MIAMI--(BUSINESS WIRE)--May 30, 2023--

Sumsub, the one global verification platform providing customizable KYC, KYB, transaction monitoring, and AML solutions for the whole customer journey, today shared Q1 2023 fraud statistics for North America and how they compare to 2022. The information is based on data collected from the United States and Canada during this time period.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230530005194/en/

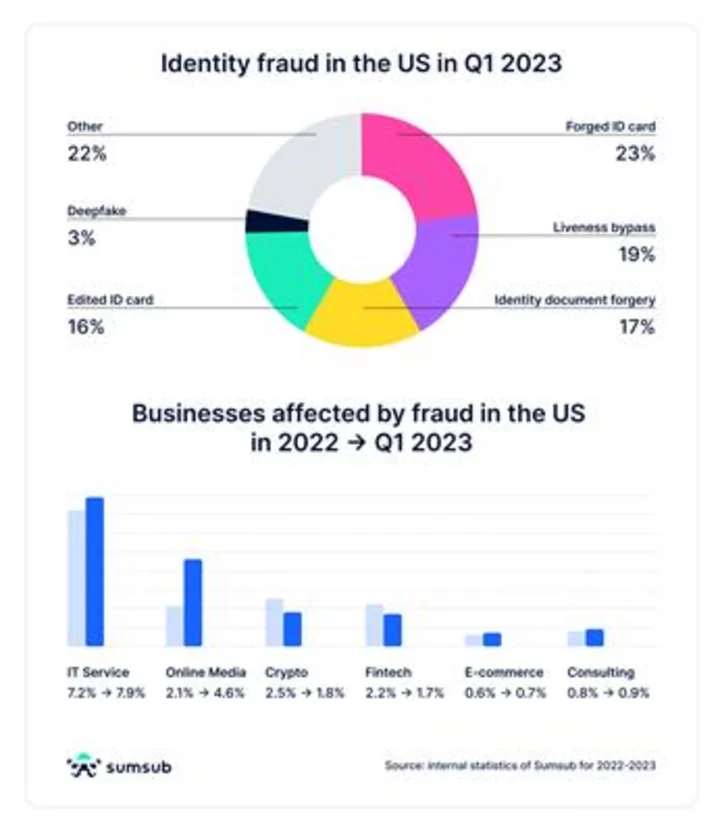

Identity Fraud Q1 2023 Infographic (Graphic: Business Wire)

In 2022, the top three fraud types in the U.S. and Canada were:

- Liveness bypass, a method of fraud where criminals swap in or edit biometric data (34% of fraud in the U.S. and 22% in Canada)

- Edited ID card (22% in the U.S. and 24% in Canada)

- Forged ID card (13% in the U.S. and 18% in Canada)

In Q1 2023, the top three fraud types in Canada remained the same, whereas in the U.S., 17% of fraud was attributed to identity document forgery.

With the rise of cyber threats and identity theft, organizations and platforms are implementing verification processes to ensure the authenticity and legitimacy of users.

The industries that are most impacted happen to also be the most regulated ones. Sumsub found that the top three industries affected by fraud in the U.S. were IT service for both 2022 and Q1 2023, classifieds, and crypto. Interestingly, online media fraud doubled from 2.1% to 4.6% in Q1 2023.

Simple KYC checks are not enough anymore. To stay protected from fraud, companies need to perform checks along the whole user journey. The ongoing checks include transaction monitoring, risk scoring, behavioral analysis, and many more.

Sumsub unites user and business verification, transaction monitoring, fraud prevention, and case management solutions into a single dashboard. The company found a few interesting global fraud trends in their data, noting two that are seeing an increase at alarming rates in North America.

Forced verification

Forced verification has emerged as a growing trend globally. In North America alone, forced verification grew from 0.5% to 0.7% in 2022 and even more in Q1 2023, from 0.6% to 1.1%.

“We’ve seen a pattern of forced verification globally, when it is visible that a person whose photo is taken or who’s passing the liveness check is doing so involuntarily while being held by others’ force. It is alarming that the proportion of such fraud is growing. Likewise, sometimes the person being verified is obviously unconscious—maybe sleeping, maybe not feeling well, or maybe under the influence of substances. This means that he or she is not actively and agreeably participating in the KYC process, which may lead to crime and financial fraud, for example, if not detected and stopped in time. Luckily, such cases are not yet very common, but their existence is a red flag,” explains Pavel Goldman-Kalaydin, Head of AI & ML at Sumsub.

AI/deepfakes

In North America, the proportion of deepfakes more than doubled from 2022 to Q1 2023. This proportion jumped from 0.2% to 2.6% in the U.S. and from 0.1% to 4.6% in Canada, respectively. Simultaneously, printed forgeries, which represented 4% – 5% of all fraud in 2022, dropped to 0% last quarter.

As Goldman-Kalaydin further explains, “Deepfakes have become easier to make and, consequently, their quantity has multiplied, as is also evident from the statistics. To create a deepfake, a fraudster uses a real person’s document, taking a photo from it and turning it into a 3D persona. Anti-fraud and verification providers who do not work constantly to update deepfake detection technologies are lagging behind and put both businesses and users at risk. Upgrading deepfake detection technology is an essential part of modern effective verification and anti-fraud systems.”

Identifying who is committing fraud

The oldest fraudsters in the world are in the U.S. In 2022, the average age was 38 years old and shifted to around 40 in Q1 2023. While in Canada, the average age of fraudsters was 32 – 33.

As for the gender breakdown, in 2022, there were over 35% female fraudsters in the U.S. and around 26% in Canada. In Q1 2023, females represented only 18% of fraudsters in the U.S. and 21% in Canada.

In 2022, the most popular hour for committing fraud was 11 a.m. Eastern Time in the U.S. and 1 p.m. Eastern Time in Canada. In Q1 2023, it was 12 p.m. Eastern Time in the U.S. and 4 p.m. Eastern Time in Canada. In Canada, the lowest amount of fraud happened at 6 a.m. Eastern Time in 2022 – 2023.

For more information on Sumsub, please visit: https://sumsub.com.

AboutSumsub

Sumsub is a full-cycle verification platform that secures the whole user journey. With Sumsub’s customizable KYC, KYB, transaction monitoring and fraud prevention solutions, you can orchestrate your verification process, welcome more customers worldwide, meet compliance requirements, reduce costs and protect your business.

Sumsub has over 2,000 clients across the fintech, crypto, transportation, trading, e-commerce and gaming industries including Binance, Mercuryo, Bybit, Huobi, Unlimint, DiDi, Poppy and TransferGo.

View source version on businesswire.com:https://www.businesswire.com/news/home/20230530005194/en/

CONTACT: Rachel Verne

PRforSumsub@bospar.com

KEYWORD: FLORIDA UNITED STATES NORTH AMERICA

INDUSTRY KEYWORD: TECHNOLOGY PAYMENTS FINANCE SECURITY FINTECH BANKING PROFESSIONAL SERVICES SOFTWARE CRYPTOCURRENCY OTHER PROFESSIONAL SERVICES

SOURCE: Sumsub

Copyright Business Wire 2023.

PUB: 05/30/2023 09:05 AM/DISC: 05/30/2023 09:05 AM

http://www.businesswire.com/news/home/20230530005194/en