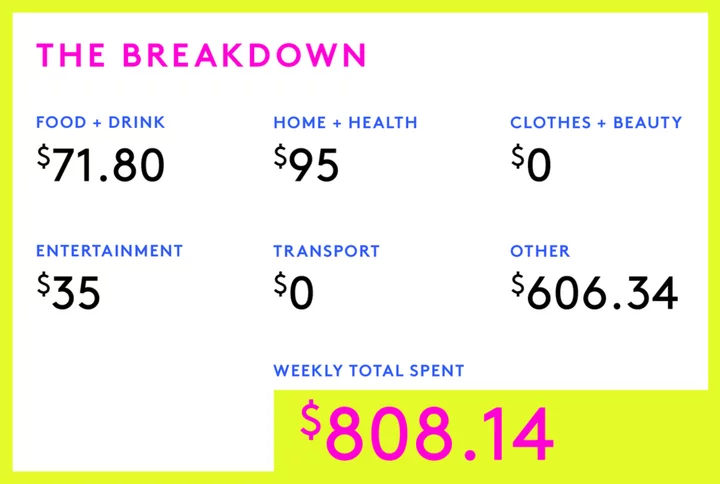

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a loan specialist who makes $91,753 per year and spends some of her money this week on a milk frother.

Occupation: Loan Specialist

Industry: Government

Age: 27

Location: Fort Collins, CO

Salary: $91,753

Net Worth: $38,622 (high-yield savings accounts (general savings: $14,689, car savings: $3,257, emergency savings: $12,448), sunken savings accounts (pet savings: $2,181, travel savings: $2,827), checking: $5,775, 401(k): $10,666. My partner and I do not live together and rotate who pays when we go to dinner or events. I have no debt).

Debt: $0

Paycheck Amount (biweekly): $2,545.98

Pronouns: She/her

Monthly Expenses

Rent: $820 (I rent a three-bedroom condo and have a roommate).

Utilities: $130

Savings: $1,100

401(k): I don’t contribute yet at this current job.

Health/Dental Insurance: $357.33

Car Insurance: $160.14

Pet Insurance: $40

Hulu/Spotify: $10.74

Kindle Unlimited: $10.74

Paramount Plus: $10 (I plan to cancel this month).

Gym: $40

Annual Expenses

Amazon Prime: $139 (I’m on my parents’ Netflix and cell phone plan).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes. Both of my parents have bachelor’s degrees and there was an expectation that all of their kids would go to college. I was very academically driven but desperate to get out of my home state. I chose a university that was very expensive, though I did get several small scholarships. My parents paid for all of my tuition, my rent, my food and my study abroad. I had a part-time catering job that paid for any fun expenses. When I went to grad school, there was an expectation I would pay for it myself but my parents gifted me $8,000 to help with my tuition. They also helped pay my rent when I was unemployed after grad school.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

I never understood our financial situation. My parents were both in sales and looking back it is clear that their finances fluctuated a lot, from well-off to extremely well-off. I still don’t know the numbers. My dad worked constantly. My mom also worked and we had a nanny until I was in fourth grade. I didn’t have a concept of how well-off we were until college, when my brothers and I all had access to our own cars and my new friends talked about taking out loans for school. Then I felt like I had to hide that my parents were paying for everything and felt ashamed. I never asked my parents for money but accepted when they offered it. They also made sure I had a savings account and credit card before I left home.

What was your first job and why did you get it?

I got a summer camp counselor job after freshman year because I wanted to have money for fun purchases when I went back to college.

Did you worry about money growing up?

Not particularly. My parents were heavily involved in real estate in 2008 so I distinctly remember things being tightened down around that time. But we always went on a vacation or two a year and spent time at my parents’ second home during the summers. During the pandemic, they were trying to sell both of their houses and I remember feeling stressed about that too, because I wanted them to be okay financially for the future.

Do you worry about money now?

