Exxon Mobil Corp. boosted dividends more than expected and posted a surprise cash flow increase, reaping the benefits of strengthening crude prices and US oil-refining margins.

The company lifted quarterly investor payouts to 95 cents a share, payable on Dec. 11, a penny higher than the Bloomberg Dividend Forecast. Third-quarter free cash flow more than doubled from the prior period to $11.7 billion, far in excess of the $9.36 billion average estimate.

The positive dividend and cash-flow news on Friday was clouded by a 9-cent miss on adjusted per-share profit, in part driven by weak chemical earnings and unsettled hedging instruments. The announcement comes just weeks after Chief Executive Officer Darren Woods secured a $60 billion all-stock deal to acquire shale giant Pioneer Natural Resources Co.

Exxon has been riding the post-pandemic wave of higher oil, natural gas and fuel prices, and enjoys the most-robust growth momentum among the oil supermajors. The company’s market capitalization has swelled by $160 billion in the past two years, more than the entire valuation of BP Plc, providing Woods with the currency needed to buy Pioneer in what is shaping up to be world’s biggest acquisition of 2023.

Higher crude prices and refining margins boosted by summer gasoline demand helped Exxon bring an end to three straight quarters of sequential profit declines. Lower petrochemical margins linked to a surge in new supplies from China detracted from the overall results.

Exxon’s investments in fossil fuel projects during the pandemic when others were pulling back, combined with efforts to reduce costs, are now “clearly coming through in the results,” Chief Financial Officer Kathy Mikells said during an interview. That allows Exxon to buy back shares on a “much more consistent basis,” she said, declining to comment on the potential to increase repurchases further.

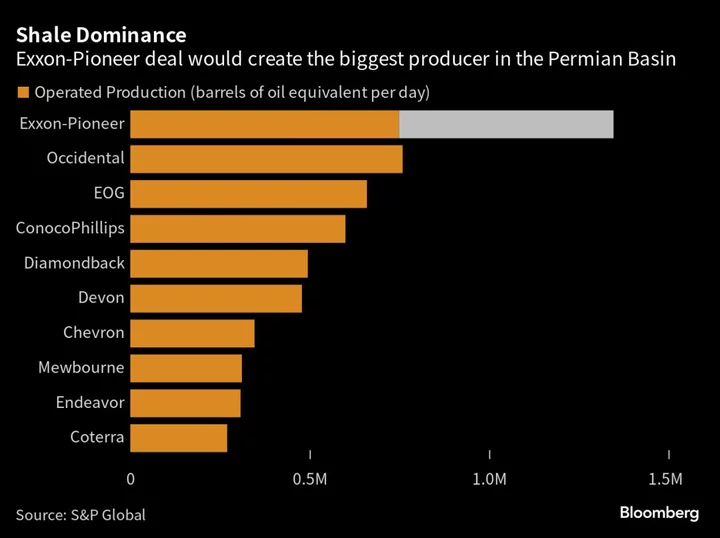

The landmark Pioneer deal will vault Exxon to the pinnacle of Permian Basin output, giving it unmatched ability to flex production depending on oil demand during the energy transition. It was quickly followed by arch rival Chevron Corp.’s $53 billion agreement to buy Hess Corp. that will secure the California-based company a 30% stake in Exxon’s fast-growing Guyana operation.

Read more: Chevron Muscles Into Hottest Oil Patch With $53 Billion Purchase

The two acquisitions highlight the US oil majors’ determination to press home their advantages over European supermajors and American independents by locking up control of vast resources than can underpin crude output for decades to come.

Investors’ feedback on the Pioneer deal has been “overwhelmingly positive,” Mikells said. “They completely understand the strategic fit and the strong synergies that we expect to be able to achieve from the transaction.”

Woods and Mikells are scheduled to discuss quarterly results during a conference call with analysts at 8:30 a.m. New York time.