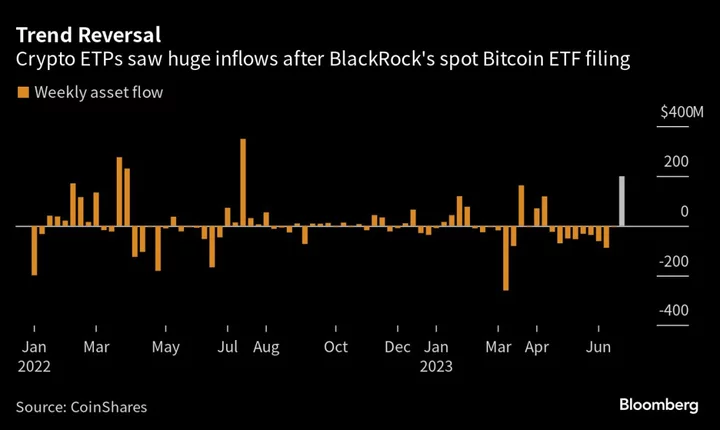

Digital-asset investment products added $199 million last week, the biggest weekly inflows in nearly a year, as a flurry of applications for spot-Bitcoin exchange-traded funds in the US sparks renewed interest in the space.

The inflows are the highest since July 2022 and follow nine consecutive weeks of outflows, according to a report from crypto research firm CoinShares. About $187 million, or 94% of the total flows, went to Bitcoin. Total assets under management now stand at $37 billion — the highest since before the collapse of Three Arrows Capital, the data shows.

“We believe this renewed positive sentiment is due to recent announcements from high profile ETP issuers that have filed for physically backed ETFs,” CoinShares wrote in the Monday report.

On June 15, BlackRock Inc. — the world’s largest asset manager — filed for a US spot Bitcoin ETF. Similar applications, including from Invesco Ltd. and WisdomTree, followed soon after.

BlackRock’s filing is seen by several crypto market commentators as a sign that the US Securities and Exchange Commission may finally approve a physically-backed Bitcoin ETF. The regulator has repeatedly rejected such a structure, citing fraud and manipulation risks in the spot market for Bitcoin.

There have been about 30 attempts for a spot-Bitcoin product, according to a Bloomberg Intelligence tally.

Meanwhile, the ProShares Bitcoin Strategy ETF — the US’s first Bitcoin futures ETF when it debuted in 2021 — saw its highest weekly inflows in about a year.

“While BITO benefited from the spot filings, if approved, they’ll likely take business from the ETF,” wrote Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, in a note Monday.

Bitcoin hit its highest level in a year last Friday, and is currently up 84% in 2023.