The more exposure I have to money, the more my worry grows. Looking back, I don’t know how I lived the way I lived when I was doing unpaid internships and working at a restaurant on the weekends. I could have asked my parents for money but I felt too proud. During the pandemic, I made $50,000 a year and felt rich. Now I seem to have accumulated a lot of bills and an expensive pet commitment, and I struggle to comprehend how I could make it work on $50,000 again. Last year, I spent more on tuition than I made; this year, I am suddenly making over $91,000. I fully intend on switching careers to use my graduate degree and expect to be making $55,000-$65,000 when this happens. I am very concerned about this switch.

At what age did you become financially responsible for yourself and do you have a financial safety net?

At age 26 when I fully took on all of my bills. I have $12,000 in an emergency fund but could 100% move back home if something happened and my parents would support me.

Do you or have you ever received passive or inherited income? If yes, please explain.

Besides the money my parents spent on my education and the car, no.

Day One

5:50 a.m. — My alarm goes off and I quickly turn it off. My puppy, Q., is surprisingly quiet. I throw on my work pajamas, release a wriggling Q. from her crate, grab my water, phone, work laptop and mouse, and balance it all down the stairs. I let Q. out and feed her and log in at 5:57.

7 a.m. — I have a slice of chocolate chip banana bread I cooked the one day I felt okay last week. Yum. I skip my morning coffee, still not trusting my stomach after the stomach bug I’ve had for the last week.

11 a.m. — I decide eating is probably a good idea. I reheat some leftover ramen I got via DoorDash the other day. I take a nap at lunch, pop a DayQuil pack and put Q. in her crate to sleep.

1 p.m. — I wake up exhausted. Only three more hours of work. I groan thinking about my evening. Luckily I canceled my biweekly therapy because I was feeling sick yesterday. At 4 I stop work and clean up Q.’s toys. I reheat some sloppy joes and dairy-free mac I made last week. I cheer myself on because this is the first full, real meal I’ve had since getting sick.

5:30 p.m. — My boyfriend, G., calls me about our pottery class ($285 for 10 weeks, paid a few weeks ago when we booked it) tonight while I’m finishing dinner. He says he’s leaving and I get confused about what time class starts because I have something else on my mind. I ask G. to move in with me when my roommate buys a house but he says he doesn’t want to be on the hook for his mortgage. He got a well-paying job right out of college and his parents helped him buy a small condo. I understand but I try not to be hurt. At some point, he will have to rent his place if he wants to live with me. I shove my worries down and head out.

6:45 p.m. — I go to pottery then have to leave early to take Q. to puppy class. It was $200 for eight weeks when I bought it a few weeks ago.

8:30 p.m. — We finish puppy class (Q. is not a star student by any means and I kind of want to cry) and go home. I get ready for bed. I’m sucked into my book until 9:15, then I go to sleep.

Daily Total: $0

Day Two

5:50 a.m. — I get up, let Q. out, feed her and get started with work by 6. Perks of working from home. After I eat some banana bread, I navigate to the living room and turn on NCIS reruns. I splurged on a trial of Paramount Plus during my sickness.

11 a.m. — I pop some Trader Joe’s mint chocolates while I heat up the last of my ramen. I look over to the living room and Q. is on the couch (not allowed!) and has my laptop charger in her mouth. I tell her no and see that she’s chewed through it. It’s literally sparking! Fire hazard! I’m glad she didn’t get electrocuted but I don’t have enough battery to finish work. I run to Best Buy to buy a new charger. Puppies cost money, people. $50

1 p.m. — My Hungryroot has arrived! I was in a meal slump and decided to try it. They gave me free chicken and zucchini noodles by accident, as well as three other meals to make for the week and some snacks. It was half off for the first delivery (I paid $87) and I’m not sure if I will do it again. It’s not a ton of food.

4 p.m. — I should walk Q. but I agreed to pick up a crate on Facebook Marketplace at 4:30 so I put her in her crate and promise her I’ll do it later. $25 later I have a medium-sized crate — it was a good deal and she’s growing fast. I go to G.’s house. I’m feeding his cat and fish while he’s out of town for the week. I feed his cat and hang out with her for about an hour, snacking on some snacks I leave at his house. $25

6 p.m. — I head home, eat my sloppy joes and freeze the leftovers. I walk Q. then I chat with my roommate until I head to bed to read around 8. I’m asleep by 9.

