Billionaire media mogul and former professional blackjack player Charlie Ergen is known to keep “feng shui water” in his office for good luck. These days, Wall Street is wondering whether he’s finally running out of it.

A week ago, Ergen averted a financial crisis by announcing plans to merge two of his cash-strapped businesses — the pay-TV provider Dish Network Corp. and satellite operator EchoStar Corp. But in a matter of months, there’s a very real possibility that the satellite TV empire he’s trying so desperately to reinvent as a wireless carrier will face another reckoning.

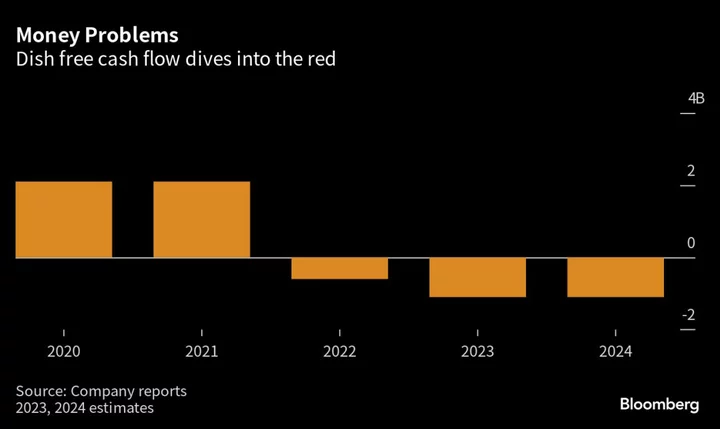

Ergen needs to hit federally mandated deadlines to build out Dish’s wireless network or risk losing his airwave licenses. But the business isn’t generating enough cash to pay for that. Punishingly high interest rates, meanwhile, have slammed the door on the credit market. Dish also had $9.5 billion in distressed debt outstanding as of Aug. 11, according to data compiled by Bloomberg, making it the largest issuer of such debt in the media and telecom sectors.

Ergen, 70, has proved the doomsayers wrong time and again during a four-decade career famous for scorched-earth dealmaking and magician-caliber financial conjuring. However, it’s not clear that merging Dish with EchoStar will be enough to keep his empire intact.

Going Mobile

Ergen’s mobile strategy started taking shape four years ago, when he persuaded US regulators to carve out enough airwaves, prepaid customers and network access from T-Mobile and Sprint, to help establish Dish as a fourth wireless competitor. The move was crucial to the government because it let officials point to a new mobile carrier and justify the combination of T-Mobile and Sprint.

There were conditions. Under the deal with the feds, Ergen had to provide service to growing percentages of the population by certain dates. Eager for him to succeed and “promote American leadership in 5G,” the Federal Communications Commission gave him considerable slack by pushing out his staggered completion deadlines to 2023, 2025 and 2027.

But creating a national carrier is expensive, and Verizon Communications Inc., AT&T Inc. and T-Mobile US Inc. are already putting the final touches on their 5G networks. Dish’s traditional TV business has been losing subscribers for 13 years, creating a cash deficit.

In June, after several delays, Dish launched Boost Infinite, its first wireless service designed to compete directly with the Big Three carriers. So far, signups are meager at best, according to analysts, who say Dish will still probably lose more than 200,000 wireless customers this year, or almost 3% of its total mobile phone subscribers.

It doesn’t help that Boost Infinite debuted with a limited number of stores, meager sales and retail staff and very little advertising, according to Roger Entner with Recon Analytics LLC.

“Infinite was like the tree that fell in the forest,” he said. “No one heard it.”

Which brings us to the merger of Dish and EchoStar, two companies that were once corporate siblings before Ergen spun off EchoStar in 2008 to separate the TV service from the satellite equipment division. The all-stock deal to combine the two units may be strategically questionable, but it gives Ergen almost $2 billion in extra cash and an expanded debt capacity for more breathing room.

Jupiter 3

Ergen also is hoping to silence the doubters by suggesting he’s dramatically expanding his satellite internet business. EchoStar operates a fleet of communications satellites that provide various services, including in-flight Wi-Fi for airlines. Last month, the company launched Jupiter 3, the world’s largest commercial communications satellite. With it, Ergen aims to provide improved satellite broadband service to North and South America, a wildly ambitious goal that would put Dish in direct competition with Elon Musk’s Starlink, along with Amazon.com Inc.’s planned Project Kuiper.

Even with the new satellite, “Starlink still has superior capacity and is better situated to pursue these opportunities,” said Tim Farrar, an analyst with TMF Associates in Menlo Park, California. “And do you really want to compete with SpaceX, a company that’s not as urgently focused on turning a profit on its satellite ventures?”

Even as Ergen talks up the merger and prospects for a Starlink-style business at EchoStar, he’s struggling to fix what ails Dish. In an effort to rein in costs and pay down debt, he cut the capital spending budget 28% below analysts’ expectations for the next two years — just as he’s trying to complete the company’s wireless network.

Time is not on Ergen’s side. Under the deal with the FCC, Dish has until June 2025 to expand its 5G network coverage to 75% of the US population — or risk losing airwave licenses. Dish said in June that it met its initial deadline to cover 70% of the population. Expanding networks to provide signals further out beyond big cities is harder and more expensive.

Last week on a call with journalists, Ergen pledged to “do what we need to do to secure our spectrum.” But even if he meets the FCC deadline, the cost-cutting suggests Dish’s network won’t be as robust or technologically advanced as rival systems, according to some analysts. That in turn could dampen consumer signups and further depress revenue.

Some analysts wonder if Dish has missed its moment. The company “is decades late to the game in a cash-intensive industry, and I’m not sure Charlie’s dreams are going to play out like he hopes, said Tammy Parker, an analyst with GlobalData.

With his empire on the brink and his fortune reduced to about $4 billion from a 2015 peak of $21 billion, Ergen is in a familiar place — with his back against the wall.

“We’re always in trouble,” he said a few years ago, comparing his enterprise to Indiana Jones. “We always get out of it.”

--With assistance from Erin Hudson and Jack Witzig.