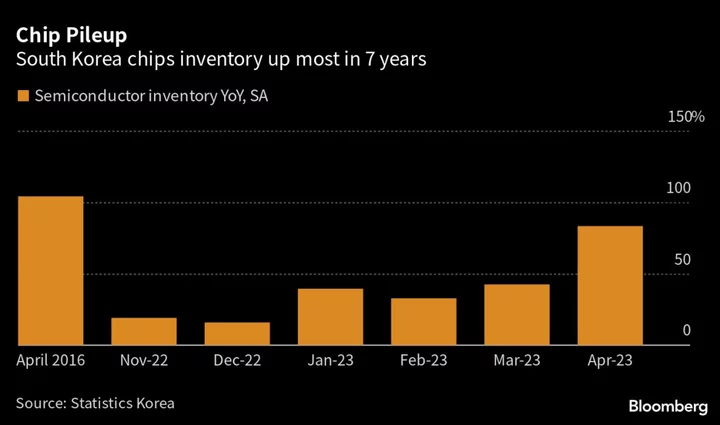

South Korea’s semiconductor inventory surged by the most in seven years, underscoring ongoing weak demand for chips despite the global boom in AI development.

Stockpiles rose 83% in April from a year ago — the biggest increase since April 2016 — and the index tracking inventories jumped to a record, according to data from Statistics Korea Wednesday. Meanwhile, factory shipments fell 33% from the year-ago period and production was cut 20%, the data show.

Smartphone and PC manufacturers are working through a glut of inventory amid a slowdown in global demand for tech products. Apple Inc. shipments of Mac laptops plummeted 40% in the first quarter, leading a sharp decline across the personal computer market. Executives from Lenovo Group Ltd., Sony Group Corp. and Qualcomm Inc. — the world’s largest supplier of smartphone processors — have all recently said they expect inventories to remain high through the second quarter and markets to normalize later this year. Smartphones, however, may take longer to rebound, they said.

Read more: Smartphone Demand Recovery Unlikely This Year, Sony COO Says

Activity in South Korea’s chips industry is an important gauge of global demand for electronics, as the country houses two of the world’s largest semiconductor companies, Samsung Electronics Co. and SK Hynix Inc. The vast majority of Korean semiconductor exports are memory chips, which go into everything from smartphones, laptops and digital cameras to connected cars and large data centers. China is the biggest market for those chips.

The technology is also a major part of South Korea’s economy, accounting for about 13% of total exports in April.

(Updates with information on inventories in electronics sector from third paragraph)