French President Emmanuel Macron’s government will present a 2024 budget on Wednesday that tests voter appetite for pouring public money into the climate transition at the same time as withdrawing support for inflation-hit households.

The Finance Ministry will unveil the details of a plan to increase investment in green programs to €40 billion ($42.5 billion) next year from €33 billion in 2023. The budget will also delay previously promised tax cuts and withdraw measures that have shielded households from soaring energy prices.

Overshadowing the risky shift in political priorities is a pressing need to rebuild public finances after Macron championed a “whatever it costs” approach to spending during the Covid pandemic. The budget includes €16 billion of savings to help stabilize debt and reduce the deficit to 4.4% of economic output from 4.9%.

Macron’s past attempts to prioritize green investment haven’t gone well.

An increase in carbon taxes after he became president in 2017 sparked the Yellow Vests movement that spiraled into months of broader and sometimes violent protests over the cost of living. Macron ultimately backtracked, spending billions of euros on tax breaks for households in an effort to restore calm.

Since his reelection in 2022, plans to announce a long-term green strategy for the climate transition have been delayed amid anger — firstly over pension reform and then after a police shooting of a teenager in June.

Sign up for Paris Edition, our weekly newsletter about what’s happening in French business and finance

“All studies show that French people are worried about climate change, but they want solutions that are affordable,” said Anne Bringault, programs director at NGO Réseau Action Climat.

Opposition parties have already slammed Macron’s plans. Even the fiscally conservative Republicains have called for cuts to fuel taxes, a move that would forgo a major source of revenue for the state. Macron has ruled that out, saying it would compromise financing of the climate transition and the welfare system.

Instead, he has asked his government to pressure the oil industry into selling fuel at cost. He also plans to reintroduce checks of no more than €100 euros for low-income workers who rely on cars for travel.

“It’s very limited, but it’s much more pertinent as we don’t help households who don’t need it,” Macron said in a television interview on Sunday. “I want to be clear: We are exiting the ‘whatever it costs’ approach.”

A large share of the €16 billion of savings will come from the phasing out of aid for businesses and households. The Finance Ministry has said it will also begin cutting long-standing fuel support for farmers and the construction industry next year. Other areas being targeted include support for apprenticeships, state financing of sick leave and prescriptions, and tax breaks for housing investment.

The government has also delayed a reduction in levies on production in France — a key plank of Macron’s pro-business reform agenda. His plan to cut €2 billion of taxes on households has been pushed back until 2025 at the earliest.

Still, there are expected to be some olive branches for households, including a reiteration of Macron’s mantra of not raising taxes. In a costly move for public finances, the government plans to forfeit around €6 billion of potential revenue by pegging income tax thresholds to inflation. The tariff shield on electricity will continue to exist to some extent and, by the end of the year, Macron says he will overhaul power markets to regain control of electricity prices.

“Macron is trying to avoid measures that could generate a movement similar to the Yellow Vests,” said Antonio Barroso, deputy director of research at political advisory Teneo.

Macron’s track record on public finances has come under sharpened scrutiny this year after Fitch Ratings cut the country’s credit score in April, warning that political deadlock and social movements could push his government toward a more expansionary fiscal policy.

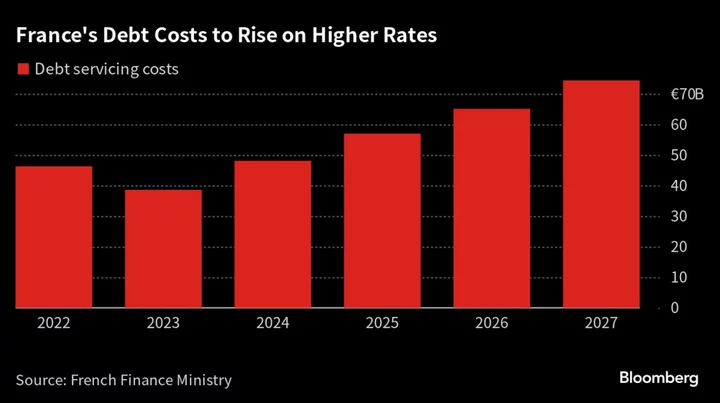

By the government’s own assessment, higher interest rates will drive up the cost of financing debt to almost €75 billion in 2027 from less than €40 billion this year.

France’s council for monitoring public finances, the HCFP, warned this week that the government’s entire fiscal strategy is based on growth forecasts that look “optimistic.”

The budget is based on an economic growth forecast of 1.4% next year. According to economists surveyed by Bloomberg, the expansion will only be 0.9%.