BlackRock Inc. backed fewer shareholder proposals on environmental and social issues over the past year as it stressed its commitment to the energy industry and navigated a debate over ESG investing.

The asset manager supported 26 of 399 — or almost 7% — of proposals related to climate change and social issues in the 12 months ended June 30, down from 22% in the same period a year earlier, BlackRock said Wednesday in a report. Many shareholder proposals have become “unduly prescriptive,” seek to “micromanage” executives and fail to acknowledge companies’ responses to climate change, including their disclosure of greenhouse-gas emissions, according to BlackRock.

“Because so many proposals were over-reaching, lacking economic merit or simply redundant, they were unlikely to help promote long-term shareholder value and received less support from shareholders, including BlackRock, than in years past,” Joud Abdel Majeid, global head of investment stewardship, said in the report.

BlackRock, the world’s largest asset manager, is among the top five shareholders in the vast majority of S&P 500 companies.

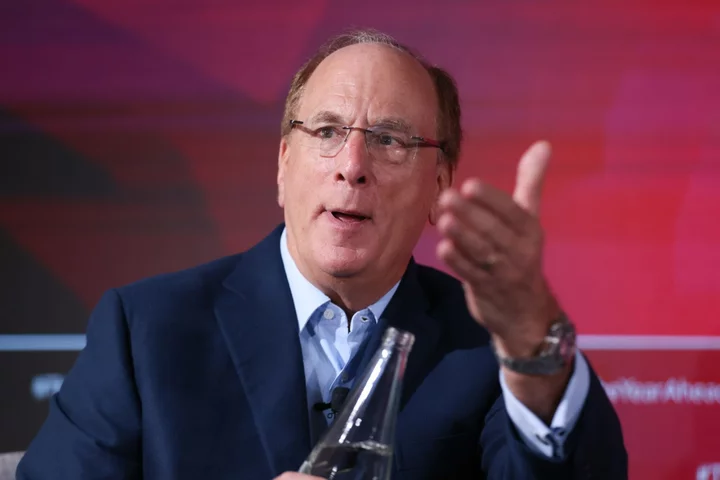

The firm has faced intense scrutiny from US investors and politicians in recent years because of the influence its senior managers, including Chief Executive Officer Larry Fink, hold over public companies and for backing ESG-related investments. Republican officials have criticized the firm over the past two years for supporting sustainable investing — leading Fink to call the attacks “personal,” “ugly” and full of misconceptions.

BlackRock has emphasized its role as one of the world’s largest investors in the energy industry, and last month named the CEO of Saudi Aramco to its board of directors.

Read More: BlackRock Appoints CEO of Oil Giant Aramco to Its Board

The asset manager said in the report that shareholder proposals, many of which are of “poor quality,” amount to less than 1% of the more than 171,500 proposals voted on. Industry support for environmental and social proposals in the past year declined alongside BlackRock’s, with median shareholder support for US environmental and social shareholder proposals declining to 15% from 25%, according to the firm’s report.

BlackRock said it’s encouraged by increased corporate disclosure of climate-related risks since 2021. Of the 399 proposals BlackRock’s stewardship team voted on globally, the firm said more than 60% had already met the goals of the shareholder proposal.

The firm has moved to allow its clients to cast their own votes at shareholder meetings, with pensions, endowments and institutional shareholders accounting for $586 billion of equity assets participating in BlackRock’s “voting choice” program.