Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an auditor who makes $60,000 per year and spends some of her money this week on doggy daycare.

Occupation: Auditor

Industry: Government

Age: 26

Location: Austin, TX

Salary: $60,000

Net Worth: ~$210,000 (savings: $55,000, employer retirement account: $5,000, trust fund: $150,000. The trust fund is a guess — I don’t personally have access to it yet (my dad is the executor until I’m 32), I just know the amount changes frequently because it’s tied to the stock market. I get an annual payment from it that’s dependent on how my taxes shape out. This most recent payment was about $11,000 and went straight to my savings. In fact, I put everything in savings to start and withdraw money as I need it.)

Debt: $0 (very lucky to have had my parents pay for most of my education and I received my dad’s used car as a gift)

Paycheck Amount (biweekly): $1,818

Pronouns: She/her

Monthly Expenses

Rent: $1,459 for a one-bedroom apartment (includes pet rent, trash, and pest control).

Utilities: ~$145

Netflix/Hulu/Prime/Disney+: I use my parents’ accounts.

Spotify: $10.81

Phone Bill: $95.15

Health Insurance: ~$30 (includes dental).

Vision Insurance: ~$9.50

Retirement: ~$300 (required by employer).

Quarterly Expenses:

Medications: ~$50 (with insurance).

Wine Clubs: ~$200

Annual Expenses:

Car Insurance: $1,200

Renter’s Insurance: $135

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Definitely. My grandpa was a professor, both my parents have undergraduate degrees, my dad has a graduate degree, and my older sibling is in graduate school. Honestly, I don’t know what I would have done if I didn’t attend college. I was very, very lucky that my parents had been setting aside money for higher education ever since my sibling was born. They paid for all four years of my undergrad at a small liberal arts college, and I paid for my graduate degree at a large state school with my inheritance (more on that in a bit), although I was also helped out by merit-based scholarships.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents talked about money, but not in a way that really educated me. I knew how much they made, but I didn’t understand anything about mortgage payments or different kinds of savings. I realize now how well off we were, but I remember them worrying about certain expenses so much that I assumed money was a little tight.

What was your first job and why did you get it?

I got a summer job in high school as a library assistant, mostly so I could have some spending money, but also to have something to do. I regularly worked seasonal or part-time positions from then on, but I didn’t get a full-time, permanent position until I finished my grad program.

Did you worry about money growing up?

I did and I shouldn’t have. I truly had no concept of how well off we were. I think this is partly because I went to a private middle school/high school (I know), and all my classmates were so visibly richer that I thought my family must have been behind. It’s also partly because my parents budgeted really well and lived so within their means that I assumed we didn’t have money for extras. (Which is crazy in retrospect — we went on vacation at least once a year! I’m embarrassed to have been so blind to that privilege.) Now that I look back, I realize that when my parents said no to buying something, they never said we couldn’t afford it, just that we couldn’t get it. I didn’t realize that we had the money, but they were prioritizing saving for our higher education and their retirement.

Do you worry about money now?

I’m learning not to. I think I internalized my parents’ thriftiness in ways that aren’t always helpful. I know I have a ton in savings for my age, but I get so hung up on the “what ifs.” What if I suddenly lose my job and can’t get a new one for months? What if my aunt with a shopping addiction loses HER job? What if I get a rare and expensive health diagnosis at my next physical? I get so afraid to touch my money because of what I might need it for in the future, but the reality is, I can afford to spend it on the things I need and a lot of the things I want right now. I’m always going to keep an eye on it, but the extreme anxiety is unwarranted.

At what age did you become financially responsible for yourself and do you have a financial safety net?

In all honesty, I wouldn’t say I was fully financially responsible for myself until I got this job when I was 24. Obviously, my parents were paying for college, but even in grad school I was still on my parents’ health insurance and they paid my car insurance and phone bill. I pay for all of those things now, but my parents or my sibling would absolutely help me out financially if I was in a tough spot.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes. I cannot emphasize enough how inherited income/wealth has cushioned me my entire adult life. My parents paid for all four years at an expensive college, I received my car as a graduation gift, and my grandparents on my dad’s side left me a trust fund when they died. I started receiving payments from it when I was 22. My grandparents grew up during the Depression, and I don’t think they ever left that mentality behind. I’m incredibly grateful, but I know I inherited so much because they were terrified of repeating the past and so they never spent their money. It makes me so sad to know they had the means to enjoy life more, especially in their later years, but that they never stopped worrying. That’s partly why I’m trying to get myself to relax a bit about my finances.