Daily Total: $75

Day Three

5:50 a.m. — I get started on work and have my first coffee in about a week! I think my stomach can handle it now. I use oat milk and a homemade orange simple syrup as a sweetener. I eat a lime coconut milk yogurt that technically expired last week with some banana, strawberries and granola. I throw NCIS on in the background until I realize I need to focus more.

12 p.m. — Normally I go for a run during lunch but I’m not feeling it so I whip up a falafel curry naan thingie from my grocery delivery. The salad mix that came with it is turned so I spend 10 minutes while I eat trying to figure out how to get a refund from the company. Finally I get $6 back in my account. I grab some Trader Joe’s peppermints, then I sit outside with the dog and read in the shade for the rest of lunch. I notice Q.’s nose is dry so I impulse-order snout soother and some calming treats I left in my Amazon cart. $31.34

4 p.m. — I work until 4 then swing by my PT office to drop off a payment that I’ve been putting off making for the sole reason that I can’t pay online, I don’t own envelopes and every time I call, it goes straight to hold. After dropping off the payment, I hang out with G.’s cat and fluff up some blankets for him. I get home and realize I have nothing to do. I’ve been so busy, I think this is my first nothing night in a long time. I should apply for jobs but I hate it. I’ve applied to 150 jobs this year and made it to several final-round interviews but have only been offered the ones I don’t really want. I feel the guilt of falling behind begin to eat me alive. I go to bed stressed. $70

Daily Total: $101.34

Day Four

7:30 a.m. — I sleep in until Q. cries and wakes me up. It’s my day off! I get every other Friday off because I work nine-hour days, and I love it. My grandma and youngest cousin are visiting so I pick up my grandma from my cousin’s house and we go to a natural area in town to bird-watch. There are no birds, it’s hot and the trail is flooded, but it’s nice.

10:30 a.m. — We decide to get coffee and go back to my house to hang out with Q. I try to pay but my grandma insists because it’s my birthday this week. I get a coconut milk iced latte with coconut cream and she gets a lemonade. We take them to go and sit in my backyard while Q. runs around. When we get hungry around noon, I pack up Q.’s stuff and we go get subs. We sit outside with Q. to eat and it’s lovely. I wanted to pay for my grandma but had to stay outside with Q. so we pay separately. I get an Italian sub. $12

2 p.m. — We go to my cousin’s house and hang out on the back patio. At 3:30, I gather Q. and take her to the vet for her final round of shots. She’s free to run around the world! It costs me $500. Her spay in a few months will also cost $500. It seriously looks like it’s gonna storm so I decide to make my cat-feeding stop now instead of later. We hang out at G.’s place with the cat for a while then head home around 5. $500

6 p.m. — I cook up some cauliflower gnocchi with prosciutto, spinach and French onion sauce for dinner from my meal kit. I was worried about the flavor combo but it’s actually good. I chill and watch TV until bed around 8:30.

Daily Total: $512

Day Five

6 a.m. — Q. wakes me up early. I feed myself an egg, bacon and everything bagel sandwich then feed and walk Q. I gather up her extra crate and all of her stuff. I literally have a backpack for this dog with food, water, treats, toys and a towel. It’s like having a baby. I forgot her treats once and it was a nightmare. I also grab some games and head to my cousin’s house. We stop and feed G.’s cat along the way.

10 a.m. — Q. and I head to my cousin’s house and hang out on the patio. My grandma, younger cousin and I get bored so we leave Q. in my older cousin’s custody and I drive the three of us to Old Town Fort Collins to walk around. We go into shops and my grandma keeps asking me what I want for my birthday so I pick out a unique pair of geode earrings from a rock shop. I buy them lunch ($31.80). We walk around some more, I impulse-buy a milk frother ($25), then we go to Ben and Jerry’s. I get a free scoop because it’s my birthday. My grandma pays for herself and my cousin before I can stop her. $56.80

4 p.m. — It looks like it’s gonna pour so we rush back to my car. I drop them off and pick up Q. to take her home. She’s exhausted! They said she was really good and I’m proud of her. I lie in bed for an hour, watching The Ultimatum: Queer Love and trying to regain energy while Q. sleeps in her crate. I’m not hungry for dinner.

