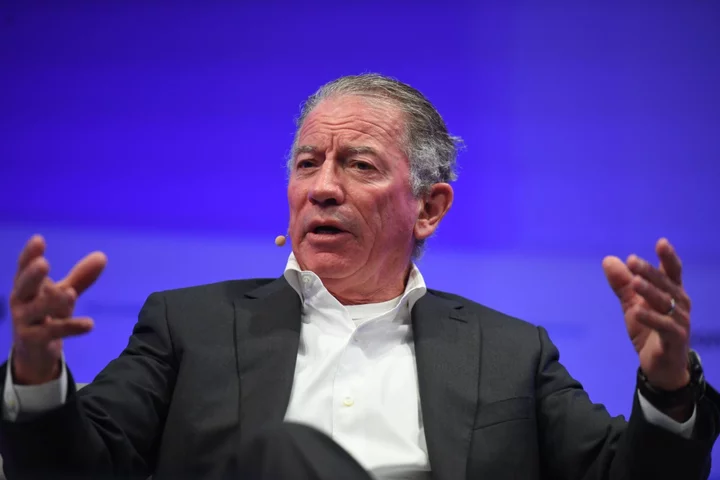

The AI hype cycle has birthed innumerable boosters. An unlikely member of this group is Silicon Valley billionaire Tom Siebel.

Since selling his first company to Oracle Corp. in 2006, Siebel started C3.ai Inc., an ostensibly cutting-edge software firm that helps customers crunch and analyze huge amounts of data. The 70-year-old founder has become a regular on the business press circuit and posited that C3’s new generative artificial intelligence product will “change the nature of the human-computer interface” and its release could be an “iPhone moment.”

Investors, with a newly insatiable appetite for anything AI, have eaten it up. In the first quarter, the share price tripled for the company whose ticker symbol is literally “AI.”

But C3’s products are different than the emerging technologies such as large language models that power OpenAI’s popular ChatGPT chatbot. Moreover, its marketing pivot to AI is fairly recent — the company is on its third name since being founded in 2009. It was earlier called C3 Energy, banking on the then-trendy concept of tracking emissions and energy. It later rebranded as C3 IOT to ride the internet-connected machine wave before calling itself C3.ai in 2019.

There are also signs of stress at the company. Interviews with more than 30 former employees and associates describe Siebel as a micromanager who fires people impulsively and must sign off on almost every decision, down to language for contracts and marketing. C3 also has demonstrated unfinished products in presentations as if they’re ready for use and had trouble signing new customers.

Some investors are betting against the stock. In April, a short-seller alleged that C3 was chasing trends and had accounting and management problems. The stock lost 37% of its value in two days, before recovering as Siebel defended the company’s practices.

Siebel called the short-sellers “scumbags who should be in jail” during an interview at C3’s New York office. He said Kerrisdale Capital and Spruce Point Capital Management had manipulated investors, sliding across the table a printed packet of Yahoo Finance comments from retail traders largely supporting C3. Both said they stood by their reports and continue to bet against the company.

An industry titan of a previous generation, Siebel helped define customer relationship management software with Siebel Systems, one of the fastest growing tech companies in the late 1990s. He has served as an adviser to several university engineering programs, authored four books on business and technology, is a major Republican donor and was named by Barron’s as one of the nation’s Top 10 philanthropists in 2009 and 2010.

Many trust Siebel’s history of building successful companies and his powerful industry connections to capitalize on new interest in artificial intelligence. But as C3 struggles to sign new customers, it’s unclear whether AI-mania can carry it any further.

Siebel and the Safari

Every company has its founding legend. Marc Benioff was inspired to create Salesforce Inc. while swimming with dolphins in Hawaii, Mark Zuckerberg developed social apps to rate classmates’ attractiveness at Harvard University, and Tom Siebel was mauled by an elephant.

While on a photo safari in Tanzania shortly after founding C3, Siebel had a near-death experience when attacked by earth’s largest land mammal. He credits the grueling multiyear recovery with focusing him on the business. A portrait of the animal hangs in his office.

He’s said it was around that time that he had the idea for an AI company. Data science is “now being accelerated with this new technology which you’re undoubtedly familiar, called generative AI,” Siebel said in an April interview with the Acceleration Economy podcast. “We’ve been out talking about this for 14 years, and now everyone around the world is talking about it every day.”

