MUNICH--(BUSINESS WIRE)--May 8, 2023--

ADVA (ISIN: DE0005103006, FSE: ADV), a leading provider of open networking solutions for the delivery of cloud and mobile services, reported financial results for Q1 2023 ended on March 31, 2023. The results have been prepared in accordance with International Financial Reporting Standards (IFRS).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230508005566/en/

Christoph Glingener, CEO, ADVA (Photo: Business Wire)

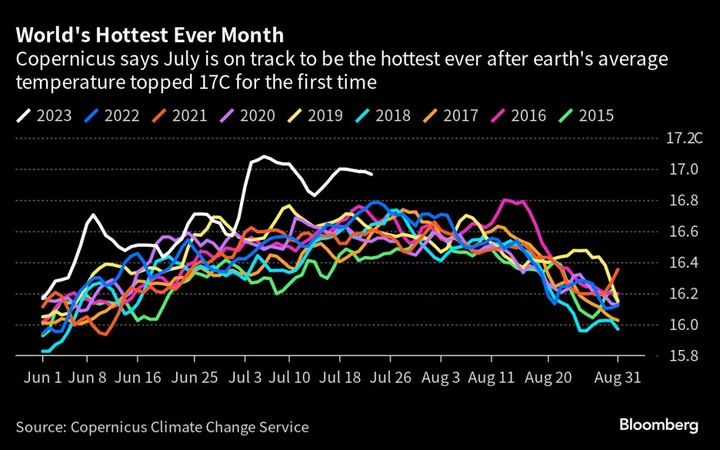

Q1 2023 financial summary 1

(in thousands of EUR) | Q1 | Q1 | Change | Q4 | Change |

2023 | 2022 | 2022 | |||

Revenues | 179,358 | 170,498 | 5.2% | 195,699 | -8.4% |

Pro forma gross profit | 58,371 | 53,405 | 9.3% | 71,434 | -18.3% |

in % of revenues | 32.5% | 31.3% | 1.2pp | 36.5% | -4.0pp |

Pro forma EBIT | 9,730 | 7,812 | 24.6% | 24,407 | -60.1% |

in % of revenues | 5.4% | 4.6% | 0.8pp | 12.5% | -7.1pp |

Operating income 2 | 6,227 | 5,976 | 4.2% | 14,803 | -57.9% |

Net income | 3,627 | 6,179 | -41.3% | 3,781 | -4.1% |

(in thousands of EUR) | Mar. 31 | Mar. 31 | Change | Dec. 31 | Change |

2023 | 2022 | 2022 | |||

Cash and cash equivalents | 67,241 | 73,002 | -7.9% | 58,447 | 15.0% |

Net cash (+) / Net debt (-) 3 | -24,296 | 763 | n/a | -19,185 | -26.6% |

1Potential difference due to rounding

2Q1 2023 including EUR 1,6 million, Q4 2022 including EUR 3.3 million and Q1 2022 including EUR 0.5 million extraordinary expenses

3Including EUR 62.0 million liabilities to Adtran

Q1 2023 IFRS financial results

Revenues in Q1 2023 decreased by 8.4% to EUR 179.4 million from EUR 195.7 million in Q4 2022 and increased by 5.2% compared to EUR 170.5 million in the same quarter last year. The decrease compared to the previous quarter was due to delivery bottlenecks and a lower order intake in the cloud access business. The increase in revenues compared to Q1 2022 is mainly attributable to the optical networking business.

Pro forma gross profit in Q1 2023 decreased 18.3% to EUR 58.4 million (32.5% of revenues) from EUR 71.4 million (36.5% of revenues) in Q4 2022 and increased 9.3% from EUR 53.4 million (31.3% of revenues) in the year-ago quarter. The year-over-year margin increase is due to lower procurement costs related to the recovery of supply bottlenecks. The significant reduction in the margin compared to the previous quarter is due to currency effects and a changed product and customer mix.

Pro forma EBIT in Q1 2023 was EUR 9.7 million (5.4% of revenues), down 60.1% from EUR 24.4 million (12.5% of revenues) in Q4 2022. Compared to the year-ago quarter, pro forma operating income increased significantly by 24.6% from EUR 7.8 million (4.6% of revenues). The quarter-over-quarter decrease is due to lower gross margins. The increase in pro forma EBIT compared to the previous year is mainly due to the improved gross margin.