Day One

7 a.m. — I’m awake! Let it be known that I am NOT a morning person. Normally I wouldn’t wake up this early, but my puppy, H., has a grooming appointment at 9 a.m. and I don’t want to be late. I feed her, take her out to potty, and then hop in the shower. I have to wash my hair and shave today, so it takes some time.

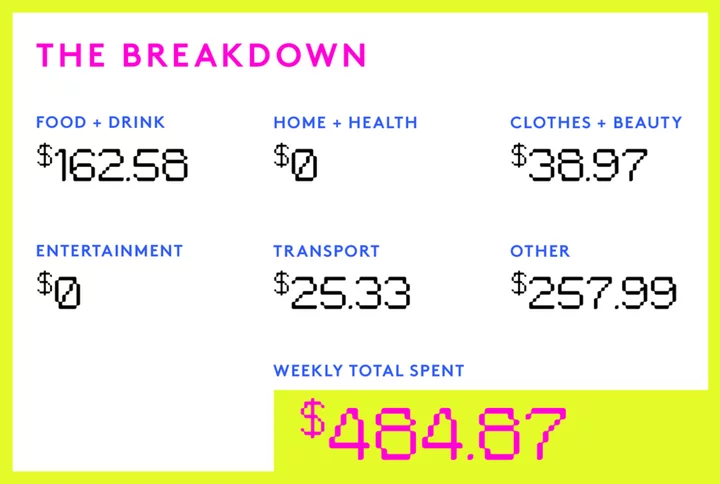

9 a.m. — I drop H. off and head to a nearby coffee shop to work until she’s ready. I’m not my most productive self there, but it’s Friday and next week is going to be unbelievably busy, so I don’t feel too guilty. I get a lavender latte and a brisket kolache. Delicious. $15.59

10:45 a.m. — I pick up H. from her appointment, and she is fully shorn like a sheep. I adore her long fluffy coat, but it’s already so freaking humid in Austin that it just had to go. The groomer recommends I talk to my vet about getting H. on anxiety meds because she was very scared. This is pretty discouraging to me, as H. IS a very anxious girl, but has been going here for months and never had a problem before. I make a mental note to make a vet appointment soon. $110.41

12 p.m. — We head back to my apartment and I get to work for real (I work from home). H. is very tired from her appointment and sleeps the afternoon away on the couch. I’m not very hungry, but I know I’m going out later and don’t want to be low on carbs, so I heat up a couple of taquitos and pick at them for a while.

4:30 p.m. — I drop H. off at her daycare/boarding. Because she’s so anxious, she gets really freaked out by being left home alone. I’m working on training her to be comfortable alone, but until then, if I need or want to go out without her, she goes to boarding. It wasn’t an expense I had planned for when I first got her, but there aren’t any quick solutions to this level of anxiety. Luckily, she loves the staff there and runs in without looking back at me. My feelings are only slightly hurt. $75

7 p.m. — My friend, J., is taking me out for a slightly belated birthday celebration. We go to a new-ish restaurant downtown and they greet us with free champagne! Feeling very bougie. We get two more drinks each and four small plates to share. She doesn’t let me pay for any of it, even the tip. We head to a nearby bar for one more drink. Turns out, it’s the kind of bar that requires a reservation, but two spots at the bar top just opened up, so they let us in. Feeling very bougie, part two. I pay, but J. immediately pays me back for her drink. I’m feeling guilty about not paying my fair share, so I leave a very generous tip for both of us. $27.10

11 p.m. — I take an Uber home, and feel grateful for my relative proximity to downtown. I take off my makeup, do my regular night routine, and am in bed by midnight. $25.33

Daily Total: $253.43

Day Two

12 p.m. — Oops. I meant to get up at 8 a.m. and take myself to breakfast, but here we are. I’m not really hungry anyway, so I talk myself into not being too disappointed about it. I shower, respond to some texts, and check tennis scores. I played in high school and recently have been getting into it again. It’s the only sport I follow with any regularity.