Yet Siebel’s company started out tracking emissions. Old associates say that initial idea was borrowed — Anirban Chakrabarti went to his former Siebel Systems boss in 2008, looking for venture funding in his carbon accounting company Clear Standards. Siebel was interested — he drafted investment terms and learned about its technology, customers and sales strategy.

But at the last minute Siebel pulled out, and “within a few months, C3 started as a replica of Clear Standards,” said Chakrabarti, who is now chief executive officer at HireLogic, about the previously unreported episode. Siebel, he says, then ghosted him for years. “Tom is one of the best sales and visionary people I know, but the guy is absolutely ruthless.” Chakrabarti said. “He will do anything.”

Siebel said he was already workshopping the idea for C3 before meeting with Chakrabarti, and passed on investing because Clear Standards was a “crummy company” and didn’t have anything different. Clear Standards ended up being acquired by European software giant SAP SE a few months later.

Whoever had the idea first, carbon accounting software ended up being a difficult sell. Martin Tate joined C3 in 2011 to court large industrial customers in Europe, but they didn’t see emissions tracking as a “top-tier problem,” and uptake was slow, he said.

Internet of things also was a more-limited market than hoped after the company changed its name in 2016 to C3 IOT. The real opportunity would be facilitating data analysis at legacy companies that have struggled to digitize, executives figured. The company went public in 2020 under an eye-catching ticker: AI.

New Excitement

Today, the product is primarily used for analytics, such as estimating the lifespan of industrial parts for Shell Plc. Its key selling point is the ability to bring together data from disparate sources including physical sensors. Artificial intelligence models built by other companies are often used for complex analysis projects.

That’s quite different from generative AI companies and labs like OpenAI or Midjourney, which specialize in building advanced models that can create text or imagery from simple prompts. This has led some analysts to suspect C3’s 2023 rally is the result of unsophisticated investors conflating different types of AI. “There’s little fundamental reason to explain the recent rally,” said Canaccord Genuity analyst Kingsley Crane.

While acknowledging most investors don’t understand the differences between AI technologies, Siebel rejected the idea that people have only piled into the stock due to its ticker. To be sure, many corporations are racing to implement an AI strategy, which could boost demand for C3’s products, even if they’re different tools from generative AI such as ChatGPT or image-maker Dall-E, said Gil Luria, an analyst at D.A. Davidson.

The company debuted a generative “product suite” in March. Siebel billed the software as a kind of Google search for internal company data that would replace the onerous work of digging through documents. He said development began in September 2022 — before the full public release of ChatGPT — under an agreement with the US Department of Defense and the software is currently being installed at three customers. “I have an architecture that allows me to take advantage of generative AI immediately,” Siebel said.

He’s not alone in trying to make the most of this moment. Tech companies from Snapchat Inc. to Atlassian Corp. have recently unveiled generative features for their products, often using models built by OpenAI. A JPMorgan analysis estimated that artificial intelligence excitement drove about half the gains in the S&P 500 through April. During Zoom Video Communications Inc.’s February earnings call, shares climbed when Chief Executive Officer Eric Yuan just mentioned new AI tools.

But C3’s history of software rollouts casts doubt on its ability to quickly deploy the generative suite. Its last big announcement was “Version 8” of its platform, which underlies all the company’s other applications. The new version was announced to be in “general availability” and paraded on stage in 2022 at the company’s annual conference in Boca Raton, Florida.

The product didn’t exist in any real usable form for months after it was announced, said former employees who asked not to be identified talking about company activities. The presentation shown at the annual conference was just a mockup of app interfaces that weren’t connected to functioning code or data, they said.

While that huge delay between the announcement of Version 8 and its actual availability “might be true,” Siebel said the company hadn’t sold it to anyone in this period. The generative suite rollout is different, he said, because it was ready for use as soon as it was announced.

“Best Place to Work”

Overstating the readiness of technology is a trend at the company, according to former employees. While enterprise software companies are notorious for this, former engineers, designers and executives say it far exceeded industry norms at C3. The company advertises more than 40 ready-to-go applications, but it generally requires months of engineering to get the apps to work for specific customer needs and some are little more than concepts, the former employees said.

A $500,000-a-year contract with the San Mateo County Sheriff’s Office in California inked last year was meant to help solve cases by integrating data from cameras, jails, driver’s license photos and fugitive lists. The software was advertised publicly as delivering “proven results in 8-12 weeks,” but the contract, obtained via a public records request, lays out a one-year timeline for deployment. In internal emails, a county employee discussed being pushed by C3 to have a testimonial included in a press release before the software was actually live.

