China is planning to boost its strategic stockpiles of cobalt, according to people familiar with the matter, just three months after the government last bought the metal used in everything from electric-vehicle batteries to aerospace alloys.

The National Food and Strategic Reserves Administration, which manages the state’s commodity stockpiles, has agreed to buy about 3,000 tons of cobalt, said the people, who are not authorized to speak publicly. This follows a meeting of five producers and traders with government officials in Beijing on October 20.

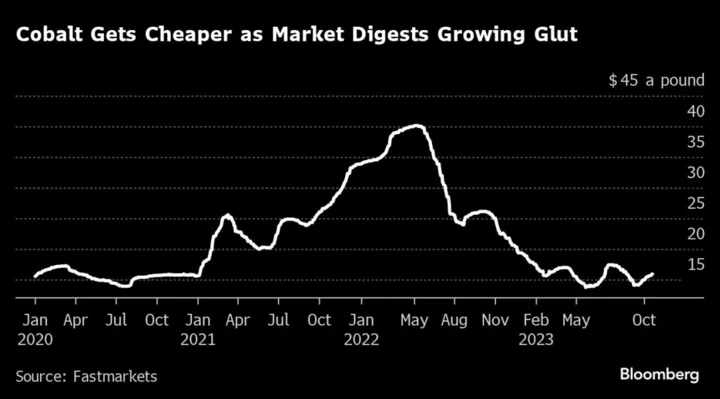

Cobalt is among battery materials that are suffering sharp price declines from rising global output this year. It’s also a metal considered “critical” by western nations who want to loosen China’s supply-chain dominance and minimize the risk of future shortages.

China’s fresh build-up of inventory comes not long after China’s purchase of about 5,000 tons of cobalt for its strategic commodity reserves in July. Global prices have slumped by more than 60% since May 2022 amid rising supplies from major producers Democratic Republic of Congo and Indonesia.

The National Food and Strategic Reserves Administration didn’t reply to a fax seeking comment.

China’s state stockpiling agency can buy some commodities to protect domestic producers, as well as to guard industries including military manufacturing against supply shocks. Batteries account for about four fifths of global cobalt demand, with magnets, high-performance materials and ceramics among other segments.

Glencore Plc, one of the world’s top two cobalt producers, said in August that a mix of “strategic and proactive stockpiling” around the world would help rebalance the cobalt market. Glencore itself was planning to sell less cobalt than it produces.

--With assistance from Winnie Zhu.

Author: Annie Lee, Alfred Cang and Mark Burton