3 p.m. — I pick up H. from boarding, and we head to PetSmart to replenish her dwindling supply of treats. I get her normal training treats, plus a couple of bully sticks she gets on special occasions. As always, she insists on greeting every willing living being we encounter. $37.58

4 p.m. — My failure to eat earlier comes back to bite me as I suddenly feel incredibly weak and shaky as we’re driving away. I pull into the nearest drive-through (Dairy Queen) and get fries and a shake. The woman working the window fawns over H. in her adorable car seat and offers H. her own sweet treat. I think we all leave this interaction extremely satisfied. $8.10

7 p.m. — I feed H., but I’m still full from DQ earlier. I tell myself I’m not allowed to have my nightly glass of wine unless I eat something, so I order sushi delivery with a Postmates coupon. The coupon requires a pretty high minimum order, so I get enough for two meals in order to hit it. H. and I chill on the couch watching makeup tutorials and tennis match recaps until bed at 1 a.m. $35

Daily Total: $80.68

Day Three

7 a.m. — I wake up and feed H. After she potties, I let her up on my bed so we both can go back to sleep.

11 a.m. — We spend too long in bed, but whatever, it’s the weekend. I have some cereal, take a quick shower, and then head out on a walk with H. I’m honestly pretty lazy and H. is in the stage of puppyhood where walks are kind of a nightmare for me, but she loves them so much that I just deal with it. We come back and I have the sushi I saved from last night for lunch. I also research some flights for an upcoming trip.

6 p.m. — I hop on my weekly Zoom call with my parents. I really miss them and worry about their health as they age. I plan to leave Austin in the next year to move closer to them. After our call, I feed H. and make myself dinner. I feel like I’ve been eating pretty unhealthily recently, so I cook some lemon salmon and Brussels sprouts and pair my meal with a cool glass of albariño.

11 p.m. — I should be going to bed soon, but instead, I’m trying to decide on flights for my trip. It’s a work trip so it’ll get reimbursed eventually, but my coworkers told me the reimbursement process can take six months or longer. I made my annual car insurance payment last week, so I was hoping to avoid any other big payments this month. I finally decide to pay one way out of pocket and one way with flight points I’ve accumulated over the past several years; honestly, I could see billing refusing to reimburse that, so I make note of the dollar amount of the flight, as well as an index of the money I had to spend on previous flights to earn the points. I’m still not very optimistic. I add trip insurance because I’ve been screwed without it before, even though the chance I actually need it now is extremely low. I get ready for bed and finally drift off around 2 a.m. ($144.50 expensed).

Daily Total: $0

Day Four

8:45 a.m. — I sleep through my alarm which is entirely predictable and wake up to H. crying to go out. I thank her for not having an accident and getting me up in time for work. She gets fed and I feed myself some homemade mocha biscotti my mom sent me for my birthday last week. I start work in my pajamas because I don’t have any meetings scheduled today. If anyone calls me for a surprise meeting, I have an emergency blazer on the chair next to me.

6 p.m. — Wow, what a long day. A project I’m leading is due in two weeks, and my team is working in overdrive to get it done. I work a little better with a time crunch, but I know I’m going to be exhausted after it’s finally over. I take H. for a nice evening walk and feed her when we get back. I have my leftover salmon (I always make two servings of anything I cook) and another glass of albariño.

10 p.m. — I should not be online window shopping at night because it inevitably turns into actual shopping. Since it’s my birthday month, I get a free gift with purchase from Ulta, and while I sometimes can resist a free gift, this time it’s Olaplex. I only purchase enough to get free shipping and stick to useful items — a brow pencil and three tinted lip balms. Did I need this order? No. Am I trying to stop crucifying myself over “want” purchases less than $50? Yes! After, I do my night routine and am in bed by midnight. $38.97

Daily Total: $38.97

Day Five

7:15 a.m. — I get up, feed H., and let her out to potty. I then shower and wash my hair, and we’re out the door to drop her off at daycare. I don’t have anywhere to be, but it’s good for her to get used to the routine of going weekly. Plus, she just loves to play with her doggy pals. I drop her off and watch as her windshield wiper of a tail disappears inside. $35

9 a.m. — I tried to eat breakfast before we left, but I was feeling really uninspired by what I had in the kitchen. I know I need to eat, so I stop at McDonald’s for a breakfast sandwich and iced coffee. $8.64

2 p.m. — I’m having another busy day, but I can’t put off washing my sheets and towels any longer, so I alternate between work and laundry. My rent is high for two reasons: location and an in-unit washer and dryer. The latter is life-changing and I’m never going back.

