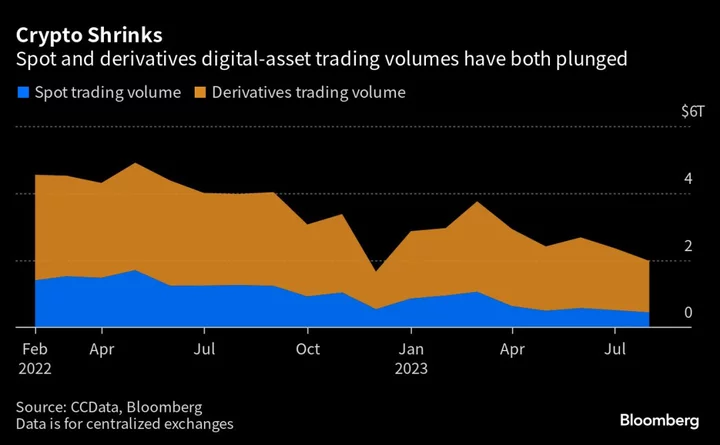

“Our profitability journey may take a bit longer than we forecast a year ago,” Mohideen said in an interview. “Volumes have come down, activity has shrunk, regulators’ needs are changing - all these are leading to some delays in our overall journey including profitability.”

Read More: Nomura Crypto Arm’s ‘Worse Case’ Is Profit in Two Years Post-FTX

Nomura’s launch of its digital-assets arm last September, one of the boldest embraces of the sector yet by a global financial firm, came amid a deep rout in crypto markets that was exacerbated by the bankruptcy of FTX in November. The crash, which wiped out $2 trillion of crypto market value, led to regulatory clampdowns globally and a sharp decline in liquidity.

Even so, Mohideen had pointed to those challenges as an opportunity, saying at the time that its profit target was a “worse-case” scenario.

The Zurich-based company recently got a license to operate in Dubai, which allows the firm to roll out its three sets of businesses - trading, asset management and venture capital - progressively in the emirate.

Laser Digital has hired 70 people so far and plans to add up to 20 more over time, he said. The crypto subsidiary of Nomura is setting up an office in Tokyo to offer support to its global trading business, Mohideen said. The company will hire 4 to 6 people in its Tokyo office, he added.

Read More: Crypto Market-Making Margins Sink 30% in Post-FTX Shake Up

Mohideen is hopeful that interest from deep-pocketed traditional players like BlackRock Inc. and other financial institutions in crypto will turn the tide for digital assets. The world’s biggest asset manager in June filed an application in the US to launch spot Bitcoin exchange-traded funds. EDX Markets, a crypto exchange backed by firms including Citadel Securities, Fidelity Digital Assets and Charles Schwab Corp, launched earlier this year.

“More institutions and institutional projects coming in despite the market turmoil gives me confidence,” he said. “The future is brighter but it may take longer.”

--With assistance from Takashi Nakamichi.