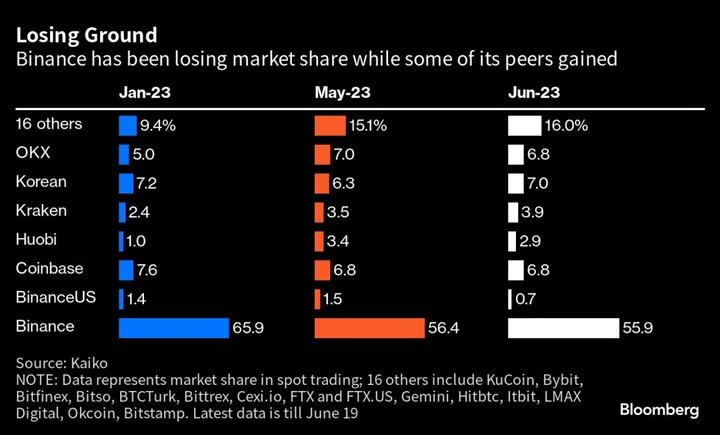

Coinbase Global Inc. has started a crypto lending service for US institutional investors, seeking to capitalize on the vacuum left after the collapse of firms such as BlockFi Inc. and Genesis Global Holdco.

Customers of the largest US crypto exchange’s Prime service have already invested $57 million in the lending program, according to a recent filing with the US Securities and Exchange Commission. Coinbase Prime is a full-service prime brokerage platform that lets institutions execute trades and custody assets.

“With this service, institutions can choose to lend digital assets to Coinbase under standardized terms in a product that qualifies for a Regulation D exemption,” Coinbase said in a statement Tuesday.

Coinbase has ventured into lending before. In May, the firm stopped issuing new loans through a service that let people borrow against Bitcoin. Called Coinbase Borrow, it served retail investors. The new institutional program is operated through the same entity, Coinbase Credit.

And in June, the SEC charged Coinbase with an unregistered offer and sale of securities in connection with its staking-as-a-service program, which let users give their coins to Coinbase to earn yields to secure blockchain networks. A group of US states demanded that Coinbase halt its staking services as well.

Lenders Celsius Network, BlockFi and Genesis Global were among some of the highest profile crypto bankruptcies in the past year. Lenders got caught making risky bets that didn’t pay off, leading to a cascading series of failures that dramatically reduced investors’ options for borrowing and leverage.