Liquefied natural gas exporters aim to advance multibillion-dollar projects and revive the sector’s growth in Australia, arguing additional fossil fuel supplies are needed to support Asia’s energy transition.

BP Plc and Woodside Energy Group Ltd. are among companies studying major developments that would add to the industry’s investments of about A$300 billion ($200 billion) over the past 15 years, a program that transformed the nation into the world’s top shipper.

Deliberations on new projects come as Australia’s annual export earnings from LNG are forecast to slide after hitting a A$91 billion peak on last year’s energy crisis, and with volumes seen plateauing. The country has already been usurped as the industry’s No. 1 exporter by the US and is expected to also fall behind Qatar.

“We see gas playing a critical role in the energy transition,” Samantha McCulloch, chief executive officer of the Australian Petroleum Production and Exploration Association, said in an interview. The industry group’s annual conference is taking place through Thursday with speakers including executives from Exxon Mobil Corp., Chevron Corp. and Shell Plc.

Woodside, which saw profits triple to a record in 2022, is advancing the $12 billion Scarborough project. It’s also considering plans to develop Browse, one of the country’s largest untapped natural gas fields, with partners including PetroChina Co.

BP last month agreed to buy Shell’s stake in Browse, citing the potential to bolster energy security in the region. Completing the development, along with an expansion of the associated North West Shelf project, will need capital expenditure of about A$36 billion through to the 2060s, according to Woodside.

“Our customers in Japan are saying they need the gas, so it will be an investable project — but we have a lot of work to do,” Woodside Chief Executive Officer Meg O’Neill said at a conference in Sydney earlier this month.

The war in Ukraine has upended the natural gas market, forcing European consumers to switch to LNG to replace pipeline fuel exports from Russia and adding new competition for buyers in Asia.

Almost 70 contracts have been signed by LNG buyers with US projects since the start of 2021, including consumers in Germany, China and Japan, and a further 12 agreements with Qatar, according to data compiled by BloombergNEF. US exports are forecast to surge as much as 75% through 2026, while Qatar aims to lift volumes by two-thirds by 2027.

Australia, with only marginal increases to LNG export capacity currently planned, has agreed six similar contracts, the data show.

“Before all this the market looked pretty full, but now that’s changed,” said Saul Kavonic, a Sydney-based energy analyst at Credit Suisse Group AG. “There is a big gap for the rest of the decade and you need to fill it.”

Projects in Australia face challenges to compete with the US and Qatar to benefit from that outlook. Shipping costs mean the nation’s cargoes are rarely sent outside Asia, while action by Australia’s government to hike taxes on projects and tighten powers to restrict LNG exports has spooked some overseas buyers.

Demand in Japan and South Korea, two of Australia’s top customers, is expected to decline over the next decade as the nations add more renewables and nuclear power. There are also question marks over an expected rise in gas consumption across Southeast Asia as some countries pursue a faster switch to solar and wind generation.

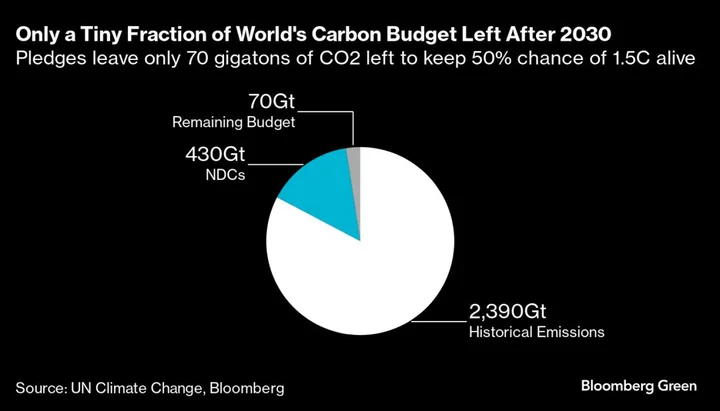

Future projects will also face more intense climate scrutiny with some opposition legislators, including the Australian Greens party, calling for a ban on the development of any new fossil fuel infrastructure.

Browse alone is forecast to emit at least 70 million tons of carbon dioxide equivalent over 30 years of operations, a higher rate than other LNG projects.

--With assistance from Stephen Stapczynski and David Stringer.