Siebel said the San Mateo contract timeline isn’t representative, as it was built “from scratch basically” for law enforcement, and afterward the same application was able to be deployed quicker for other clients. Still, he rejects the idea that any of the 42 “turnkey” applications advertised aren’t ready to be shipped and used immediately. “In order for that to be true, we would have to have made fraudulent misrepresentations in SEC filings,” he said.

Former employees say C3 is a demanding workplace, which helped fuel a departure rate of about 31% for the year ending in March, according to a Revelio Labs analysis. That’s more than double the attrition rate at a sample group of peers, including Palantir Inc. and Databricks Inc., according to the analysis.

Siebel said turnover is in line with other Silicon Valley companies at around 20%. He added that workers are always given a chance, and many salespeople who were fired weren’t even making sales calls. “They didn’t even try.” He added that the company continues hiring and underperformers are consistently managed out.

A five-day-a-week office mandate is the clearest example of C3’s strict culture. Big tech companies like Amazon.com Inc. and Meta Platforms Inc. have only recently begun pushing a return to part-time office work while C3’s full-return rule has been mostly in place since June 2021. Multiple people who spoke for this article either quit or were fired in relation to this policy.

If you “want to work from home four days a week in your pajamas,” you should be at Salesforce, Siebel said in a March keynote. He touted an image of C3’s full parking lot on a Friday afternoon compared with an adjacent empty Google lot. The company’s headquarters is in Redwood City, California, in a complex with Siebel’s family wealth management office, First Virtual Group.

Positive evaluations on workplace review website Glassdoor are a point of pride for Siebel, though multiple ex-employees say he’s repeatedly warned them that he can see who writes critical responses there. Glassdoor said in a statement that it doesn’t identify users.

The intense culture has succeeded in attracting top talent — many ex-employees interviewed said they’d never worked with such smart and driven staff, and that salaries exceed industry norms.

“Some of my best students have gone to work there and been successful,” said Stanford Business School Lecturer Robert E. Siegel, who wrote a case study about the company in 2019. He acknowledged it’s not a place that suits every personality type, such as those seeking work-life balance.

Still, many ex-employees describe a company full of incredibly smart people who aren’t allowed to make decisions without the “TS” sign-off. C3’s style and strategy is fundamentally a reflection of its founder. Much of its core leadership team dates back to the Siebel Systems days, including Chief Technology Officer Ed Abbo and Chief Product Officer Houman Behzadi. “C3 is absolutely a bet on Tom,” said Stanford’s Siegel.

Proxy advisory firm Institutional Shareholder Services rates C3.ai as a maximum governance risk, as Siebel individually has a controlling share in the company, and board directors aren’t up for election each year. Among the directors are some of Siebel’s marquee connections such as former Secretary of State Condoleezza Rice.

AI as Resuscitation

Though C3 has signed impressive deals, analysts have raised concerns about the company’s struggle to find new business. It had 236 customers as of January, but many of these are different divisions of the same parent company. In regulatory filings, C3 has repeatedly warned investors about the risk of high reliance on just a handful of customers.

Baker Hughes Co. alone made up 43% of sales in the most recent quarter. The oil company, which was part of General Electric Co., once owned 12% of C3’s stock as part of a reseller arrangement. It has since sold much of that stake and its CEO has left C3’s board.

“We believe investors should be open to the possibility that Siebel’s Rolodex, which drove many early wins, is simply tapped out,” wrote short-seller Sahm Adrangi of Kerrisdale Capital in his March 2023 report. Bets against the stock have jumped this year, with short interest amounting to about 29% of shares available to the public, according to data from S3 Partners.

The company earlier this month released preliminary results for its fiscal fourth quarter, saying the “overall business environment for enterprise AI is more active than we have seen since the company’s inception and seems to be accelerating.” During the quarter, C3 “closed 43 deals, including 19 pilots that were initiated” in the period, it said in a statement.

A recent shift to consumption pricing — paying for software based on use rather than in a flat subscription — is meant to make it easier to pick up new customers who were hesitant to commit to big contracts. The shift has helped double C3’s sales pipeline over the last year, the company said when it released the preliminary results.

The focus on generative AI represents Siebel’s latest effort to move the company forward.

“There’s no board, no CEO, where this is not in the forefront of their attention,” Siebel said. “The world has kind of come around seeing the way that we’ve been talking about it for the last 12 or 14 years.”