Dassault Systemes SE’s revenue increased 8% from a year earlier in the second quarter on a constant currency basis, comfortably in its expected range, with the company citing a “positive shift in the market.”

The French software firm reported sales of €1.45 billion ($1.61 billion) for the three months, driven by recurring revenue and a rebound in Chinese demand. A 10% drop in software license sales in the previous quarter had worried analysts, but the latest period saw a 6% increase, beyond the company’s expected range of 0%-5%.

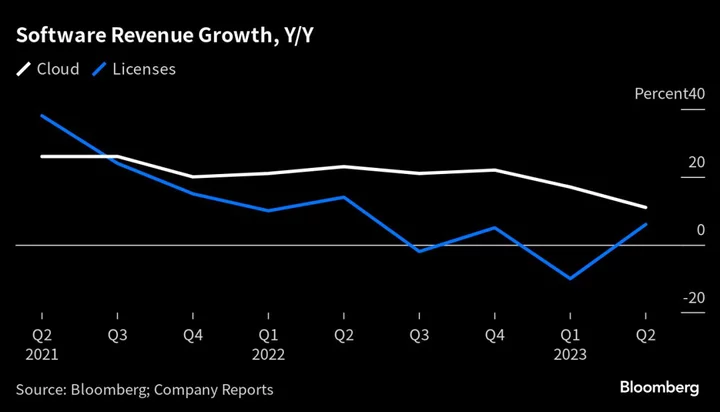

Concerns persist among analysts about the company losing market share in the industry shift toward the cloud. Cloud software revenue grew 11% in the latest quarter, down from 17% in the previous one. The company is targeting a third of its software sales being cloud-based in 2025, up from 23% currently.

Just 9% of Dassault Systemes’ engineering application-software sales come from products hosted in the public cloud, a market that’s growing more than 20%, according to Bloomberg Intelligence.

Chief Executive Officer Barnard Charles reiterated the importance of an omni-channel approach in the company’s previous earnings call, saying the ability to offer the mix “is extremely valuable for many of our customers.”

The company has increased cloud-based sales with its 3DExperience platform and Medidata acquisition. Further expansion into industries such as Life Sciences, however, may distract from a focus on manufacturing, where cloud-based competition is increasing, Bloomberg Intelligence said.

The company has greater exposure than many of its peers to one-time perpetual licenses, which are priced higher upfront than recurring subscriptions and are therefore more vulnerable to economic headwinds. Weaker activity among manufacturers remains a challenge.