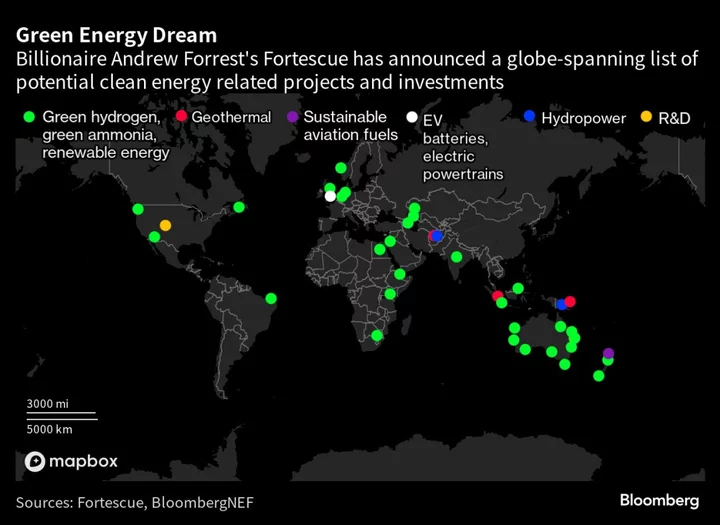

Billionaire Andrew Forrest’s Fortescue Metals Group Ltd. approved $750 million of investments in an initial slate of three clean energy projects, taking a modest first step to expand beyond iron ore and target the green transition.

Fortescue will develop a $550 million electrolyzer and hydrogen facility in Arizona, a second project targeting the fuel in Australia’s Queensland state and a green iron plant to deliver zero-emissions steelmaking materials at the producer’s Christmas Creek mine in Western Australia.

The size of the first round of developments reflects a disciplined approach “prior to large scale investments,” Fortescue Energy Chief Executive Officer Mark Hutchinson said Tuesday in a statement. “This is the start of a pipeline of green energy projects we are dedicated to delivering.”

Capital expenditure in Fortescue’s energy unit will rise by $100 million to $500 million in the year to June 30, while spending in the metals group will remain at as much as $3.2 billion. Approved investments in the three projects will be made over three years, the company said.

A series of other potential developments, including a fertilizer project in Kenya, a green hydrogen facility in northeastern Brazil and a clean ammonia site in Norway will also be advanced.

Plans to develop a 550-megawatt hydrogen and ammonia project on Gibson Island, in Queensland, require further work as “Australia struggles to shed its petrostate status and still suffers structurally high green electricity costs,” Fortescue said in its statement.

Fortescue, which holds an annual meeting later Tuesday, rose as much as 2% Tuesday as of 11:35 a.m. in Sydney.

“This doesn’t put any undue pressure on capital available for dividend distribution,” said David Coates, a Sydney-based analyst at Bell Potter Securities Ltd., who rates Fortescue as a sell. “I don’t think there’ll be any sticker shock at the size of the investments.”

Forrest’s ambition to develop Fortescue into a producer of clean fuels to enable the world’s most polluting industries to decarbonize has drawn skepticism from critics who question the company’s ability to deliver complex projects in new sectors, or to build sufficient demand for products like zero-emissions hydrogen.

A series of executives have exited the producer this year over disputes on Fortescue’s push into green industries, while the producer’s energy unit had an annual loss of $617 million in the 12 months to June 30.

Fortescue previously said it intends to retain equity stakes of between 25% and 50% in its energy projects and has set up a New York-based entity to seek co-investment from third parties including sovereign wealth funds and insurance providers.

The Phoenix hub — which is expected to qualify for tax credits under President Joe Biden’s Inflation Reduction Act — will include an 80-megawatt electrolyzer facility and seek to have capacity to produce as much as 11,000 tons a year of liquid green hydrogen, with first output from 2026.

A company’s Gladstone, Australia, green hydrogen project requires $150 million of investment and will aim for production from 2025. The $50 million Christmas Creek trial plant aims to use clean electricity and iron ore to deliver as much as 1,500 tons of fossil fuel-free steel making materials beginning in 2025.

(Updates with share price in seventh paragraph)