6 p.m. — It’s time to pick up H. from daycare and I’m exhausted. I just know I don’t have the energy to make dinner. I pick up ahi tuna poke from a place on the way, even though my brain is screaming at me that I’ve already had too many meals out this week. I retrieve H. and we head home. She is sooo sleepy, it’s adorable. Her eyes are drooping even as she scarfs down dinner. $25.45

11:45 p.m. — Ok yikes, what happened? Last thing I remember was sitting down with H. on the couch and looking through the mail and now it’s four hours later and we’re both horizontal underneath a blanket. I quickly get ready and get in my actual bed, but my tiredness is magically gone and I don’t fall asleep for a while.

Daily Total: $69.09

Day Six

9:30 a.m. — Aaaaand I slept through my alarm again. This time H. is a master of her bladder (and not hungry?), and I only wake up because someone is knocking on my neighbor’s door. I quickly feed H. and sit down to work. Luckily, my hours are pretty flexible and I can make up the time by working late, but I feel ridiculously guilty anyway.

12 p.m. — After almost three hours of feverish work, I realize I haven’t eaten anything yet. I tend not to take lunch breaks so that I don’t ruin my work momentum, so I opt for frozen taquitos again in order to eat them while I work.

6 p.m. — I work an extra half hour to wrap up a task, and then H. and I head out for our evening walk. I feed her when we get back and then I make myself spaghetti and meatballs that I pair with a glass of tempranillo. I am once again feeling exhausted. For most of the year, my work is pretty casually paced and I have a lot more energy to get out of my apartment during the week. It’s just when projects are in the last stage that I’m genuinely busy for all 40 hours of the work week.

11 p.m. — I meant to go to bed earlier, but I was busy researching some living situations. As much as I like my apartment, I think H. would do a lot better somewhere with an enclosed yard and less foot traffic. I haven’t made any decisions yet, but my lease does end in a couple of months, so it would be a good time to move. I get ready for bed and have a hard time falling asleep.

Daily Total: $0

Day Seven

8:15 a.m. — That was not a great night of sleep. My alarm went off 45 minutes ago, but since H. seemed happy to stay in her crate, I let myself stay in bed a bit longer too. I get up and feed her and take a quick shower. My poor sleep is showing on my face — I count three new breakouts. I think the humidity is also partially to blame. I have hormonal acne on my chin pretty much year-round, but otherwise, my skin has been clear during the dryer winter months. I hear all the time that humidity is good for the skin, but it doesn’t seem good for my skin. After feeling sorry for myself for a couple of minutes, I get to work.

1:30 p.m. — Yet another day I forget to eat because my morning is so busy. My coworker calls me and I put together a spinach, avocado, pesto, and goat cheese sandwich while we gossip about our manager. I was the youngest person in the office until she joined and I didn’t realize how much I missed working with other twentysomethings. I do like my other coworkers, but most of them are married with kids, so it can be a little hard to relate to them as a single childless person.

4:30 p.m. — I log off work and take H. out for a walk. Normally I wouldn’t go at this time, but we have somewhere to be later. Hot, damp, and gray is my least favorite kind of weather. Like, pick a struggle.

6 p.m. — H. and I head over to J.’s apartment for a girls’ night in. I stop for Chinese takeout for us along the way. J. and her roommate had told me not to worry about bringing H., but she’s a complete menace. She does not stop running the whole time we are there, except to have two (!!) accidents on J.’s rug. I know she’s still a puppy, but she hadn’t had an accident in four months AND I spent so long trying to get her to go before we left my place. J. is very understanding, but I still feel mortified, so I ask her to consider takeout my treat. $35.88

8:30 p.m. — We stop at Whataburger on our way home because I want a comfort shake. When we get back to my apartment, H. gobbles down her food, gets the zoomies for 20 minutes, and then promptly conks out on the couch. I take it as a sign we both needed an early night, so I do my night routine and get to bed by 10 p.m. $6.82

Daily Total: $42.70

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Email us here.