In the evolution of the electric vehicle, the United Kingdom is like the Galapagos. The battery-powered genus is thriving, having fractured elegantly into a plethora of different species. There are swanky sedans for the CEO set, sporty SUVs for the country driver and tiny hatchbacks for urban commuters. All told, the UK market now boasts 72 distinct EVs across 187 variants — be it a bigger battery, all-wheel drive or sportier motors.

A complete breakdown of the field can be found in the new UK edition of Bloomberg Green’s Electric Car Ratings, which unpacks range, price, charging speed and battery size for each model on offer, and combines those specs to identify which cars buyers should consider the “greenest.” (The greenest car, according to our methodology: the Tesla Model 3.)

The number of EVs in the UK pales in comparison to the hundreds of models on offer in China — the world’s most developed electric market — but reflects logistical and policy factors that are working in Britain’s favor. Although the country is the eighth-largest car market in the world, it is now No. 4 in EVs. In July, EVs accounted for 16% of new-car sales in the UK, which has a catalog with 40% more choices than the 50 electric cars and trucks available in the US.

“We’re now moving absolutely from early adopters towards more mainstream consumers,” says Paul Clarke, founder and editor of the British Green Car Guide.

The UK benefits from its proximity to an array of global carmakers, which are focused on both electrification and affluent markets that are open to EV imports.

Take French car brands Peugeot (which sells the e-208, e-2008 and e-Rifter in the UK), Renault (Megane E-Tech and Zoe) and Citroen (E-Berlingo, E-C4 and E-Spacetourer). Because of the British islands’ proximity to France, these carmakers collectively crank out eight EVs that are available in the UK. None of them are available in the US, which Peugeot, Renault and Citroen pulled out of in the 1990s.

The UK advantage also applies to other carmakers, including Cupra (Born), MG (MG4 EV, MG5 EV, ZS EV) and Skoda (Enyaq iV). Continental drivers can choose an electric version of BMW’s iX3 SUV that has yet to cross the Atlantic. The same goes for the Mercedes C-Class sedan. And while Americans have only one electric Volkswagen to choose from — the ID.4 — UK drivers have four of them, including the larger ID.5, the pint-sized ID.3 and the battery-powered rebirth of VW’s storied van, the ID.Buzz.

Of all 72 cars on the UK list, almost two-thirds are made by European carmakers and just 4% come from US companies (one Ford and a couple of Teslas). Roughly 30% are from brands based in Asia, including four models out of China.

That makes the UK somewhat unique among major EV markets: In China, the No. 1 market for electric cars, US- and European-made models account for a small minority of sales. In the US, the No. 2 market, electric cars made in China aren’t available at all.

In recent years, the UK has implemented a number of policies to encourage EV adoption among companies and consumers. One such incentive comes via the benefit-in-kind tax. It’s relatively common in the UK for employers to provide company cars — both for employees who drive on the job and as a general benefit. The worker typically has to pay a tax on this vehicle, but the benefit-in-kind perk minimizes those taxes for EVs. In situations where the employer isn’t paying for the car in full, the incentive also allows drivers to pay for it using pretax earnings.

“For businesses, it’s crazy not to buy an EV,” Clarke says. These fleet cars — or “corporate cars” — now account for slightly more than half of the UK’s total car market, according to Bloomberg Intelligence.

The UK has also set a 2035 sunset date for sales of petrol cars, though it has been sending mixed messages about how tolerant it will be of them after 2030. That moratorium, which only applies to new vehicles, comes with a ceiling on emissions that gets steadily lower over time. Next year, carmakers face fines of up to £15,000 per vehicle if combustion vehicles comprise more than 80% of their total sales by unit.

Both the targets and the penalties are tougher than emissions regulations in the US, making it more critical for carmakers to establish a beachhead for EV sales in England. “The whole market is policy-driven and tax-driven,” says Michael Dean, a Bloomberg Intelligence analyst in London.

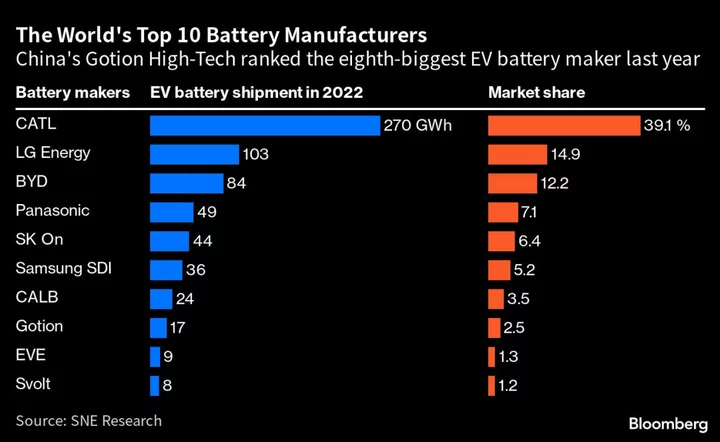

Globally, every major EV market is evolving in lockstep with the companies and policies that inform it. In the US, car companies are focused on sales of premium SUVs and pickups, frustrating consumers looking for affordable options. In the European Union, where Chinese cars account for 8% of EV sales, regulators recently launched an investigation into China’s EV subsidies to ward off a flood of cheap imports. In China, fierce competition in a fast-growing EV market has already spurred a wave of consolidation.

For now, only some of those challenges are familiar to the UK. The country has its share of luxury sleds — like the six-figure BMW i7 — but also has 45 models that cost less than £50,000. Smaller, cheaper cars, like the £32,000 Ora Funky Kat, are able to scoot around the alleys of London even as they wouldn’t pass muster on US highways. UK sales of the BYD Atto 3, meanwhile, may serve as a useful signal of the country’s appetite for cars made in China.