As Europe embarks on a wholesale review of the world’s biggest ESG investing rulebook, an executive at Deutsche Bank AG’s fund unit says the complete makeover that some in his industry want would be a terrible mistake.

Dennis Haensel, head of ESG advisory at DWS Group in Frankfurt, said he’s aware that “the frustration level can be very high” among fund managers after years spent trying to adapt to rules that the European Commission now says may not be fit for purpose.

But if the European Union ends up tossing out major planks of the existing framework, that “would be a nightmare,” he said in an interview.

The European Commission launched a consultation into the Sustainable Finance Disclosure Regulation last month, after longstanding complaints from investors and national regulators that its ESG rulebook was full of holes. Some academic studies even suggest that SFDR has helped feed the very greenwashing it was designed to prevent.

Mairead McGuinness, the EU commissioner for financial markets and services, has said the key question she wants answered is whether SFDR is giving investors the information they need to help steer capital toward more sustainable activities.

For asset managers, a key issue they want resolved centers on the EU’s insistence that SFDR be used not as a fund labeling framework, but instead as a disclosure regime. In practice, however, market participants have ignored that requirement.

The EU has given market participants until Dec. 15 to respond to its consultation on SFDR.

Haensel isn’t alone in defending the basic building blocks of the regulation. Laurence Caron Habib, head of public affairs for BNP Paribas Asset Management, said it would be a bad idea to start from scratch. There are “positive elements,” she said in an interview.

Last year, fund managers, including industry heavyweights such as BlackRock Inc. and Amundi SA, descended into a wave of SFDR reclassifications that revealed deep gaps in how the regulation was being interpreted. Analysts at Goldman Sachs Group Inc. estimate that the episode resulted in SFDR’s most stringent ESG disclosure category — Article 9 — being stripped from about $240 billion worth of client assets.

DWS, which last month agreed to pay $19 million to settle the US Securities and Exchange Commission’s probe into its alleged ESG misstatements, was among asset managers downgrading Article 9 funds.

Analysts at Barclays Plc have since warned that the EU’s review of SFDR may have significant ramifications for flows within the regulation’s weaker ESG fund category, known as Article 8. According to Bloomberg Intelligence, about $6 trillion in client funds are currently registered as Article 8, making it the biggest SFDR fund class.

Habib said the main concern is Article 8, and the huge array of sustainable claims it now covers in the absence of minimum criteria. It’s a situation made worse by the lack of consistency in how national regulators within the EU interpret SFDR requirements, she said.

“Expectations aren’t the same” from supervisor to supervisor, including the kind of product information they want to see and where they set thresholds for Articles 8 and 9, she said.

“There is a gray zone,” Habib said. “Nobody can tell you that your interpretation isn’t the right one.”

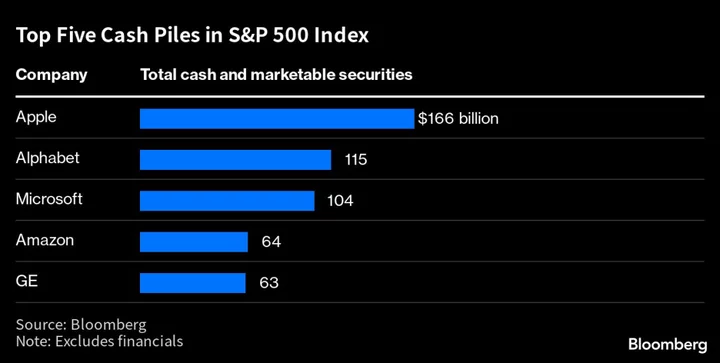

AUM Per SFDR Article Captured as of March 2023

The European Commission plans to hold an SFDR workshop on Tuesday, and says it has registered “exceptionally high interest” in the event. The workshop will cover a range of issues, including how the regulation interacts with other elements of the EU’s sustainable finance framework and whether new product categories would be useful.

Haensel said the key is to address confusion around SFDR without jettisoning the underlying principles behind its existing fund designations. These include the extent to which fund managers are expected to show their use of the EU’s taxonomy regulation, as well as its newly enforced principal adverse impact indicator, he said.

Some asset managers selling products into the EU never figured out how to apply SFDR’s disclosure articles after it was first enforced in 2021, according to the DWS manager. There are “some market participants that have not finalized the first step,” he said.