Africa will need more than $700 billion in finance over the next decade to develop renewable power and mines to extract the metals required for the green energy transition, according to Standard Bank Group Ltd.

The continent’s financial institutions won’t be able to provide even half of that and most of the money will need to come from investors from elsewhere, Kenny Fihla, chief executive officer of Standard Bank’s corporate and investment banking unit, said.

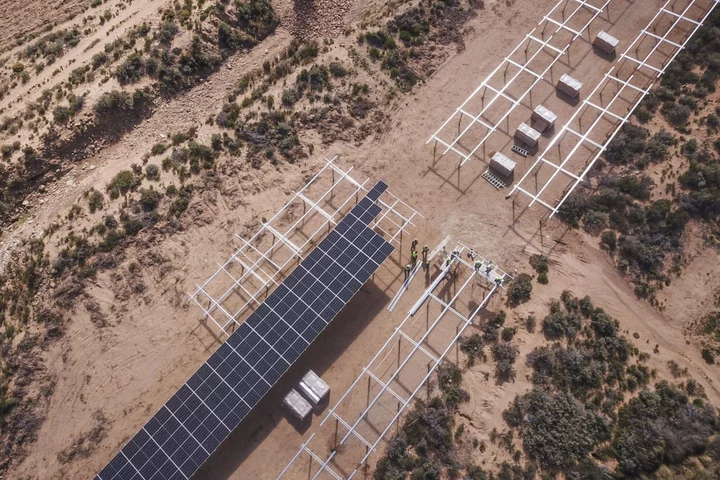

“Many of the minerals that are required to build solar panels, lithium batteries, wind turbines and so on, are found in sub-Saharan Africa,” Fihla said. “Our team has also quantified the amount of investment that is required in that space as in the order of hundreds of billions of dollars.”

African governments are under pressure to extend power supply to the 600 million people — about half of the continent’s population — who currently don’t have access to electricity. At the same time, copper and cobalt deposits in the Democratic Republic of Congo and Zambia, lithium reserves in Zimbabwe and platinum and manganese seams in South Africa are seen as key to providing the materials needed for everything from solar panels to electric vehicle batteries.

“The financial resources that the banking sector in sub-Saharan Africa has will be inadequate for us to be able to support these initiatives completely,” Fihla said. “The bulk of that money will have to come from international investors who want to grow in the renewable space or play a role in the renewable space or in the mining of those critical minerals.”

Fihla, whose bank is Africa’s largest by assets, said in South Africa alone Standard Bank is likely to hit the “upper end” of lending between 250 billion rand ($13 billion) and 300 billion rand to renewable energy initiatives by 2026.