Exxon Mobil Corp. is lobbying the Biden administration to allow hydrogen made from natural gas to qualify for some of the most lucrative subsidies available in the President Joe Biden’s signature climate law, pushing for billions of dollars in tax credits intended to help phase out fossil fuels.

The company is targeting “key decision makers” in Washington including Democratic lawmakers, US Treasury Department officials and think tanks, according to an internal memo seen by Bloomberg. Exxon is stepping up efforts to ensure that what it dubs as low-carbon natural gas is “properly recognized“ by the Biden administration, the memo said.

Exxon Chief Executive Officer Darren Woods met last week with White House senior clean energy adviser John Podesta to make the case himself, according to people familiar with the matter.

While the subsidies are intended to promote an alternative to fossil fuels, Exxon argues it can produce hydrogen from natural gas without releasing significant amounts of carbon dioxide. The company says the result is a fuel that’s as safe for the climate as hydrogen that’s made from water and renewable energy and, hence, should qualify for the law’s top tax credit.

If Exxon’s efforts are successful, it will likely open the door for fossil-fuel companies to win billions of dollars in subsidies and become dominant players in hydrogen, which some analysts say is crucial for decarbonizing heavy industries, trucking and other sectors. That worries environmentalists who are skeptical hydrogen from natural gas can ever be emission-free and say promoting it will ultimately spur more fossil-fuel production, undermining the tax credit’s original goals.

“We are going to end up spewing billions of dollars of subsidies to extremely carbon-polluting projects,” said Rachel Fakhry, a policy director at the Natural Resources Defense Council.

Matt Furman, Exxon’s vice president of public and government affairs, said in an interview that the company is confident it can make hydrogen clean enough to qualify for the top-tier subsidy, saying its findings are backed by government officials who ran the modeling.

“Their view is the model would say that hydrogen we can produce has lower carbon emissions and therefore would qualify for a higher tax incentive,” Furman said.

A Treasury Department spokeswoman said the agency is “focused on ensuring this incentive advances the goals of increasing energy security and combatting climate change.” An administration official said Podesta’s meeting with Woods is evidence the White House is willing to meet with all stakeholders.

If Exxon wins the approval, the company would be getting tax credits intended to help fight climate change after coming under criticism for sowing doubt about the climate crisis. The company is also among those named in California’s landmark lawsuit accusing Big Oil of deceiving the public about climate change. Exxon has consistently rejected the assertion that it downplayed climate risks.

Read More: California Governor Newsom Calls Out Oil Companies for ‘Lying’

Hydrogen, which emits no greenhouse gases when burned, is the universe’s most common element. But on Earth, it’s typically bound together with oxygen, nitrogen, carbon or other elements. To use hydrogen as a fuel, it must be cleaved from those compounds. This can be done in many ways — but most methods generate emissions.

The vast majority of hydrogen produced today is derived from natural gas. It’s done using a process called steam-methane reforming, which releases carbon dioxide into the atmosphere. So even if the hydrogen itself burns cleanly, the process of making it worsens emissions that cause global warming. Hydrogen produced from natural gas is known as “blue hydrogen.”

To environmentalists, the gold standard for producing hydrogen is separating it from water using machines called electrolyzers that are powered with wind or solar energy. The result is “green hydrogen” that’s 100% emission free, from production to combustion.

Read More: Big Oil Shows Support for Energy Transition But on Its Terms

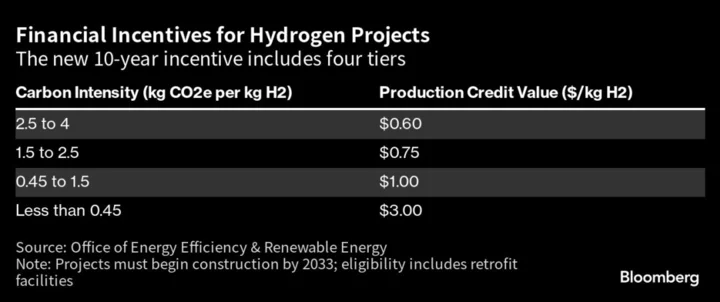

Biden’s climate law, the Inflation Reduction Act, provides four levels of tax incentives for hydrogen, paying out $3 per killogram for fuel that’s nearly 100% emission free. Officials are pushing to finalize the rules for claiming those credits later this fall. Meanwhile, a lobbying battle is playing out behind the scenes as utility companies, clean energy developers and fossil fuel producers push to cash in on the subsidies.

To make its natural-gas based hydrogen clean, Exxon plans to capture the emissions from the steam-methane reforming process and store them underground. Plus, the company plans to ensure that the natural gas it uses to make hydrogen is “lower carbon intensity differentiated gas,” according to the memo. That means the wells and pipelines used to produce the gas have been checked to ensure they’re not leaking methane, a highly potent greenhouse gas.

Too much focus, Exxon said in its memo, has been on hydrogen that’s made by using electricity to split water into hydrogen and oxygen.

“It is important to expand this discussion to include other production pathways eligible for the credit,” the memo said.

Exxon already produces about 200 million cubic feet per day of natural gas in New Mexico that’s been independently certified by a third party for emissions management, with plans to certify some output in Pennsylvania and West Virginia, too, according to a 2022 statement. The company currently produces about 1.5 billion cubic feet of hydrogen a day and is planning the world’s largest low-carbon hydrogen plant to come online in either 2027 or 2028.

Lobbying Targets

The company’s other lobbying targets included Secretary of Energy Jennifer Granholm, White House Climate Advisor Ali Zaidi, Senate Majority Leader Chuck Schumer and Democratic Senator Joe Manchin, according to the memo. The company’s campaign also sought to identify “aligned third parties” and others that would be influential with its lobbying targets, the memo said.

Exxon hasn’t always embraced tax credits for green projects. Former Chief Executive Officer Lee Raymond, who masterminded the 1999 merger between Exxon and Mobil, was famous for railing against wind and solar power for being financially dependent on government subsidies.

Now the company is taking the opposite approach, saying financial assistance is necessary to fund new low-carbon technologies in the short-term before market forces take over.

“If the tax credit is not present, then its not possible to make this kind of hydrogen,” Furman said. “It’s simply too expensive.”

--With assistance from Jennifer A. Dlouhy and Kevin Crowley.