Tristan Tate proposes Howard Stern's 'woke' stance is shield against accusations similar to Russell Brand's, Internet says 'he's playing safe'

Tristan Tate said, 'It will take them less than 8 seconds to find women from his past to raise criminal charges on him'

2023-09-21 19:00

'Diablo IV' is almost here. What to know about the video game's coming release

The release of “Diablo IV” is right around the corner

2023-06-02 02:26

How to Reach Starlink Customer Service

The entire Starlink internet experience is remarkably hands-off. You set up your dish on your

2023-09-07 08:57

T-Mobile to lay off 5,000 employees

T-Mobile on Thursday announced it plans to lay off 5,000 employees, or around 7% of its total staff, over the next five weeks.

2023-08-24 22:17

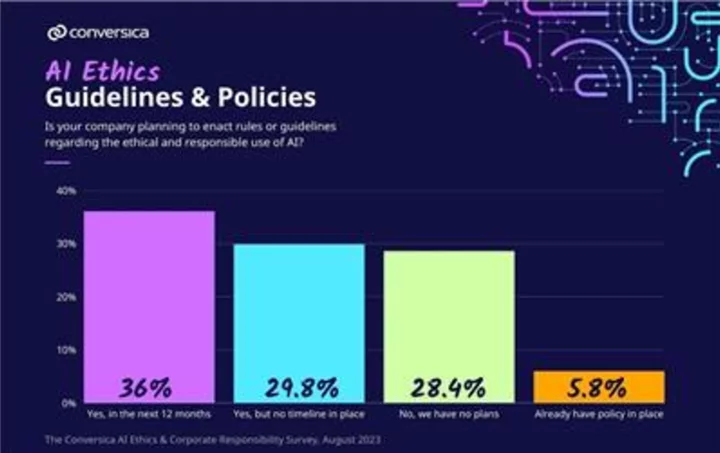

Conversica Survey Reveals Only 6% of Companies Have Policies for the Responsible Use of AI Despite 73% Recognizing the Importance of Clearly Established Guidelines

SAN MATEO, Calif.--(BUSINESS WIRE)--Aug 29, 2023--

2023-08-29 20:54

Valorant Champions 2023 Twitch Drops: How to Get

Viewers can get free Valorant Champions 2023 Twitch drops, including a Spray, Title, and Player Card, as they watch the tournament unfold in August.

2023-08-04 03:22

Spyware Infects iPhones Belonging to Employees at Kaspersky

Is the US government using iOS spyware in Russia? That's the allegation coming from the

2023-06-02 03:58

Save 66% on a 2-year subscription to NordVPN Complete

SAVE 66%: A two-year subscription to NordVPN Complete is on sale for £126.43, saving you

2023-07-05 12:16

Scientists unearth a secret hidden within the Mona Lisa

The Mona Lisa has been the subject of awe and fascination for centuries, with experts from around the world desperate to solve the mystery behind her iconic, enigmatic smile. Now, thanks to X-ray technology, scientists have begun to uncover the secrets of Leonardo da Vinci’s legendary portrait, and explain how he was able to create something so mind-bending with just a few strokes of a brush. The research, published in the Journal of the American Chemical Society on Wednesday, suggests that the Italian Renaissance master may have been in a particularly inventive mood when set about crafting the piece in the early 16th century. "He was someone who loved to experiment, and each of his paintings is completely different technically," Victor Gonzalez, the study's lead author, told the Associated Press.. Gonzalez, who has studied the chemical compositions of dozens of works by Leonardo and other artists, discovered that there was something special about the paint used for the Mona Lisa. Specifically, the researchers found a rare compound, called plumbonacrite, in Leonardo's first layer of paint. The discovery confirmed that Leonardo most likely used lead oxide powder to thicken and help dry his paint as he began working on the portrait. He is thought to have dried the powder, which has an orange colour, in linseed or walnut oil by heating the mixture to make a thicker, faster-drying paste. "What you will obtain is an oil that has a very nice golden colour," Gonzalez said. "It flows more like honey." Carmen Bambach, a specialist in Italian art and curator at New York's Metropolitan Museum of Art, who was not involved in the study, called the research "very exciting". She emphasised that any scientifically proven new insights into Leonardo's painting techniques are "extremely important news for the art world and our larger global society." Finding plumbonacrite in the Mona Lisa attests "to Leonardo's spirit of passionate and constant experimentation as a painter—it is what renders him timeless and modern," Bambach said. The paint fragment Gonzalez and his team analysed for their study was taken from the base layer of the painting and was barely visible to the naked eye. It was no larger than the diameter of a human hair, and came from the top right-hand edge of the picture that now takes pride of place in Paris’s Louvre Museum. The scientists peered into the sample’s atomic structure using X-rays in a synchrotron – a large machine that accelerates particles to almost the speed of light. This allowed them to unravel the speck's chemical makeup and detect the plumbonacrite. The compound is a byproduct of lead oxide, allowing the researchers to say with more certainty that Leonardo likely used the powder in his paint recipe. "Plumbonacrite is really a fingerprint of his recipe," Gonzalez said. "It's the first time we can actually chemically confirm it." After Leonardo, Dutch master Rembrandt may have used a similar recipe when he was painting in the 17th century; Gonzalez and other researchers have previously found plumbonacrite in his work, too. "It tells us also that those recipes were passed on for centuries," Gonzalez said. "It was a very good recipe." Still, the ‘Mona Lisa’—said by the Louvre to be a portrait of Lisa Gherardini, the wife of a Florentine silk merchant—and other works by Leonardo still have other secrets to tell. "There are plenty, plenty more things to discover, for sure,” Gonzalez said. “We are barely scratching the surface.” Sign up for our free Indy100 weekly newsletter Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.

2023-10-12 22:25

Circle Says $1 Billion in Cash Serves as Buffer While Market Share Declines

Circle Internet Financial is counting on a more than $1 billion cash cushion to help weather fresh competition

2023-08-10 21:47

Amazon Prime Video will soon start running ads unless you pay a monthly fee

Amazon Prime Video will include advertising during shows and movies starting early next year, joining other streaming services that have added different tiers of subscriptions. Members of Amazon Prime can pay $2.99 per month in the U.S. to keep their service ad-free, the company said Friday. Amazon said limited advertisements will be aired during shows and movies starting early next year so that it can “continue investing in compelling content and keep increasing that investment over a long period of time.” Ads in Prime Video content will start in the U.S., U.K., Germany, and Canada in early 2024, followed by France, Italy, Spain, Mexico, and Australia later in the year.

2023-09-22 23:27

Did you know Amouranth was once domestic violence victim? Has Twitch queen moved on?

It all started when she was on the phone with her husband, who seemed irritated with her

2023-06-18 15:16

You Might Like...

When Does Valorant Episode 7 Act 2 Start?

What happened to Fousey? Streamer reveals Adin Ross offered help before arrest: 'I’ll drive to you right now'

Ludwig unveils participants' names, date and time for World's Greatest Gamer event

Comcast Opens 141,000 Free Xfinity WiFi Hotspots as Hurricane Idalia Approaches

Inventec and Renesas to Jointly Develop Proof-of-Concept for Automotive Gateways

The Best Fitness Trackers for 2023

Penpot Introduces Innovative New Design Collaboration Tools and Partners with Tokens Studio to Build an AI Engine for Design Systems

The Standard Names Dave Friesen Second Vice President of Enterprise Data and Analytics