7 p.m. — I bike down to old town for a concert. There was a miscommunication and my family bought tickets for Sunday when I thought they were buying them for tonight. I’m going with my friends to a different concert tomorrow but figure I might as well go see this concert since I’m here so I get a ticket at the box office. It’s pretty easy to shimmy through the crowds alone but I wish I’d had a friend in town to go with. Once home, I eat an Oatly ice cream bar from the freezer, let Q. out and go to bed at 9:30. $35

Daily Total: $91.80

Day Six

5:25 a.m. — Q. wakes me up at 5:25, I let her out and feed her breakfast, then we go back to bed. She wakes me up again at 8:25 a.m. and I relent. We go downstairs and I have the second half of my burrito for breakfast with a vanilla latte, using the milk frother I impulse-bought last night. It’s better than my last one and I’m glad I bought it. I sit outside for a bit.

10 a.m. — I gather Q. and take her to a coffee shop across the street from G.’s house after I feed the cat. I’m still in the process of socializing her. I get a Moroccan mint tea and tip $1. We hang out until 12:30. $4

1 p.m. — I eat leftover prosciutto and gnocchi and clean up the garage while Q. naps in her crate. Surprise! A check from my 401(k) from my last job shows up in my mailbox ($258.33).

4 p.m. — I meet my friends B. and C. at a Mexican place for an early birthday dinner before the concert. I order two tacos, a strawberry frozen marg and a Topo Chico. My friends split my portion of the bill as a birthday treat. Pleasantly buzzed, we pay our bill, walk to the front of the restaurant around 5:30 and realize that it’s absolutely pouring. We head across the street to a dive bar and I order us tequila shots and another round of Topo Chicos. Dive bar = cheap drinks. We migrate to the back. $24

7:30 p.m. — It’s 7:30 on a Sunday but we are lit. B. got us another round of tequila shots and drinks, and we chat with people around us, finding out that the concert has been delayed again. Sensing the concert is off, we decide to go to a dancing bar. We run into one of G.’s friends on the way out and I drag him with us.

8 p.m.— We get to the new bar, C. orders us a round of drinks and we get a text that the concert will start at 8:30! We chug the drinks (mistake), abandon G.’s friend (sorry) and race through the rain to the concert venue. We get super close to the stage at 8:30 on the dot and the first performer comes out to start hyping up the crowd. Literally three minutes later, a producer cuts him off and announces the event is officially canceled because of lightning. Everyone boos but they start taking equipment off the stage. It’s a lost cause. Still too drunk, B. and I walk C. to her hotel, then walk the mile back to my house. It’s still raining. B.’s husband comes to pick her up and I play with Q. in my room until I’m sober enough to go to sleep around 10. I’m bummed about the concert but I had a great time overall.

Daily Total: $28

Day Seven

5:50 a.m. — I wake up and immediately chug electrolytes and water. I’m feeling surprisingly fine considering I had an obscene amount of drinks last night, but I also chugged a lot of water while out. I start work and Q. starts misbehaving. It’s my birthday but it doesn’t feel like it. One of my brothers calls me to wish me a happy birthday, which is a pleasant surprise. He reminds another one, who venmos me $8 for a birthday beer. My third brother texts me “hbd bum.” Brothers.

12 p.m. — I eat leftover falafel for lunch and take a nap on my lunch break. I’m exhausted. I head back to work and get sucked in.

4:45 p.m. — I work 45 minutes past the end of the day by accident. On my birthday! I’m annoyed and flustered. I get up to eat dinner before pottery and Q., the devil, chews through my new laptop charger. I’m furious. I’ll need to buy another. It only took her 30 seconds!

5:45 p.m. — I’m late for pottery and barely have time to make a lopsided mug before I have to leave for puppy class. G. is frustrated with pottery and I feel bad for leaving him. At puppy class, Q. is amazing during the walking but has an accident inside. Embarrassing. We head home at 8.

9 p.m. — I scroll on my phone and reply to birthday texts until bedtime. I go to bed feeling like yesterday felt more like my birthday and wondering what G. got me for it. He will give me his present at our dinner date tomorrow. I fall asleep wondering.

Daily Total: $0

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.