The European Central Bank should consider tweaking the composition of its public-sector bond holdings to mirror the European Union’s climate priorities, according to Executive Board member Frank Elderson.

“When there is no clear monetary-policy rationale for preferring domestic sovereign bonds, we should contemplate increasing the share of EU supranational bonds in our total bond holdings to avoid potential climate and nature-related risks and to better align our balance sheet with the general economic policies in the EU,” Elderson said.

In a speech Wednesday in Berlin, he also floated the idea of greening cheap longer-term funding for banks, should such an instrument be required in future crises.

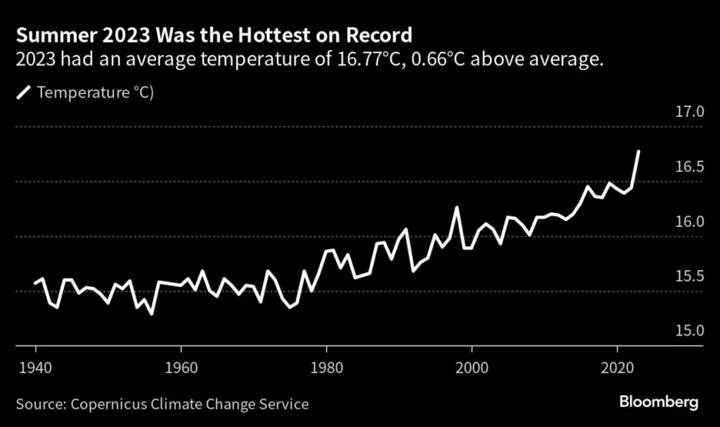

The ECB is among central banks that have joined the fight against climate change. Though melting glaciers may be a huge leap from monetary policy, policymakers around the world — with the notable exception of the US Federal Reserve — have said they must respond to threats that have the potential to disrupt the global economy.

The ECB’s price stability mission may be under threat if policymakers ignore the risks emanating from climate change, Elderson warned.

“The massive impact of the climate and nature crises on the economy, including the financial system, makes it crystal clear that we must take climate and nature into account,” he said. “If we didn’t do so, we would risk failing to deliver on our mandate.”

Elderson highlighted five economic consequences of the climate and nature crises that are specifically relevant to monetary policy:

- Macroeconomic volatility – including the volatility of inflation – due to climate events

- Climate and nature shocks complicating monetary-policy analysis

- A fall in the equilibrium rate of interest as savings increase due to climate threats

- Soundness of banks and other institutions may be impaired by financial risks arising from climate crises

- Financial institutions’ weakness might also undermine the solidity of the central bank balance sheet

“In the pursuit of price stability, central banks benefit from mitigation of climate and nature-related risks, which – as analysis consistently shows − is best ensured by securing a timely and orderly transition,” Elderson said.