Operating income decreased significantly by 57.9% from EUR 14.8 million in Q4 2022 to EUR 6.2 million in Q1 2023 and increased by 4.2% compared to EUR 6.0 million in Q1 2022.

Net income was EUR 3.6 million in Q1 2023, down 4.1% compared to EUR 3.8 million in Q4 2022 and down 41.3% compared to EUR 6.2 million in Q1 2022.

The company’s cash and cash equivalents increased by EUR 8.8 million to EUR 67.2 million compared to EUR 58.5 million at the end of Q4 2022 and decreased by EUR 5.8 million compared to EUR 73.0 million in Q1 2022.

The company’s net debt increased by EUR 5.1 million from EUR 19.2 million in Q4 2022 to EUR 24.3 million in Q1 2023 and increased by EUR 25.1 million compared to a net cash position in Q1 2022 of EUR 0.7 million.

Management commentary

“Our revenues in the first quarter of 2023 were once again at record levels, and despite seasonally lower profitability in the first quarter, the pro forma operating result was also satisfactory,” said Christoph Glingener, CEO of ADVA. “Delivery capabilities and procurement costs are gradually improving. However, shorter delivery times and better availability are also leading to a change in ordering behavior among our customers and a willingness to reduce inventory risk. The adjustment of inventories will probably continue to be a factor in the coming quarters. However, against the background of a very strong order backlog, we expect solid business performance overall and reiterate our guidance for the full year.”

Financial outlook 2023

For the fiscal year 2023, ADVA expects year-on-year revenue growth in the high single-digit to low double-digit percentage range. In addition, the management board expects to further increase pro forma EBIT in 2023 compared to 2022.

The company will publish its financial results for Q2 2023 on August 8, 2023.

The complete quarterly statement 3M 2023 (January – March) is available as a PDF: https://www.adva.com/en/about-us/investors/financial-results/financial-statements

Forward-looking statements

The economic projections and forward-looking statements contained in this document relate to future facts. Such projections and forward-looking statements are subject to risks that cannot be foreseen and that are beyond the control of ADVA. ADVA is therefore not in a position to make any representation as to the accuracy of economic projections and forward-looking statements or their impact on the financial situation of ADVA or the market in the shares of ADVA.

Use of pro forma financial information

ADVA provides consolidated pro forma financial results in this press release solely as supplemental financial information to help investors and the financial community make meaningful comparisons of ADVA’s operating results from one financial period to another. ADVA believes that these pro forma consolidated financial results are helpful because they exclude non-cash charges related to the stock option programs and amortization and impairment of goodwill and acquisition-related intangible assets, which are not reflective of the company’s operating results for the period presented. Additionally, non-recurring expenses relating to M&A restructuring measures are not included. This pro forma information is not prepared in accordance with IFRS and should not be considered a substitute for the historical information presented in accordance with IFRS.

About ADVA

ADVA is a company founded on innovation and focused on helping our customers succeed. Our technology forms the building blocks of a shared digital future and empowers networks across the globe. We’re continually developing breakthrough hardware and software that leads the networking industry and creates new business opportunities. It’s these open connectivity solutions that enable our customers to deliver the cloud and mobile services that are vital to today’s society and for imagining new tomorrows. Together, we’re building a truly connected and sustainable future. For more information on how we can help you, please visit us at www.adva.com.

Published by:

ADVA Optical Networking SE, Munich, Germany

www.adva.com

View source version on businesswire.com:https://www.businesswire.com/news/home/20230508005566/en/

CONTACT: For press:

Gareth Spence

t +44 1904 699 358

public-relations@adva.comFor investors:

Steven Williams

t +49 89 890 66 59 18

investor-relations@adva.com

KEYWORD: GERMANY EUROPE

INDUSTRY KEYWORD: TELECOMMUNICATIONS SOFTWARE NETWORKS INTERNET HARDWARE TECHNOLOGY MOBILE/WIRELESS SECURITY

SOURCE: ADVA

Copyright Business Wire 2023.

PUB: 05/08/2023 11:00 PM/DISC: 05/08/2023 11:00 PM

http://www.businesswire.com/news/home/20230508005566/en