Not long ago, Vietnam’s government warned parents that too many videogames could lead children to a life of crime — even murder.

But when the first-ever Vietnam GameVerse Day was held in Ho Chi Minh City earlier this year, government officials were front and center promoting the country as the region’s hottest market for entertainment apps development.

Hanoi now views mobile games as an export asset and a crucial part of its emerging technology sector, as it seeks to shift beyond being a center for outsourced software and sneaker factories. The change is also an acknowledgment of the industry’s economic potential: the global mobile gaming market is estimated to exceed $300 billion next year, with an annual growth rate of over 7% in coming years.

The country ranked among the world’s top five in mobile game production by downloads in the first half of 2023, according to data.ai. While Vietnam is one of the five Communist-ruled countries in the world, the gaming industry’s rise isn’t too much of a surprise for those who’ve seen the economy first-hand. Smartphone penetration is among the highest in Asia and about half of its population is under 30. Hustling and competing is part of everyday life in its cities, where street vendors line congested streets selling noodle dishes and ice coffees while tech entrepreneurs make elevator pitches at networking events.

The local gaming industry is led by a growing cadre of game developers and publishing startups including Amanotes, known for its mobile music games, and Falcon Squad publisher OneSoft. Their rise also reflects Vietnam’s success at bolstering its education system. Vietnamese students regularly outperform counterparts in the US and other OECD countries on PISA test scores, and interest in engineering and technology runs high. Coding camps for children are increasingly popular, while universities include game development in curricula.

“There is that Silicon Valley go-out-and-get-it spirit in Ho Chi Minh City,” said Khoi Nguyen, founder of Good Story Time, a startup creating tools for video game development. He relocated to Vietnam from the Bay Area after working as a lead engineer for Oculus VR Inc., acquired by Meta Platforms Inc. in 2014. “The engineering talent is pretty top notch.”

Read More

- Silicon Valley Talent Is Helping Grow Vietnam’s Startup Hub

- Axie Infinity Creator to Be ‘Even More Aggressive’ With Crypto

- AI Is Rewriting the Rules of $200 Billion Games Industry

Vietnam first caught the attention of global gamers in 2013 after Hanoi developer Dong Nguyen created a simple but addictive game app called Flappy Bird that became a sensation. It was so popular that Dong, reportedly disconcerted by the sudden attention, took it down — but not before earning as much as $50,000 a day from pop-up advertisements. Flappy Bird provided a jolt to Vietnamese developers, who saw how successful such simple mobile games, widely known as casual games, could be.

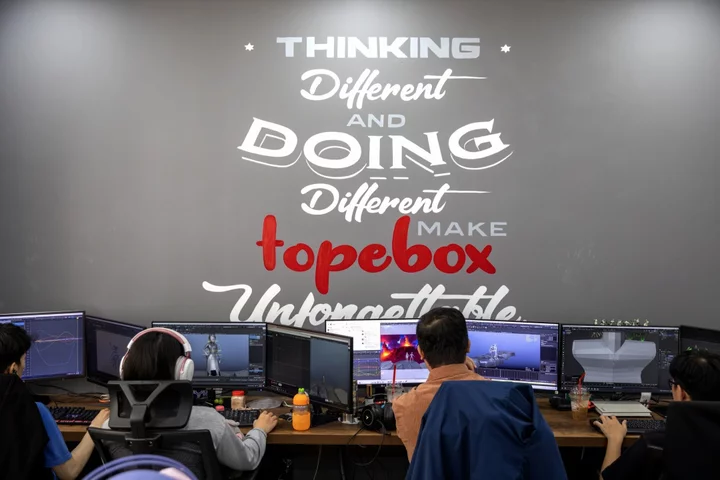

Thai Thanh Liem, chief executive officer of game publisher Topebox and part of the new generation of successful gaming entrepreneurs, recalls the excitement of those early days a decade ago. He and his friends, who would later become co-founders of the company, worked tirelessly on free-to-play gaming apps that would later be downloaded on smartphones from Singapore to San Francisco.

“We would eat, sleep and work together on the rooftop,” he said, looking back on nights huddled over laptops on a small roof — Vietnam’s version of a Silicon Valley garage.

Their first game, within a year, achieved half a million downloads and $1 million in global revenue. Bigger hits followed. Sky Dancer, a parkour-style game in which users bounce off cliffs and floating islands, is published in China by TikTok Inc.’s parent company ByteDance Ltd., and has been downloaded at least 50 million times.

Game studios now dot the country, competing to create the next global blockbuster. Amanotes’ Magic Tiles 3 ranked among the 20 top mobile games in global downloads last year, according to Sensor Tower Inc., which provides market research on mobile apps and digital advertising. Amanotes says the game has been downloaded more than one billion times since its release in 2017.

OneSoft last year was the world’s fourth-largest mobile game publisher by downloads from the App Store and Google Play, data.ai said, while Zego Studio ranked 9th among app and games publishers worldwide in terms of downloads in the fourth quarter last year, according to Sensor Tower. The country was also a center for blockchain games, before a heist of around $600 million from a blockchain network connected to the popular Axie Infinity online game created by Ho Chi Minh City startup Sky Mavis Inc.

Bill Vo, co-founder and chief executive officer of Amanotes, said that while it has more than three billion downloads of its games, many users aren’t aware of the company’s nationality.

“People don’t know Amanotes is a Vietnamese company,” he said. “We are positioning ourselves as a global company.”

Amanotes — a portmanteau of amateur and musical notes — is best known for the music games Magic Tiles 3 and Tiles Hop and has 100 million monthly active users, most of them in the US. Amanotes is in discussions with potential investors, including private equity firms and venture capitalists, as it looks to scale its business, Vo said.

Tighter Regulation

Vietnamese developers, though, face growing challenges in the global gaming market as governments adopt stricter data collection regulations. The changes are forcing gaming companies to devote resources to directly engage with players and encourage them to volunteer information so developers can customize games. This adds more expense for larger companies, and is particularly difficult for smaller startups to pull off, said Kelly Wong, vice president of game entertainment at Vietnam’s gaming, messaging and payment giant VNG Corp., which is reportedly eyeing a US listing.

“The Flappy Bird model is not going to exist anymore,” he said.

Most of the popular Vietnamese games free-to-play casual games with simple interfaces. While a successful few like Amanotes also offer subscription services, and others are likely to try gearing their games for consoles, such changes will be difficult for many. Developing games for consoles such as PlayStation and Xbox would require several years and more than $100 million in investment, Wong said.

Vietnam’s developers, however, are gaining experience and the costs of making big-budget video games will likely decrease with new technology, making more sophisticated games possible, said Ho Chi Minh City-based Binh Tran, co-founder of Ascend Vietnam Ventures.

For now, the government appears to be supporting its growth. While it had previously considered taxing online gaming services, it recently decided against such a move for now, providing some relief to domestic gaming companies.

Growing tensions between China and the US could also work to the advantage of Vietnamese game developers as publishers look outside of China for developers of more sophisticated projects, said Samuel Stevenin, art division managing director of Virtuos Ltd, a video game development company with three Vietnam production studios.

“It’s making Vietnam — and the whole of Southeast Asia — more attractive.”

--With assistance from Nguyen Dieu Tu Uyen.