Meta Reports Earnings Today. Watch for the Story in Ad Revenue.

The Street projects Meta will post quarterly sales of $33.5 billion, up 21% from a year ago, with profits of $3.61 a share, up from $1.64.

2023-10-25 13:23

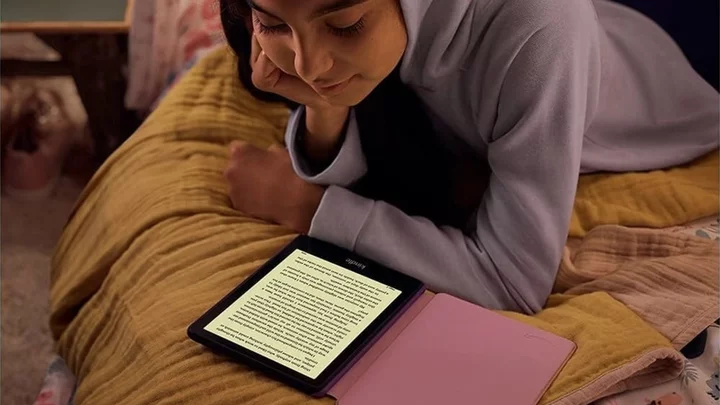

The best early Prime Day Kindle deals include the Kindle Paperwhite Kids on sale for its lowest price ever

UPDATE: Jun. 21, 2023, 12:15 p.m. EDT This story has been updated with the latest

2023-06-22 00:58

Skip subscription fees with this $30 Microsoft Office for Mac lifetime license

TL;DR: As of July 3, get the Premium Microsoft Office Training Bundle and lifetime license

2023-07-03 17:48

Nobel laureate Maria Ressa acquitted of last tax evasion charge

Philippine Nobel Peace laureate Maria Ressa was acquitted of tax evasion Tuesday, according to her news site Rappler, in the latest legal victory for the veteran journalist.

2023-09-12 09:50

Hurricane Idalia Exposes Florida’s Dangerous Flood Insurance Gap

Hurricane Idalia unleashed its fury on northwest Florida on Wednesday morning, landing in a sparsely populated area with

2023-08-31 08:20

Watch Nearly 90 Minutes of Memorable ‘90s Commercials

If you lived through the 1990s, the retro commercials in this video may look familiar.

2023-05-30 03:19

When ‘The Crowded Room’ star Tom Holland was 'kicked out' of bar while prepping for movie

Tom Holland is currently gearing up for the release of his upcoming miniseries ‘The Crowded Room’

2023-06-07 19:57

Gfycat is shutting down, so save your best reaction GIFs now

Gfycat is being put down. The GIF-hosting platform has announced it will soon shut down,

2023-07-03 11:59

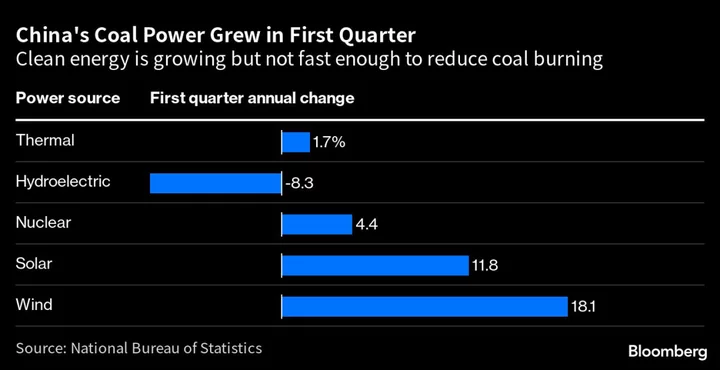

China’s Rising Emissions May Soon Be Eclipsed by Clean Power Push

China’s post-Covid rebound is boosting its world-leading power emissions this year, but rapid deployment of clean technology means

2023-05-12 07:24

When is the Modern Warfare 3 Reveal Event?

The Modern Warfare 3 reveal event will take place in Warzone Season 5 on Aug. 9 to give the community more information surrounding Call of Duty 2023.

2023-07-19 00:49

Unlikely savior: Musk's antics give Zuckerberg PR makeover

After years of bad press and scandal, Mark Zuckerberg is seeing his reputation spruced up in the fickle world of tech, largely thanks to the...

2023-07-12 09:54

It’s Carmakers Against Miners in Battle Over China-Funded Metals

US policymakers, eager to foster the country’s own electric-car supply chain, mostly agree Chinese raw materials shouldn’t play

2023-07-18 22:55

You Might Like...

What we know about Threads, Meta's 'Twitter killer'

Chipmaker GlobalFoundries forecasts downbeat quarter, shares fall

BLACKPINK tease new game soundtrack The Girls

SoftBank books $5.2 billion quarterly loss as investments and weak yen bite

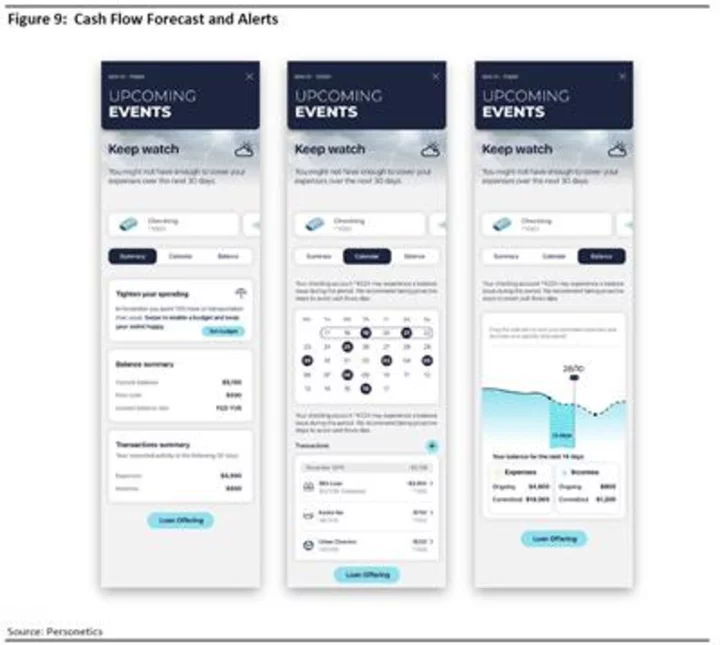

Celent Report Finds Personetics Is the Top Banking Solution for Small Business Banking in North America

The Pokémon Company boss discusses quality of games with such regular releases

Xbox Series X Black Friday 2023 Buying Guide: Best Deals, Prices, Bundles

Amazon just unveiled a new Echo Show: 3 new features that'll make you want to get one